Bitcoin Tokenized on Ethereum Approaches $1 Billion

More investors are using their Bitcoin to invest in high yielding DeFi farming incentives as the amount of tokenized BTC has surged to record levels.

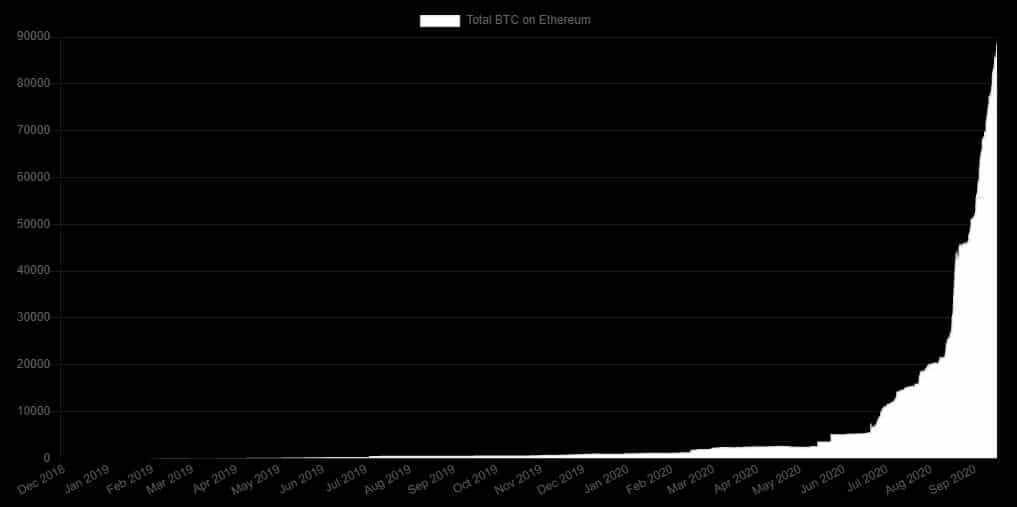

Tokenized, or wrapped, Bitcoin has gained so much popularity this year that there is almost a billion dollars’ worth of it circulating now. The parabolic surge over the past couple of months has been driven by the DeFi token farming boom which has resulted in a 1200% increase in collateral locked in the sector since the beginning of 2020.

90,000 BTC on ETH

Full-stack software developer going by the twitter handle ‘lastmjs.eth’ (@lastmjs) has noted that a large milestone is approaching.

Hey everyone, we're getting close to $1 billion of tokenized BTC on Ethereum, and nearing 100,000 tokenized BTC.https://t.co/PqU9DE8AG5

— lastmjs.eth ⟠ (@lastmjs) September 15, 2020

According to btconethereum.com, there are a total of 89,000 Bitcoins on the Ethereum network at the time of writing. At today’s prices, this works out at $956 million, just shy of a billion dollars.

Of that total, 65% is wrapped Bitcoin, or wBTC, which is the most popular standard at the moment. renBTC is the second most popular method of tokenizing Bitcoin and there is 21,400 BTC currently using this method to access Ethereum based protocols and dApps.

The rapidly approaching milestone is bullish for Bitcoin in that it is being used for other investments as opposed to just hodling, and bullish for Ethereum in terms of economic activity on the network.

Why Wrap Bitcoin?

Since most of DeFi is based on Ethereum, BTC will not natively work with it so it needs to be wrapped, or tokenized into ERC-20 form.

A wrapped Bitcoin is equivalent to a Bitcoin except that it can now be used across a wide range of DeFi platforms and dApps that operate on the Ethereum network. A new wave of DeFi farming incentives is emerging offering liquidity pools using various versions of tokenized BTC which allow investors to use their holdings without selling their Bitcoin.

According to Defipulse.com, which recently launched its own Index, the amount of collateral locked into wBTC has surged 1300% over the past 90 days to an all-time high of $630 million.

RenVM, which is the interoperable network and custodian for renBTC and DeFi assets, has seen even greater growth of 2700% over the same period with its TVL also hitting an all-time high of $270 million.

There are several lesser-known tokenized versions of Bitcoin and these include HBTC, sBTC, imBTC, and pBTC, but they all essentially do the same thing.

- Crypto Traders Reduce Fed Rate Cut Expectations Even as Expert Calls Fed Chair Nominee Kevin Warsh ‘Dovish’

- Crypto, Banks Clash Over Fed’s Proposed ‘Skinny’ Accounts Ahead of White House Crypto Meeting

- XRP News: Ripple Expands Custody Services to Ethereum and Solana Staking

- Bernstein Downplays Bitcoin Bear Market Jitters, Predicts Rally To $150k This Year

- Breaking: Tom Lee’s BitMine Adds 40,613 ETH, Now Owns 3.58% Of Ethereum Supply

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%