Huge Shift For Bitcoin Miners With Rise Of Ordinals, On-Chain Data Suggests

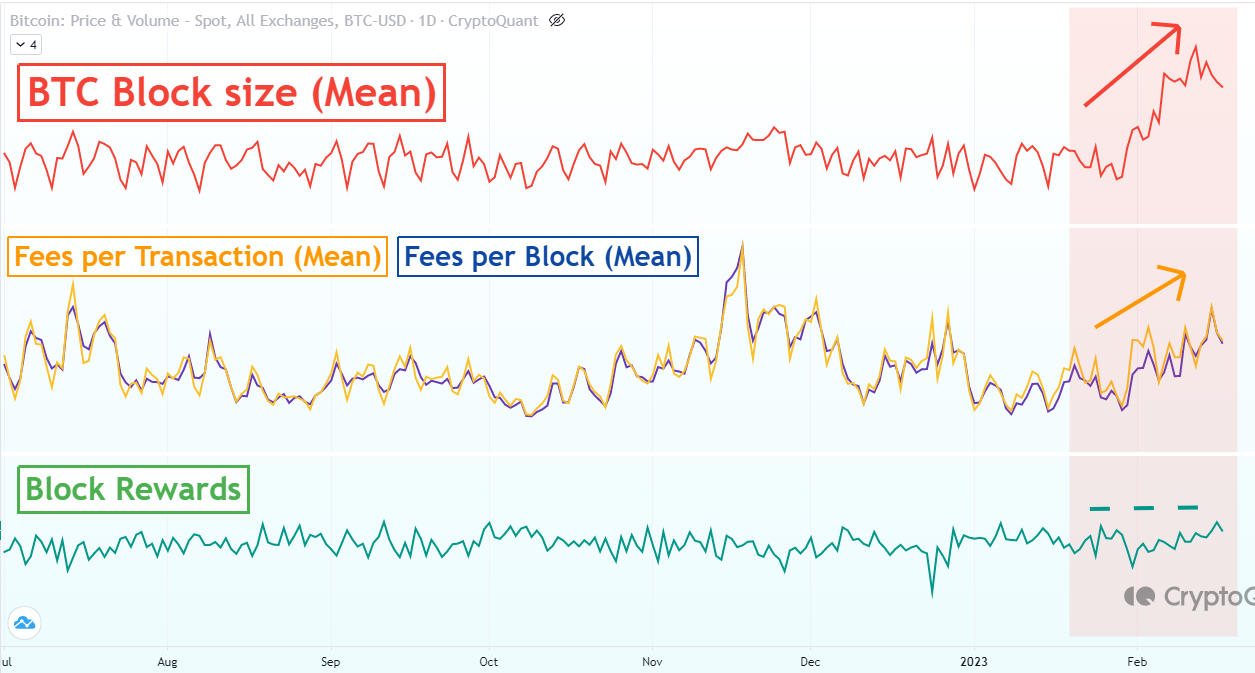

Bitcoin Ordinals: While the Bitcoin halving is considered the biggest event in the cryptocurrency’s life cycle, the onset of Bitcoin based NFTs could potentially go on to become the next biggest development. Primarily, Bitcoin was so far seen as a layer 1 blockchain with its use case being peer to peer transactions. With the coming of Non Fungible Tokens (NFTs) on Bitcoin layer itself, there could be a paradigm shift in the way miners operate, going forward. On chain data shows that the mean miner transaction fee per block rose in parallel with the adoption of Ordinals.

Also Read: Polygon (MATIC) Set To Reach New Record, Bullish Ahead Of zkEVM?

As a layer 1 blockchain, Bitcoin had the distinction of maintaining a standard peer to peer network. However, the blockchain network was deprived of use cases like NFT support. Hence, considering its reliability and stability as a regulator-friendly blockchain, Bitcoin adds more meaning to the Ordinals project. The adoption is clearly seen as miners rake gains from increased transaction fees thanks to the NFT activity on chain.

Bitcoin NFTs With Ordinal Theory

The Ordinals project rose to prominence as NFT transactions on Bitcoin network does not require a separate blockchain layer or changes to the Bitcoin network. For the purpose of store of value, these transactions also do not go with any other cryptocurrency but Bitcoin itself. The protocol was powered by two soft fork upgrades — Segregated Witness and Taproot.

As per Crypto Quant data, a clear rise in Bitcoin block size and miner fees per transaction was clearly affected by the use of Ordinals NFTs. Overall, there is growing interest in the Bitcoin NFTs.

Also Read: Will Bitcoin Price Rally Above Key 200-WMA Level? Or It’s A “Bull Trap”

- US PCE Inflation Estimates by JPMorgan, BofA, & Other Wall Street Banks

- CLARITY Act: Banks and Crypto Make Progress Following “Constructive” Dialogue at White House Meeting

- Expert Warns Bitcoin Bear Market Just In ‘Phase 1’ as Glassnode Flags BTC Demand Exhaustion

- SEC Chair Reveals Regulatory Roadmap for Crypto Securities Amid Wait for CLARITY Act

- ProShares Launches First GENIUS Act Focused Money Market ETF, Targeting Ripple, Tether, Circle

- Top 3 Price Predictions Feb 2026 for Solana, Bitcoin, Pi Network as Odds of Trump Attacking Iran Rise

- Cardano Price Prediction Feb 2026 as Coinbase Accepts ADA as Loan Collateral

- Ripple Prediction: Will Arizona XRP Reserve Boost Price?

- Dogecoin Price Eyes Recovery Above $0.15 as Coinbase Expands Crypto-Backed Loans

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?