Bitfinex Limit Order Book Hints A “Buy The News” Event for Bitcoin (BTC)

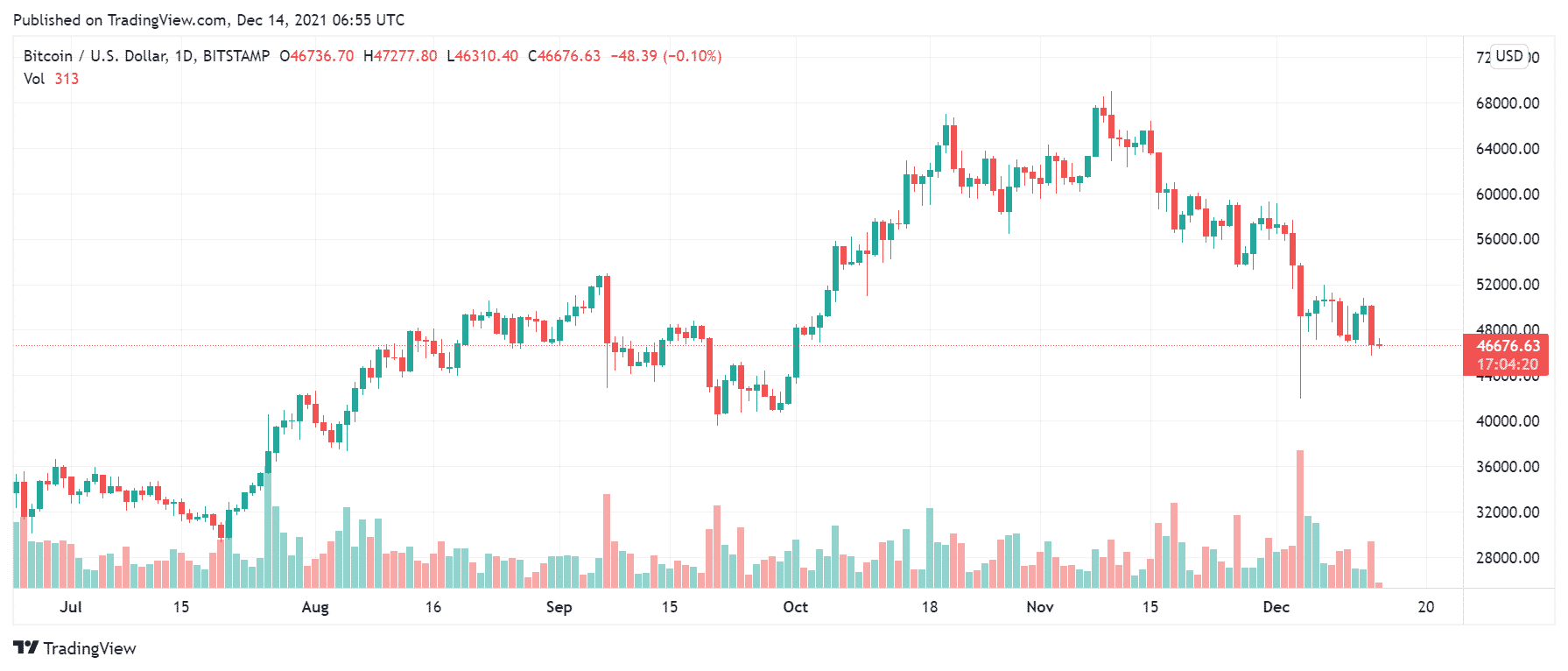

Bitcoin (BTC) fell over 10% on Monday as the crypto market registered another flash crash in December. BTC price fell to a daily low of $45,894 before recovering above $47K. However, it lost $47K support again early Tuesday and was trading at $46,664 at the time of writing.

The market slump was attributed to a recent class-action lawsuit filed against Tether and its entities in a New York court over allegations of fraud. Another key factor that many belive is playing a key part in the recent crypto market slump is the upcoming Fed meeting on Wednesday. The U.S consumer inflation hit the highest in four decades and the upcoming fed meeting is expected to announce the faster tapering of bond purchases. This could potentially trigger an upswing in inflation hedges like gold and Bitcoin.

Gold prices have already started to show an uptick and the stock market is recovering as well, and crypto could potentially be the next.

Bitfinex’s Bitcoin Limit Order Book Hints at “Buy The News” Event

Despite the current market slump Bitcoin whales have continued accumulation across the board. Bitfinex crypto exchange’s limit order book indicated that the retail market is selling in a panic ahead of the FOMC meeting while whales have continued their accumulation. The FOMC meeting could be the potential trigger point, and experts belive the current market is the perfect “Buy the News” scenario.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Bitcoin Price Rebounds as Jane Street “10 am Dump” Pattern Stops Amid Lawsuit

- US OCC Proposes Rule to Implement GENIUS Act & Prohibits Stablecoin Yield

- ETHZilla Abandons Ethereum, Rebrands as Forum to Focus on RWA Tokenization

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale