Bitcoin ETF Inflows Continue Despite Britain, US Likely to Join Iran-Israel War

Highlights

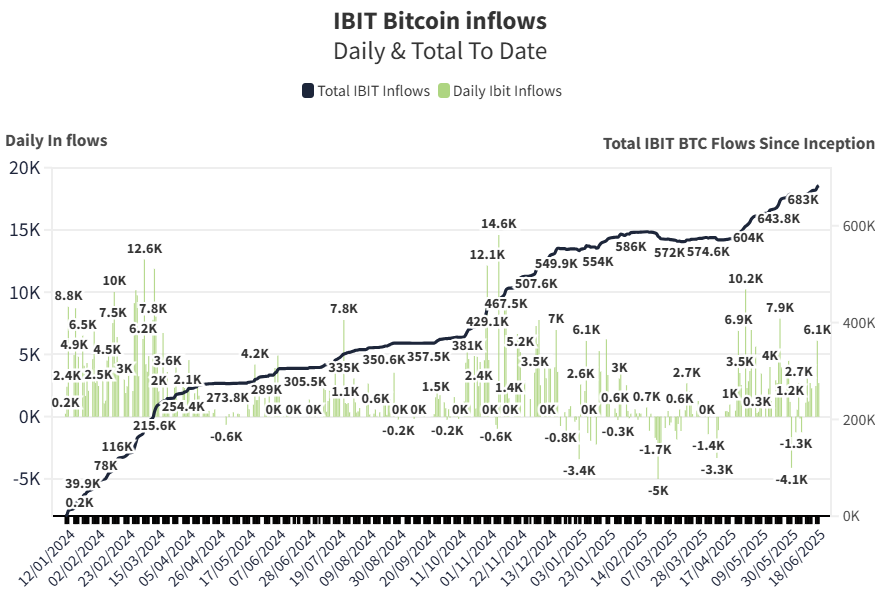

- Spot Bitcoin ETFs witnessed $386 million in net inflows on Wednesday, with BlackRock's IBIT leading.

- U.S. Bitcoin ETFs have now recorded a total a total of $11.25 billion in net inflows in 2025.

- The Iran-Israel conflict continues to escalate, with reports suggesting potential U.S. and U.K. involvement.

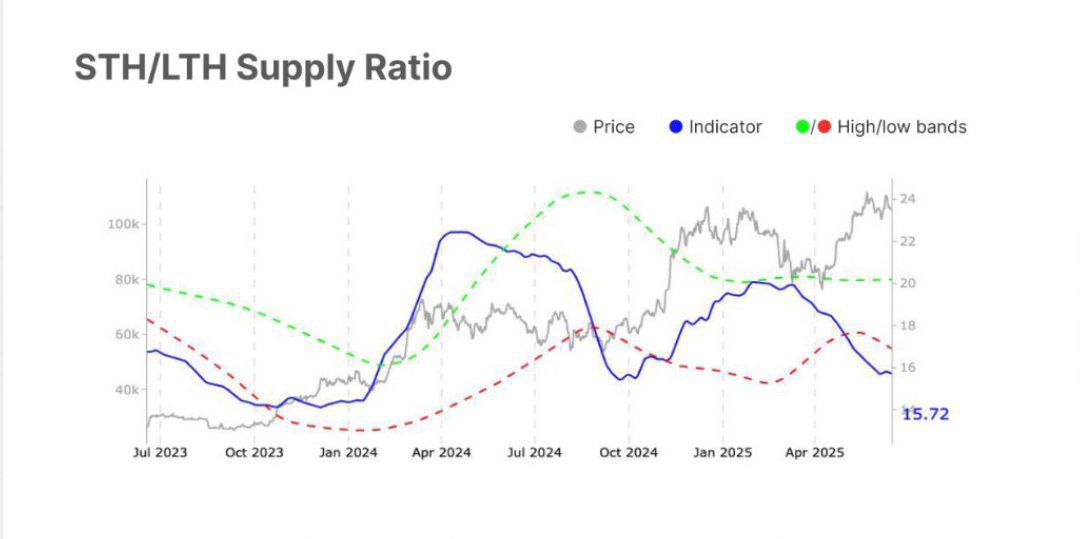

- Bitcoin price has stabilized around $104,000 with STH/LTH Supply Ratio has dropped to 15.7%.

Amid rising tensions in the Iran-Israel conflict, Bitcoin ETF inflows have surged alongside a spike in Gold prices. On Wednesday, net inflows into BTC ETFs reached $386 million, nearly double the previous day’s figure, signaling increasing institutional confidence. These inflows came after Jerome Powell’s FOMC meeting, which maintained unchanged interest rates, as the crypto market adopts a cautious stance amid ongoing geopolitical uncertainties.

Bitcoin ETF Inflows Surge Amid Iran-Israel Conflict

Inflows into spot Bitcoin ETFs surged all the way to $388 million across all the US ETF issuers on Wednesday. BlackRock’s iShares Bitcoin Trust (IBIT) once again led the pack with $280 million in inflows, while Fidelity’s FBTC managed to recover the lost ground with over $100 million in inflows. BlackRock’s IBIT purchased an additional 2861 Bitcoins yesterday, taking its total BTC holdings to 680,336, as per the official IBIT data.

The US Bitcoin ETFs have witnessed strong inflows for eight consecutive trading sessions. Since the beginning of 2025, these products have netted a total of $11.25 billion in net inflows, showing strong institutional demand.

Iran-Israel Conflict Can Escalate With Britain, US Joining

Geopolitical tensions are on the rise amid the ongoing Iran-Israel conflict, with superpowers like US and UK hinting that they are willing to join the war. As per the latest Bloomberg report, senior officials in the US are preparing for a strike on Iran. This comes as Trump denied any peace talks with Iran in the ongoing conflict earlier this week.

Some of the sources told Bloomberg that Washington officials are assembling the infrastructure in order to engage in a direct conflict with Tehran. According to The Times, Britain is weighing the possibility of joining a conflict against Iran if the United States intervenes alongside Israel.

Ahead of the FOMC meeting, Bitcoin price faced selling pressure and is currently holding support at $104K. As the geopolitical conflict escalates, investors take a wait-and-see approach.

The STH/LTH Supply Ratio has declined to 15.7%, dipping below its statistical low band. This indicates that short-term traders remain inactive, while long-term holders continue to maintain their positions.

- Expert Predicts Deeper Bitcoin Decline as JPMorgan CEO Warns of Similarities to the 2008 Financial Crisis

- Trump Won’t Pardon FTX’s Sam Bankman-Fried (SBF), White House Says

- Third Spot SUI ETF Goes Live as 21Shares Fund Launches on Nasdaq

- Mark Zuckerberg’s Meta Reportedly Eyes Stablecoin Integration This Year Amid Regulatory Clarity

- Coinbase Rivals Robinhood As It Rolls Out Stocks, ETFs Trading In ‘Everything Exchange’ Push

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

- Sui Price Eyes Recovery as Third Spot SUI ETF Debuts on Nasdaq

- Pi Network Price Eyes a 30% Jump as Migrations Jumps to 16M

- Will Ethereum Price Dip to $1,500 as Vitalik Buterin Continues Selling ETH?

- XRP Price Outlook as Clarity Act Passage Odds Plunge to 53%

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

Claim Card

Claim Card