Bitcoin, Ethereum and XRP Record Massive Drop in Institutional Interest: CoinShares

Highlights

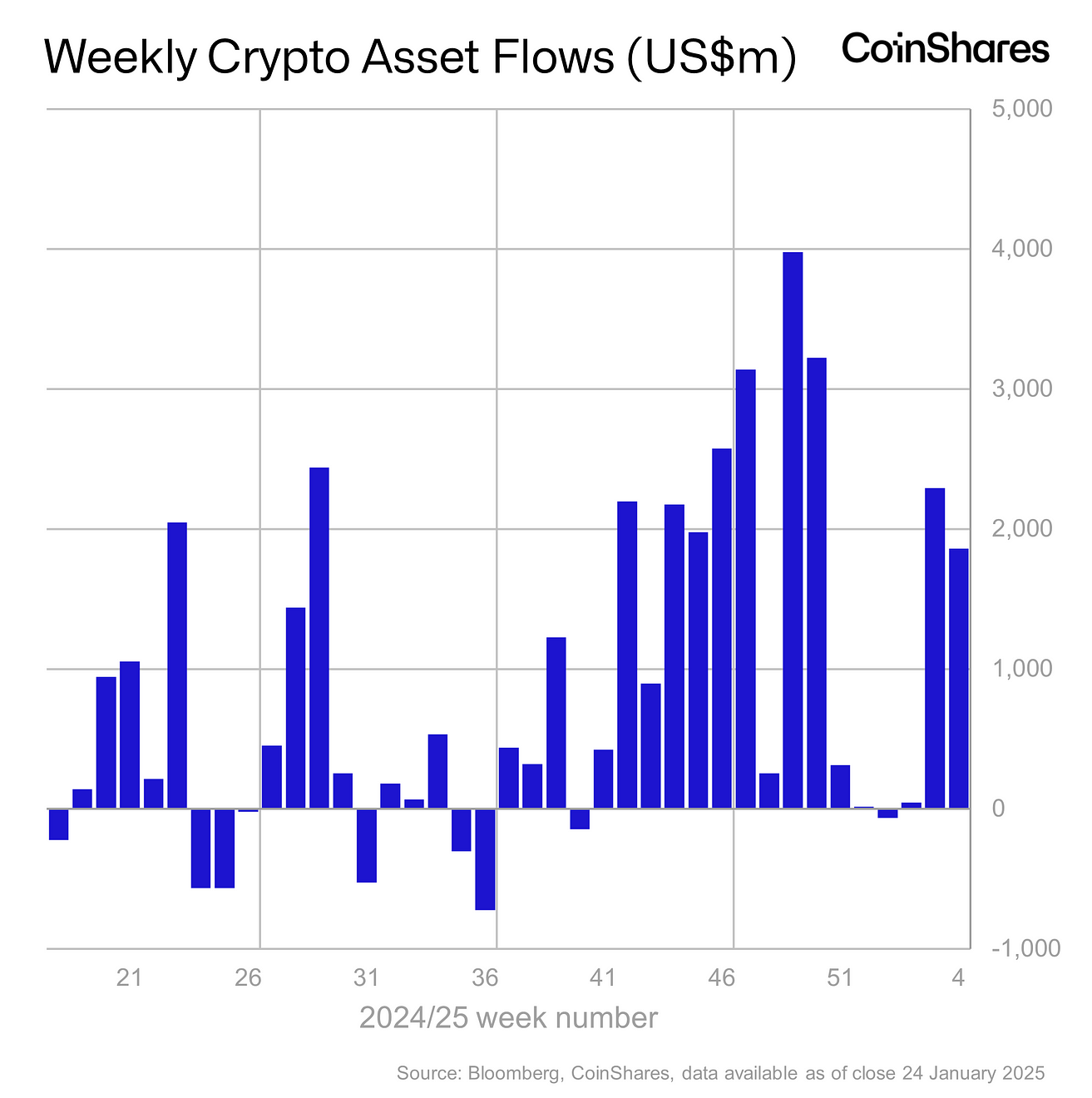

- CoinShares reports indicates a significant drop in institutional interest in Bitcoin, Ethereum, and XRP.

- Weekly inflows into digital assets are down to $1.9 billion from $2.2 billion.

- BlackRock digital asset ETFs are leading with a weekly inflow of $1.4 billion.

There is a notable decline in institutional interest in Bitcoin, Ethereum, and XRP. The same sentiment is reflected in their prices, leaving the community wondering what’s next now that US President Donald Trump has reaffirmed his intention of making the US a crypto capital of the world. Also, inflows into BlackRock’s iShares ETFs are growing continuously reaching $1.45 billion in a week.

Institutional Interest Drops in Bitcoin, Ethereum, and XRP

According to a report by CoinShares, Bitcoin, Ethereum, and XRP recorded a significant drop in inflow last week. It indicates a decline in interest from institutional investors. Inflows into digital assets are now down to $1.9 billion from $2.2 billion in an earlier week.

Nevertheless, trading volume remained high with a recorded number of $25 billion throughout the week. It is speculated that the number has changed in response to the Presidential executive order establishing a strategic digital asset stockpile in the US. This could include altcoins such as Ethereum (ETH), XRP and Hedera (HBAR).

The Year-to-Date inflow stands at $4.8 billion, a boost that is rooted to the proposal of an executive order that aims to develop a National Digital Asset Stockpile. It has triggered bullish sentiments across the crypto market and is gaining further momentum since Donald Trump has reaffirmed his commitment to making the US a crypto capital.

Inflows into Bitcoin are down from $1.9 billion to $1.6 billion over a week. Similarly, flows into Ethereum have dipped from $246 million to $205 million. Inflows into XRP are down from $31 million to $18.5 million.

Flows by Provider Into Digital Assets

iShares ETFs are leading the chart with an inflow of $1.4 billion, bringing its MTD flows to $2.9 billion for an AUM of $64.6 billion. It is followed by Fidelity ETFs and Ark 21 Shares with an inflow of $202 million and $173 million, respectively. Four providers recorded a weekly outflow.

- Grayscale Investments recorded an outflow of $124 million.

- Bitwise ETFs recorded an outflow of $19 million.

- CoinShares XBT recorded an outflow of $14 million.

- Volatility Shares Trust recorded an outflow of $17 million.

Other providers accumulated a weekly inflow of $180 million, bringing their MTD flows to $92 million with an AUM of over $33 billion. Also, the US registered the maximum level of inflows across different major countries with an inward movement of $1.7 billion. Sweden is the only region to record an outflow of $5.7 million.

Bitcoin, Ethereum and XRP Price Crash

The global crypto market has crashed today due to multiple reasons including panic towards China’s DeepSeek AI model, FOMC Meeting, and others.

BTC price has slipped below the $100,000 milestone with a 5.66% dip in the last 24 hours. Bitcoin is now exchanging hands at $98,738.10. BitMEX co-founder Arthur Hayes predicted a crash to $75K before rebounding again for a new all-time high.

Meanwhile, XRP has plunged by 11.15% to $2.77, and there is a risk that XRP price may fall to $2. Experts are bullish that such a huge decline is not on the horizon for Ripple’s native token.

Finally, ETH is down by 7.55% in the last 24 hours and is trading at $3,050. It also reflects a drop of 9.44% over the past 7 days and 8.60% in the last month.

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Market Weekly Recap: Crypto Bill White House Meeting, Binance Buys $1B BTC, and More (9- Feb 13)

- TRUMP Coin Pumps 5% as Canary Capital Amends ETF Filing With New Details

- Crypto Prices Surge Today: BTC, ETH, XRP, SOL Soar Despite US Government Shutdown

- Crypto Price Prediction For the Week Ahead: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs