Bitcoin ETFs Record $2.2B Weekly Inflows as BTC Price Surges Past $120K

Highlights

- Bitcoin ETFs recorded $2.2B in inflows this week, the highest since August.

- BlackRock’s IBIT led with 3,930 BTC ($466.5M) purchased in a single day.

- BTC price broke $120K, gaining 10% amid “Uptober” optimism.

Bitcoin ETF products recorded more than $2.2 billion in weekly inflows, building on the momentum of previous weeks. In light of this, the BTC Price rallied above $120,000 for the first time since August.

Bitcoin ETF Inflows Hit Record $2.2 Billion Inflow

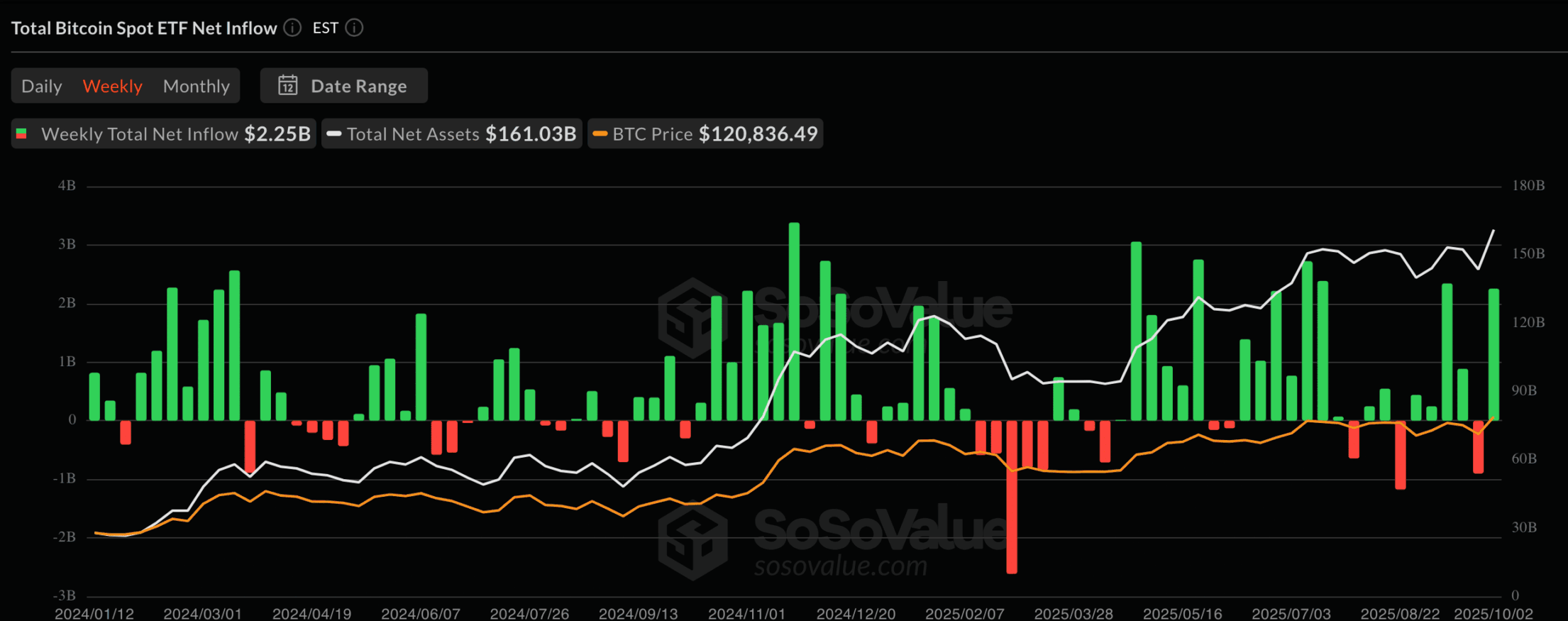

According to SoSoValue data, Bitcoin ETFs recorded $2.2 billion in inflows this week, following a shaky September that saw nearly $1 billion in outflows.

On October 2, the U.S. spot ETFs collectively added 5,290 BTC worth roughly $627 million in a single day. In the lead, BlackRock’s iShares Bitcoin Trust (IBIT) bought 3,930 BTC for $466.5 million. Fidelity’s FBTC also reported substantial inflows of around $89 million worth of tokens.

Bitcoin ETFs posted one of its strongest inflows of the month on September 12, recording $642 million. Experts attribute the Fed’s rate cuts to a significant catalyst. Weak payroll data in the U.S. bolstered expectations of further easing. This shifted probabilities toward another reduction.

In total, September closed with net inflows of $3.5 billion across all U.S. Bitcoin ETFs. This suggests that institutional interest is growing.

In a parallel development, BlackRock’s IBIT surpassed Deribit to become the largest platform for BTC options. This leap followed the SEC’s approval of options trading for IBIT earlier this year.

Ethereum ETFs also attracted solid daily inflows. This was led by BlackRock’s ETHA with $177 million, followed by Fidelity at $60.7 million. However, ETH products had largely underperformed during the late-September crypto rally. The fund managed less than $100 million in net inflows across three consecutive days last week.

BTC Price Breaks $120K Amid Uptober Momentum

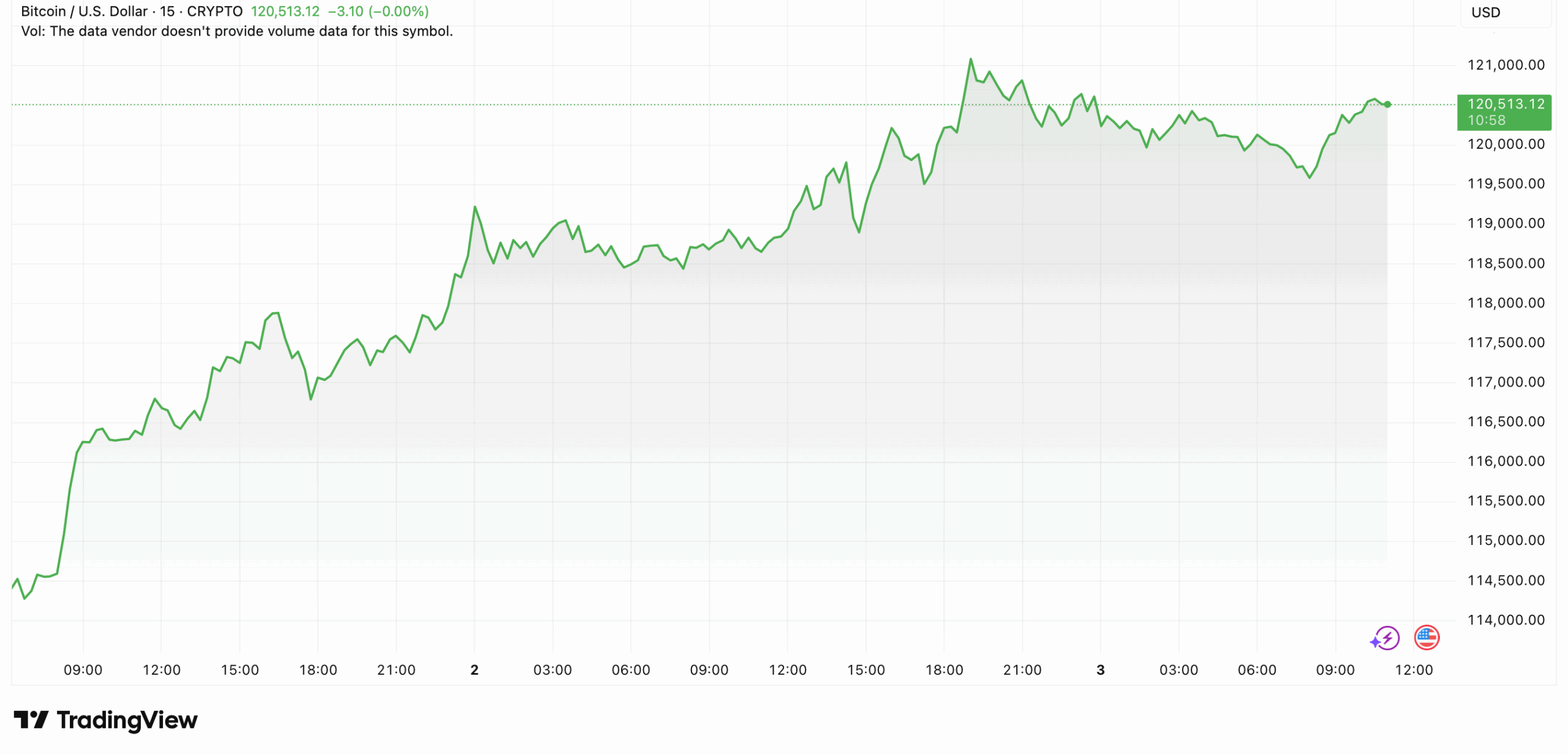

The BTC price has surged to $120,015 this week, gaining over 10% despite the backdrop of a U.S. government shutdown. The rally comes as “Uptober” gets underway.

Supporting the bullish outlook, Bitcoin’s Accumulation Trend Score hit 0.62, its highest since August. Wallets holding between 10 and 1,000 BTC have been steadily accumulating. This essentially absorbs selling pressure from larger holders. Retail selling has also slowed, easing exchange supply.

Notably, Arkham Intelligence shared that the estimated 1.1 million BTC linked to Bitcoin creator Satoshi Nakamoto is now worth over $130 billion. This comes on the back of the BTC price’s recent rally. The on-chain tracker also shared that these coins have remained untouched since 2010.

SATOSHI’S NET WORTH IS NOW BACK ABOVE $130 BILLION

HE HAS NEVER SOLD $BTC pic.twitter.com/RdcLK21SDX

— Arkham (@arkham) October 2, 2025

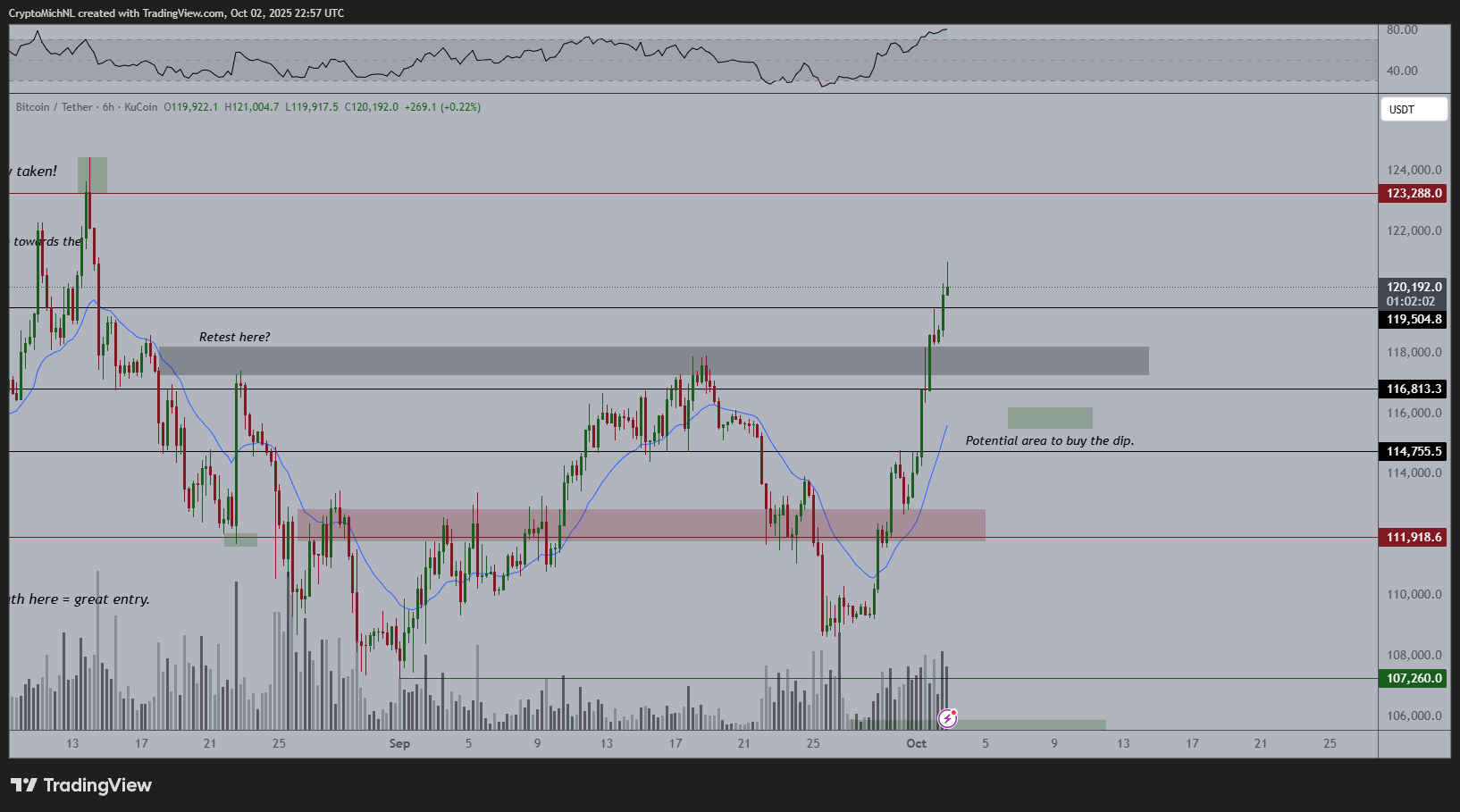

Furthermore, Crypto analyst Michael van de Poppe has predicted a strong upside for the BTC price throughout the month. He shared that the token could soon establish a new all-time high, noting that consolidation at current levels could set the stage for the next breakout.

- Breaking: White House to Meet Bank and Crypto Executives Over CLARITY Act Clash

- Breaking: Federal Reserve Holds Rates Steady After FOMC Meeting as Expected

- Senators Propose Amendments To Crypto Market Structure Bill Ahead Of Tomorrow’s Markup

- Ethereum Gains Wall Street Adoption as $6T Fidelity Prepares FIDD Stablecoin Launch

- Bitcoin Faces Fresh Geopolitical Risk as Trump Threatens ‘Far Worse’ Military Action Against Iran

- How High Can Hyperliquid Price Go in Feb 2026?

- Top Meme Coins Price Prediction: Dogecoin, Shiba Inu, Pepe, and Pump. Fun as Crypto Market Recovers.

- Solana Price Targets $200 as $152B WisdomTree Joins the Ecosystem

- XRP Price Prediction After Ripple Treasury launch

- Shiba Inu Price Outlook As SHIB Burn Rate Explodes 2800% in 24 Hours

- Pi Network Price Prediction as 134M Token Unlock in Jan 2026 Could Mark a New All-Time Low