Bitcoin’s Price Flashes Buy Signal, Is $35,000 In Sight?

As the first quarter of 2023 draws to a close, the price of Bitcoin reveals some intriguing future projections. From the beginning of 2023, Bitcoin has displayed remarkable strength and has provided investors with gains of roughly 70%. The important support and resistance levels for the second quarter of 2023 are few of the parameters, market participants are keenly looking forward to in hopes of a fresh rally.

Bitcoin Price Upsurge

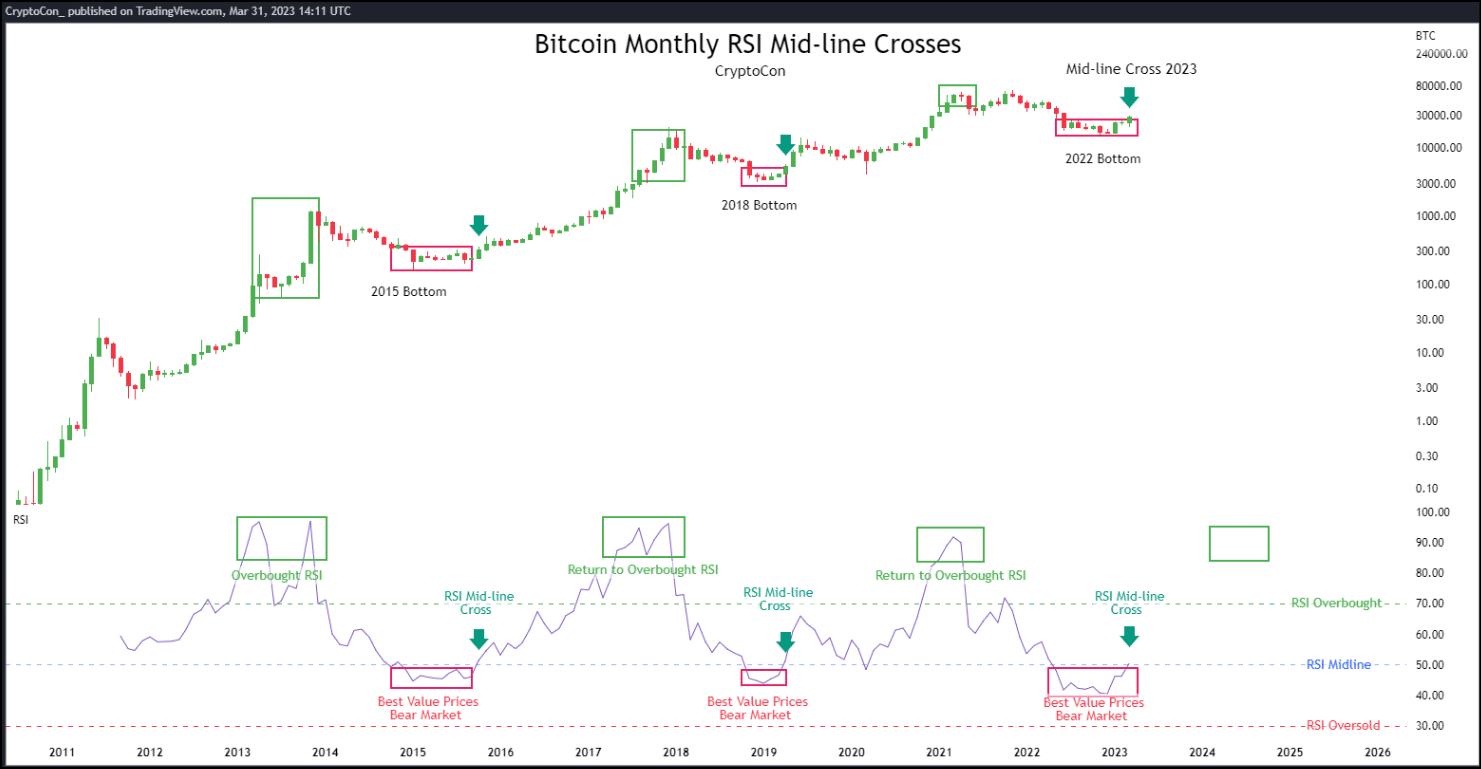

The recent increases come as a result of upbeat macroeconomic data from the United States, specifically the Personal Consumption Expenditures (PCE) index for February, which came in slightly lower as per market estimates. Moreover, renowned cryptocurrency analyst CryptoCon believes that the monthly RSI mid-line cross is taking place right now, which would eliminate the final remaining support for bearish sentiment regarding the price of bitcoin.

Read More: Top Mastercard-Backed Blockchain App Migrates To Hedera; Is HBAR Price Gunning For $1?

According to the findings of his study and analysis, Bitcoin “should now return to the overbought zone”, and forecasts significantly higher prices for the flagship cryptocurrency on the horizon in the near future.

Bitcoin Flashes Bullish Signal

At this time, the Relative Strength Index (RSI) is located below the 50-line and is attempting to climb higher. It’s possible that if the positive momentum persists, prompting the RSI to flip the median, it will indicate that the run-up would continue. The Awesome Oscillator (AO), which displays a continuous drop in the bearish momentum as two consecutive months conclude with a burst of bullish momentum, provides additional evidence for this optimistic prognosis.

As things stand, the price of BTC is currently exchanging hands at $28,464 which represents an increase of 0.71% over the past 24 hours as opposed to a gain of 1.41% recorded over the previous seven days. Additionally, it should be noted that BTC’s technical analysis (TA) indicators at CoinGape’s crypto market tracker presently recommend a “strong buy” position, advising a “buy” at level 16 and a “sell” at level 0 by its moving averages.

Also Read: Hindenburg Research Grills Block’s Official Response; SQ Stock Price In Danger?

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs