Bitcoin Miner Marathon (MARA) Bags $130M In BTC Amid Strong Market Interest

Highlights

- Marathon (MARA) purchased $130 million in Bitcoin, sparking market optimism.

- Earlier this week, the firm has again accumulated a similar purchase, indicating its strong confidence towards the asset.

- Bitcoin whales are on a buying spree, indicating further rally ahead for the flagship crypto.

The top Bitcoin miner, Marathon Digital (MARA), has once again caught the eyes of investors with its recent BTC buying move. According to the latest data, the miner has accumulated 1300 BTC recently, following a similar transaction of 1,423 Bitcoin earlier this week. Notably, this comes after the firm announced the closing of its second $850 million convertible note offering, a move aimed at increasing its Bitcoin buying plan.

Bitcoin Miner Marathon (MARA) Continues BTC Buying Spree

The leading Wall Street players have recently been shifting their focus toward the digital assets space, as evidenced by the massive buying of the players. Despite BTC hitting $100K, it appears that the institutional interest in the flagship crypto remains unaltered.

According to recent data, Bitcoin miner Marathon (MARA) has accelerated its BTC buying plan, as evidenced by the latest transactions. Arkham data showed that MARA has recently acquired 1300 Bitcoin, worth around $130.66 million, from yesterday, sparking market optimism.

In addition, the firm made a similar purchase earlier this week, which has further caught the eyes of the investors. For context, earlier this week, the BTC miner acquired another 1423 Bitcoin, valued at around $139.5 million.

Notably, this substantial purchasing activity comes just after the BTC miner’s announcement of the successful closure of its second $850 million convertible note offering. According to the firm, the primary aim of this strategic move was to accelerate its Bitcoin acquisition plan, while also partially repurchasing existing notes that are set to mature in 2026.

Will BTC Continue To Rally?

BTC price today was up over 1% and exchanged hands at $99,531, making a bounce back from the 24-hour low of $97,629. However, the crypto’s trading volume dropped by 32% to $93,57 billion at the same time. The flagship crypto has touched a 24-hour high of $102,039.88, indicating strong market interest amid Marathon’s buying spree.

According to CoinGlass data, BTC Futures Open Interest was down 0.5% to $61.25 billion in a 24-hour time frame, while noting a slight rebound in the short term. Considering that, it appears that the investors are once again entering the BTC market after a short-term pause.

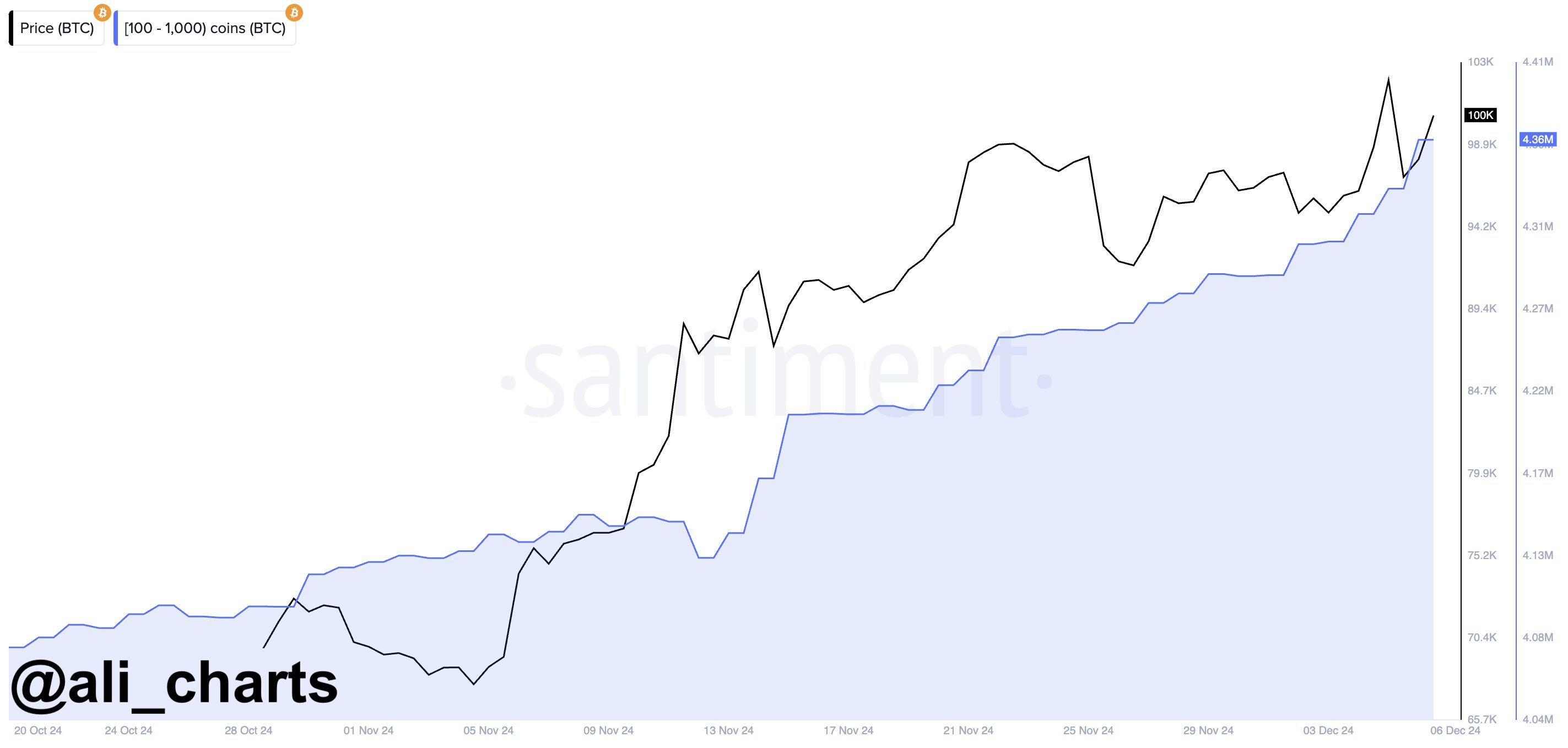

In addition, Bitcoin whales are also on a buying spree alongside the institutions. According to Ali Martinez, the whales have accumulated 20,000 BTC since yesterday, worth around $2 billion, signaling strong confidence in the asset. Having said that, it appears that BTC is likely to set a new record ahead, breaking its ATH of $103,900 attained on December 5.

- Crypto, Banks Clash Over Fed’s Proposed ‘Skinny’ Accounts Ahead of White House Crypto Meeting

- XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking

- Bernstein Downplays Bitcoin Bear Market Jitters, Predicts Rally To $150k This Year

- Breaking: Tom Lee’s BitMine Adds 40,613 ETH, Now Owns 3.58% Of Ethereum Supply

- Bitget Partners With BlockSec to Introduce the ‘UEX Security Standard’ Amid Quantum Threats to Crypto

- Cardano Price Prediction as Bitcoin Crashes Below $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%