Bitcoin ETFs Records Best Week Since October Crash as Market Faces New Bearish Pressure

Highlights

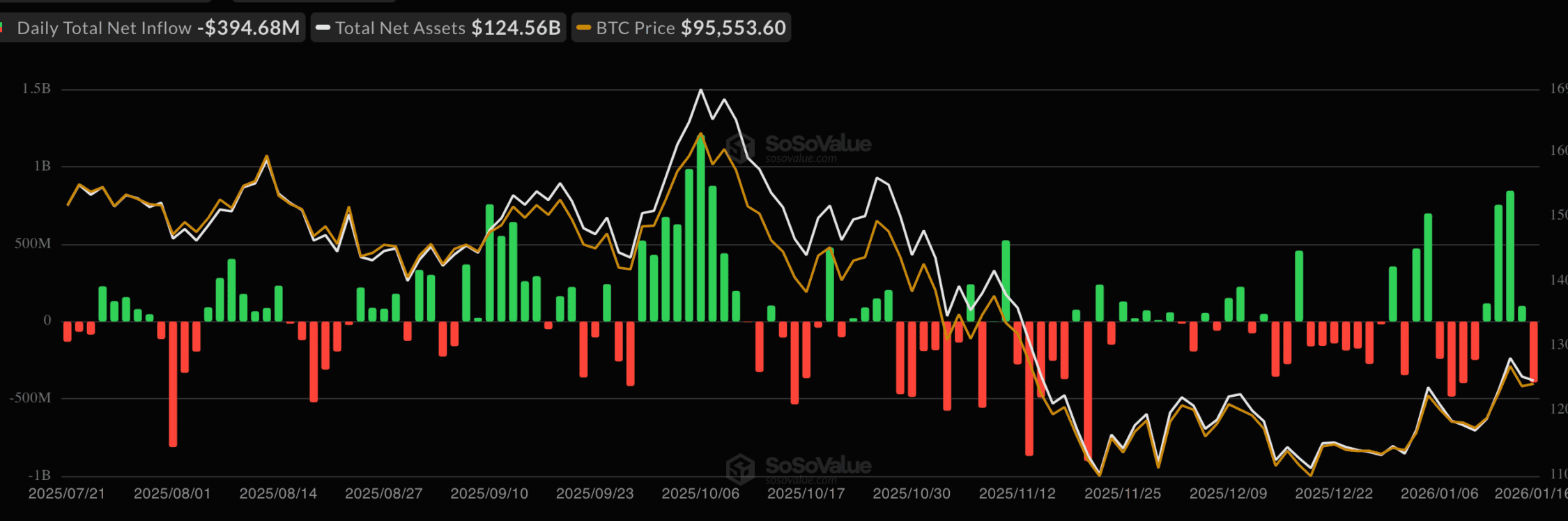

- U.S. spot Bitcoin ETFs recorded $1.42 billion in weekly inflows last week.

- This is their strongest performance since the October crypto market crash.

- Bitcoin futures open interest rebounded 12% since the start of the year.

U.S spot Bitcoin ETFs have made a remarkable comeback in the market since the new year started. They saw their best weekly performance since the October crypto crash. This positive trend comes just as the market faces new bearish sentiment amid trade tensions.

Bitcoin ETF Sees $1.4B in Inflows

According to data from SoSoValue, the BTC ETFs posted $1.42 in weekly inflows last week. This is the highest it has seen since October. This builds on the early momentum seen in the crypto market in 2026.

The largest asset manager, BlackRock, led the inflows, accounting for over 71% of the inflows. Only IBIT saw about $1.035 billion. This comes despite claims that they were selling off BTC tokens. The second largest came from Fidelity’s FBTC ETF, which saw a net inflow of $194 million.

As of press time, Bitcoin ETFs’ net asset value stands at $124.5 billion, and their asset ratio now stands at 6.53%. This came as the coin rose to almost $98,000 during the week. This was largely a major rebound from the token trading below $90,000 at the beginning of the year.

Crypto experts had begun to make bullish projections for the token thanks to the fresh momentum. However, the Bitcoin price has pulled back sharply amid the trade tensions growing between the U.S and the EU.

Meanwhile, the U.S. spot Ethereum ETFs also saw their largest weekly inflows since the crash last year. It recorded $479 million in inflows, with BlackRock’s fund leading the pack.

BTC Futures Open Interest Rebounds Amid Bearish Pressure

Apart from the return in momentum for Bitcoin ETFs, the token’s open interest has gained 12% since the year started. This follows the develeraging trend from October to December.

CryptoQuant analyst DarkFrost highlighted the change in an analysis on X. According to him, BTC futures OI fell by 17.5% over the last three months following the 36% price crash in October. He then shared that there is a trend of recovery in motion. Analysts are now making Bitcoin price predictions based on whether the trend will hold.

Data shows that it has increased from its eight-month low of $54 billion on January 1 to now $61 billion on January 19. It reached its highest on January 15 with $66 billion.

“At present, Open Interest is showing signs of a gradual recovery, suggesting a slow return of risk appetite. If this trend continues and strengthens, it could increasingly support a continuation of the bullish momentum, although for now the rebound remains relatively modest,” he said.

Meanwhile, the crypto market is bracing for impact amid upcoming key events in global markets. Some experts have also called for a potential pullback in Bitcoin ETF inflows.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs