Bitcoin Price Calm Before The Storm: Selling Now to Buy Later?

Bitcoin price continues to prolong the monotony in a tight range above $29,100, with its immediate upside capped under $30,000. Its lull market structure may, however, result in more volatility, implying that investors and traders must be cautious.

Bitcoin Price Volatility in The Cards?

The trading range in Bitcoin price, alongside that of altcoins like Ethereum, has narrowed significantly over the past six weeks, based on insights released by K33 Research, a digital assets wealth management platform.

According to the report, the crypto market stability continues to defy macroeconomic factors, and key industry events, which would have sent investors on a rollercoaster a few years ago.

“A deep crypto sleep tends to be followed by a violent wake-up,” Vetle Lunde a K33 senior analyst said. “The market is clearly in an unprecedented stable stage, which has typically acted as a massive pressure valve for volatility once it finally reignites.”

Meanwhile, support at $29,100 has been reinforced by the 61.8% Fibonacci level, and with the Money Flow Index (MFI) moving above the midline, the path with the least resistance could to the upside.

A rebound from that support would confirm a buy signal from the Moving Average Convergence Divergence (MACD) indicator. Traders trading this momentum indicator may want to ascertain that the MACD line in blue has flipped above the signal line in red before triggering their buy orders.

A subsequent break above the 50-day Exponential Moving Average (EMA) (red) would add credence to the uptrend, thus increasing investor confidence in the Bitcoin price recovery above $30,000.

“My short-term thesis,” Lunde continued, “is that the market’s volatility pressure is about to climax and that an eruption is near.”

Bitcoin Price Could Explode Anytime

Bitcoin’s five-day volatility low dropped below that of the S&P, Nasdaq, and gold. Based on the K33 Research report, this has happened only a handful of times, with a volatility eruption following thereafter.

Investors should consider the 30-day volatility index, which has recently dropped almost to a five-year low in addition to the volume significantly shrinking.

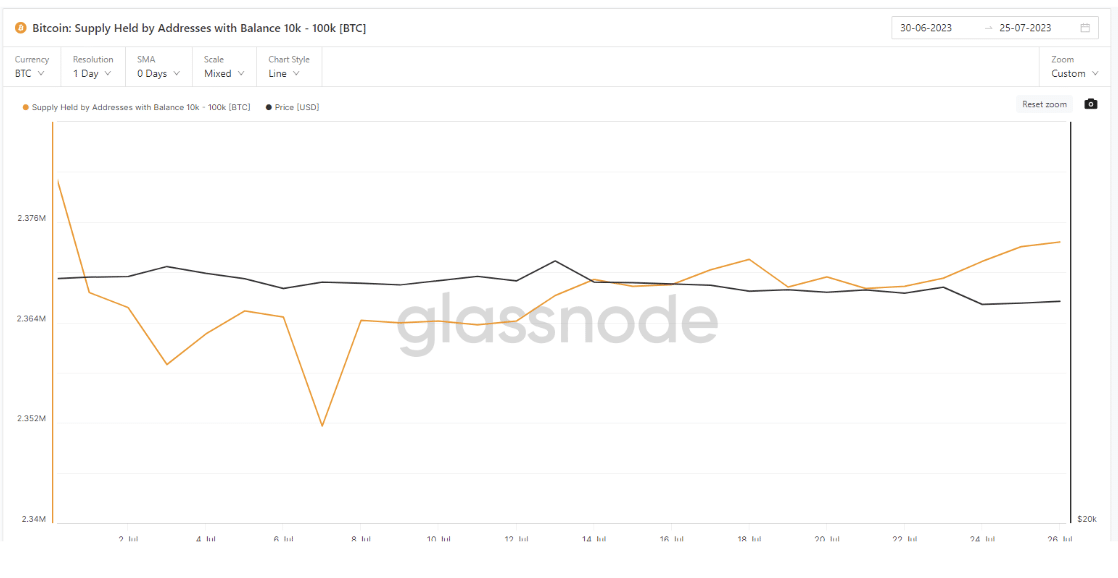

On-chain insights from Glassnode show that long-term holders of Bitcoin have been reducing their supply, suggesting that they are ready to sell, especially if the price sinks further below $30,000.

An increase in the supply of BTC held by long-term holders shows that investors are willing to keep their positions, instead of taking profits.

That said, losses below $29,100 support might trigger panic selling among investors, exerting more pressure on $28,000. It is too early to rule out the possibility of declines extending to $25,000 before Bitcoin begins the run-up to $35,000 and $38,000 subsequently.

Related Articles

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- ChangeNOW Is Settling Crypto Swaps in Under a Minute.

- $3B Western Union Expands Into Crypto With USDPT Stablecoin Launch on Solana

- XRP News: Key Ripple Whale Indicator Turns Bullish After Months, Price Rally Ahead?

- Crypto Market Today: BTC, ETH, XRP, SOL, and DOGE Rally as Geopolitical Tensions Ease

- Crypto Market Bill Hits New Deadlock as Banks Reject White House Deal

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

- COIN Stock Analysis as Bitcoin Retests $72k Ahead of February NFP Data

- Robinhood Stock Price Prediction As Cathie Wood Buys $12M Dip in Bold ARK Move

Buy $GGs

Buy $GGs