Bitcoin ETF Recovery Boosts Digital Asset Inflow To $862M

Highlights

- Bitcoin ETFs boost digital asset inflow to $862M, signaling market recovery.

- Bitcoin leads the inflow chart, while Ethereum faces outflow amid SEC scrutiny.

- US Spot Bitcoin ETFs drive momentum with $845M influx, reversing previous outflows.

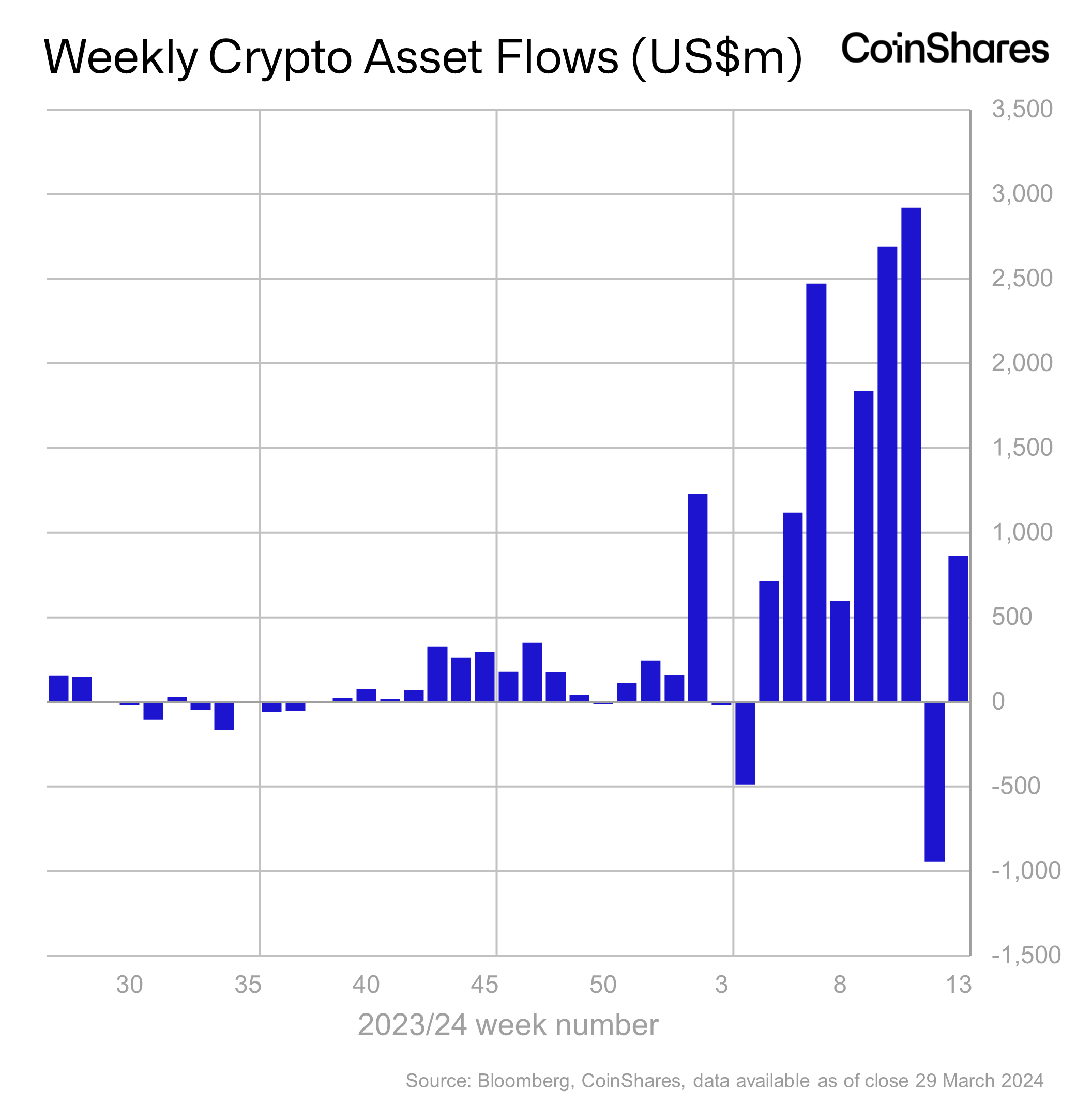

The digital asset investment landscape experienced a resurgence as Bitcoin Exchange-Traded Funds (ETFs) rallied last week, bolstering confidence among the crypto market enthusiasts. Notably, according to James Butterfill, CoinShares’ Head of Research, the recent surge in Bitcoin ETFs has propelled a significant inflow into the digital asset segment, reaching a notable milestone of $862 million last week.

Bitcoin ETF Fuels Digital Asset Inflow Surge

James Butterfill’s recent report highlights a remarkable turnaround for Bitcoin ETFs, marking a substantial influx of $862 million in the past week. Notably, this resurgence in investment signals renewed confidence among stakeholders.

Meanwhile, Bitcoin led the inflow with $865 million, emphasizing its continued dominance in the digital asset market. Additionally, Solana saw a noteworthy inflow of $6.1 million amid soaring interest in the crypto itself as well as the Solana-based meme coins.

However, Ethereum experienced an outflow of $18.9 million amid soaring tensions over the SEC’s scrutiny of ETH’s security status. Besides, the regulatory tension on Ethereum’s status has also sparked concerns over a potential delay in the Ethereum ETF approval by the regulators.

Despite Ethereum concerns, the surge in Bitcoin ETFs revitalizes investor sentiment while propelling the overall digital asset sector’s inflow. Butterfill’s report underscores the pivotal role of U.S. Spot Bitcoin ETFs in driving this momentum, following a previous week of outflows.

Notably, last week saw an influx of $845 million into Spot Bitcoin ETFs, significantly reversing the trend from the prior week’s BTC ETF outflow of approximately $900 million. Furthermore, the cooling outflow from Grayscale’s GBTC adds to the positive market sentiment.

Also Read: Ethereum Co-Founder Unveils Protocol Simplification Strategy “The Purge”

Global Trends in Digital Asset Inflow

Amid the surge in Bitcoin and cryptocurrency investments, global trends in digital asset inflow reveal intriguing dynamics. The United States emerges as the top contributor, with an inflow of $897 million, indicating robust market participation.

However, Canada and Switzerland witnessed outflows of $20.3 million and $15.6 million, respectively. Notably, these divergent trends underscore the varying regulatory landscapes and investor sentiments across different regions.

Meanwhile, Butterfill’s insights shed light on the evolving nature of digital asset investments, influenced by regulatory developments and market dynamics. Despite challenges, the recent surge in Bitcoin ETFs and overall inflow signals resilience and growing acceptance of cryptocurrencies in mainstream finance.

Also Read: TON Blockchain’s PoW-Token GRAM Now Available for Trading on MEXC Exchange

- Crypto Market Crash: Glassnode & 10x Research Warn Deeper Bitcoin Price Fall Ahead

- Operation Chokepoint: Federal Reserve Advances Proposal to End Crypto Debanking

- LUNC News: Terraform Labs Administrator Sues Jane Street for Terra-LUNA Crisis

- Crypto.com Joins Ripple, Circle With Conditional Bank Charter Approval Amid WLFI’s Probe

- Michael Saylor Says Quantum Risk To Bitcoin Is a Decade Away, Describes it as ‘FUD’

- COIN Stock Risks Crashing to $100 as Odds of US Striking Iran Jump

- MSTR Stock Price Predictions As Michael Saylor’s Strategy Makes 100th BTC Purchase

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?