Bitcoin [BTC] Futures Open Interest Reaches All-Time High Above $5 Billion

Bitcoin [BTC] futures Open Interest (OI) across leading derivatives platforms topped its ATH in February to a new high above $5 billion.

Okex Exchange is leading the futures market with an OI of $1.11 billion followed by BitMEX at 0.97 billion. The spikes on institutional platforms like CME and Bakkt are particularly grabbing the attention of the market. On 17th August 2020, the OI on CME at $948 million (an All-Time High) was nearly three times the OI during the high in February.

Along with Bitcoin, the futures OI for Ethereum [ETH] is also at ATH levels around $1.5 billion. Okex and Huobi are the leading platforms with OI above $300 million, each.

Institutional Spikes

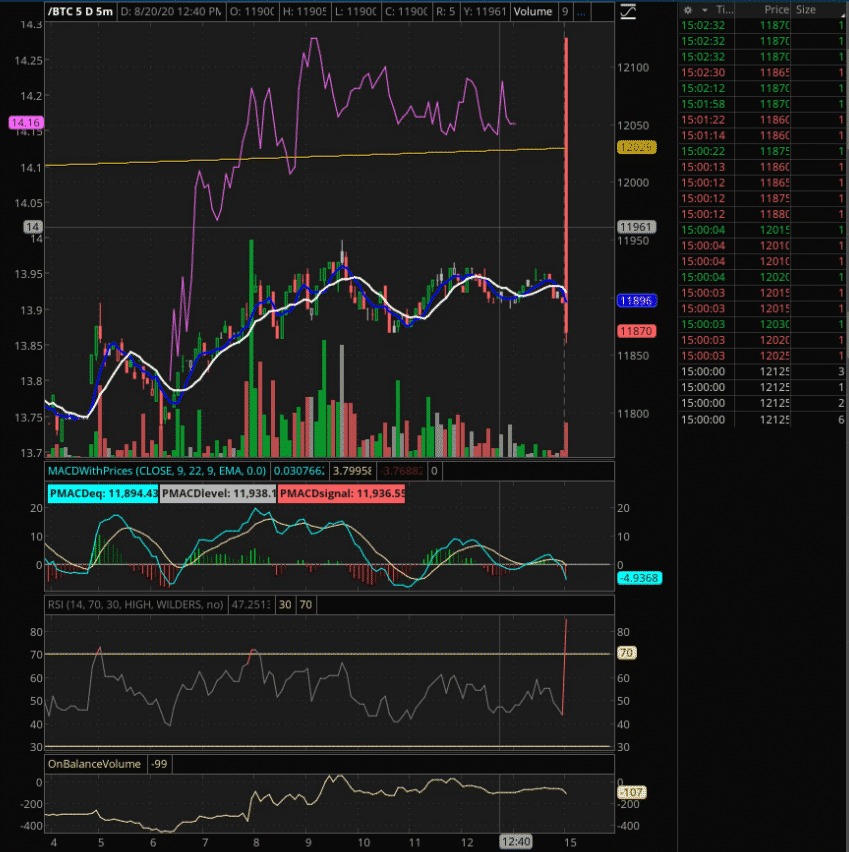

CME is the leading institutionally regulated platform which saw an unusual spike in the volume and RSI (Relative Strength Index) yesterday. Grain of Salt (alias), a crypto trader and analyst who noticed the spike tweeted,

Someone is playing with @CMEGroup#Bitcoin

futures. That was a big spike. Volatility incoming…

The amount of #BTC

futures contracts held to expiry in August increased by 133% from the lows in July, to 135 BTC. The USD amount increased even more (202%) and ended up at $1.6 million.

While the increasing institutional interest is a positive signal for market liquidity, in the past, it has acted as a top indicator as well. The funding rate on BitMEX and the contango level on CME is currently positive, but not near euphoric levels. The price of Bitcoin [BTC] at 12: 00 hours UTC on 21st August 2020 is $11700, down 1.34% on a daily scale.

Do you think the high Open Interest represents bullish euphoria or institutional shorts? Please share your views with us.

- Crypto Traders Reduce Fed Rate Cut Expectations Even as Expert Calls Fed Chair Nominee Kevin Warsh ‘Dovish’

- Crypto, Banks Clash Over Fed’s Proposed ‘Skinny’ Accounts Ahead of White House Crypto Meeting

- XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking

- Bernstein Downplays Bitcoin Bear Market Jitters, Predicts Rally To $150k This Year

- Breaking: Tom Lee’s BitMine Adds 40,613 ETH, Now Owns 3.58% Of Ethereum Supply

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%