Bitcoin Halving: Miners On Edge As Bitcoin (BTC) Hash Rate Hits All-Time High

Bitcoin’s reward halving is less than 10 days away and the mining frenzy is at an all-time high as signaled by the exploding mining hash rate on Sunday, May 3rd, 2020. Miners will hope for a bull run in the coming days to keep profitability stable through the block reward halving in the next 9 days. Currently, BTC/USD trades at 8,880, representing a slight 1.4% decrease in a day.

A Mining Frenzy Heading to the ‘crazy Bitcoin Halving’

According to data from Glassnode, the hash rate briefly soared over 142 Exahashes, setting a high on the 24 hour SMA, signaling increasing miner participation heading into halving. The halving was originally coded into Bitcoin by Satoshi Nakamoto, stipulating that the reward for each block will be cut in half every 210,000 blocks mined. The block number is approaching 630,000, where the block reward will be cut from 12.5 BTC to 6.25 BTC.

#Bitcoin hash rate hit a new all-time high. pic.twitter.com/XtPbZRU8wp

— glassnode (@glassnode) May 3, 2020

With less than 2000 blocks remaining (approx. 9 days), BTC mining pools are increasing their mining processes sending the hash rates to ATH. F2Pool, Pooling, BTC.com, and AntPool dominate Bitcoin’s mining with over half of the total hash rate distributed among the four pools.

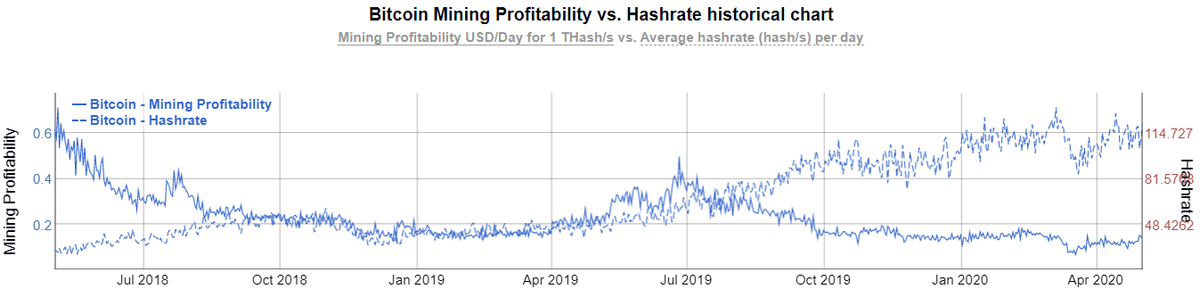

The hash rate rising is a sign the network is secure, preventing 51% attacks on the blockchain. As seen in the chart above, the price has followed an exponential rise in tandem with the hash rate, and as BTC tested a run towards $10,000 in the past few days, miners are in a frenzy to obtain the last of the 12.5- BTC reward blocks.

The greatest Bitcoin halving yet?

Several analysts have come forward describing the upcoming Bitcoin halving as possibly the most impactful yet. Bitcoin’s last halving in 2016 reduced the rewards from 25 BTC to 12.5 BTC. This was before the evolution of crypto derivatives, powerful ASIC miners, the evolution of other crypto options such as USDT, and the current global economic pressures.

This halving is receiving a wild amount of media coverage and Google Trends searches for the term reached all-time highs.

Concerns on the hash rate plummeting following the halving remain high. Small miner capitulation, low profits, and low prices of BTC are the most likely causes of killing the exponential increase in the hash rate in the coming year. However, crypto analyst, Mati Greenspan, who recently announced he’ll be moving 100% of his eToro assets into BTC, believes the hash rate will not drop following the halving.

The more the price rises into the halving the less the hashrate will drop after it's over.

— Mati Greenspan (tweets are not trading advice) (@MatiGreenspan) May 2, 2020

Looking at the chart below, the 2018 crypto bloodshed did not sway miners as the hash rate steadily increased despite the mining profitability of miners dipping over the past two years.

As miners prepare for the “greatest bitcoin halving” yet, the competition is stiffening as the last 12.5-BTC reward blocks are mined.

- Trump’s World Liberty Partners With Securitize in Tokenization of Real Estate

- Coinbase Adds XRP, ADA, LTC, DOGE as Collateral for Crypto-Backed Loans

- CLARITY Act Odds Spike to 90% as Coinbase CEO Confirms “Great Progress” On Crypto Bill

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand