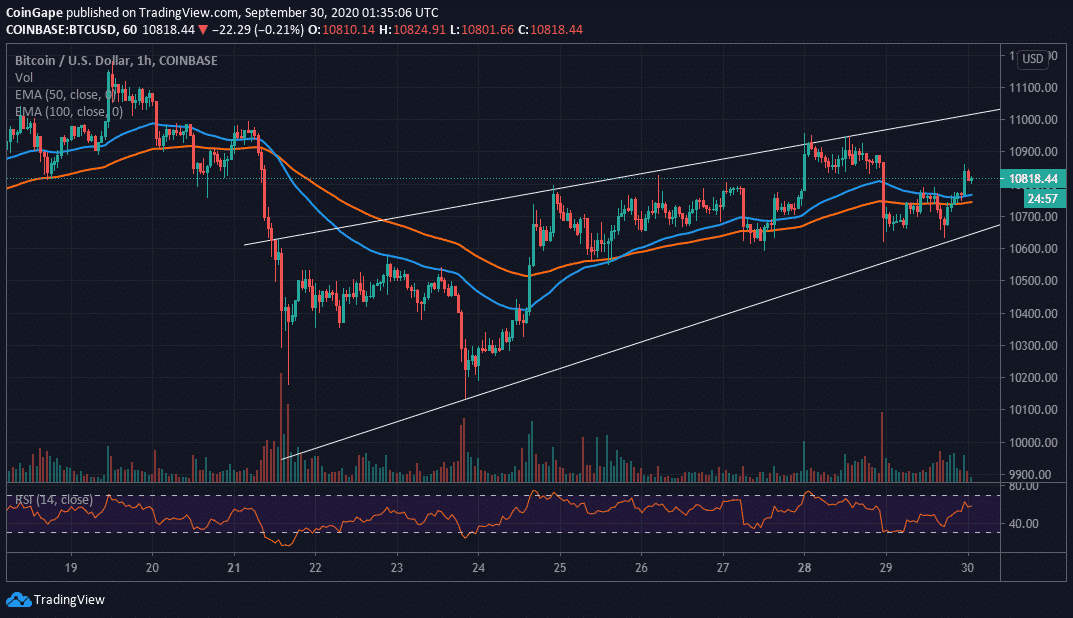

Bitcoin Technical Analysis: BTC Eyes Retreat Before Another Breakout To $11,000

- Bitcoin price is poised for a retreat to the next support at $10,600.

- The 50 EMA and 100 EMA are in line to offer support to save Bitcoin from the potential fall to $10,600.

The flagship cryptocurrency has been able to rise above the stubborn resistance at $11,000. However, there was an impressive bullish price action over the weekend that saw Bitcoin draw closer to $11,000. Unfortunately, the bullish case was cut short, leaving a gap that has been explored by the bears. BTC/USD refreshed support at $10,600 after which bulls took another shot at $11,000 but hit a barrier at $10,860.

Meanwhile, Bitcoin is trading at $10,810 even as bulls seek support above $10,800. Looking at the Relative Strength Index (RSI), the bellwether digital asset is still in the hands of the bulls. However, a minor retreat made by the RSI suggests that exhaustion is slowly engulfing the bullish camp.

BTC/USD hourly chart

If Bitcoin delays the run-up to $11,000, sellers could eventually gain traction, sending the price back to $11,600 support. From there, buyers will have the energy to push to $11,000, mainly riding on newly created demand from investors who choose to buy low. Note that if the support at $10,600 is shattered, Bitcoin may be forced to seek refuge in the next key range at $10,000 – $10,200. The bearish scenario would also confirm a forming rising wedge pattern.

Support is envisioned at the 50 Simple Moving Average (SMA) and the 100 SMA in the hourly range. Bitcoin could invalidate the reversal to $10,600 if the price holds above these moving averages. On the upside, a break above $11,000 would pave the way for gains towards $11,200 resistance, in turn, allowing buyers to shift the focus back to $12,000.

Bitcoin Intraday Levels

Spot rate: $10,800

Percentage change: -33

Relative change: -0.31%

Trend: Short term bearish bias

Volatility: Low

- What Will Spark the Next Bitcoin Bull Market? Bitwise CIO Names 4 Factors

- U.S. CPI Release: Wall Street Predicts Soft Inflation Reading as Crypto Market Holds Steady

- Bhutan Government Cuts Bitcoin Holdings as Standard Chartered Predicts BTC Price Crash To $50k

- XRP News: Binance Integrates Ripple’s RLUSD on XRPL After Ethereum Listing

- Breaking: SUI Price Rebounds 7% as Grayscale Amends S-1 for Sui ETF

- Solana Price Prediction as $2.6 Trillion Citi Expands Tokenized Products to SOL

- Bitcoin Price Could Fall to $50,000, Standard Chartered Says — Is a Crash Coming?

- Cardano Price Prediction Ahead of Midnight Mainnet Launch

- Pi Network Price Prediction as Mainnet Upgrade Deadline Nears on Feb 15

- XRP Price Outlook Amid XRP Community Day 2026

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter