Breaking: BlackRock Bitcoin ETF (IBIT) Sees $597M In Inflow, Saves the Day

Highlights

- BlackRock's iShares Bitcoin ETF (IBIT) recorded over $597 million in inflow.

- Spot Bitcoin ETF in the U.S. witnessed a net inflow of $53.46.

- Net inflow came in positive despite Bitcoin and crypto market crash due to macro concerns.

- BTC price continues to trade lower near $96K

BlackRock’s iShares Bitcoin ETF (IBIT) recorded over $597 million in inflow on Tuesday. The BlackRock Bitcoin ETF saves the day for the bleeding crypto market after investors turned cautious with strong US JOLTS job openings and ISM Services PMI data.

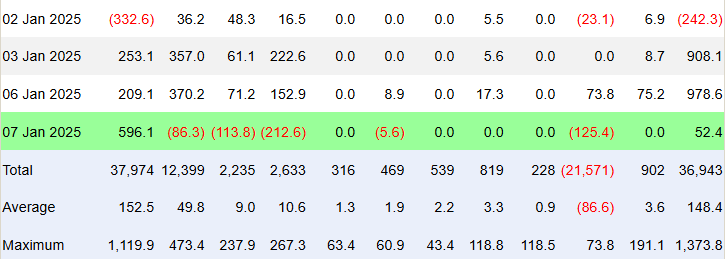

The spot Bitcoin ETF in the United States saw a net inflow of $53.46. Bitcoin ETFs by Fidelity, Bitwise, Ark 21Shares, Franklin Templeton, and Grayscale recorded outflows.

BlackRock Bitcoin ETF Saw Inflow Despite Crypto Market Crash

BlackRock’s iShares Bitcoin ETF (IBIT) purchased 6,078 BTC worth $208.7 on January 7, while miners only mined 450 new BTCs. IBIT recorded an inflow of $597.18 million, as per Trader T data.

This makes the third consecutive inflow into IBIT despite a major selloff in the crypto market. Notably, US Bitcoin ETF saw an inflow of $978.6 million on Monday, sparking optimism as the flagship crypto soared past the $102K mark.

Meanwhile, Fidelity’s FBTC, Bitwise’s BITB, and Ark Invest’s ARKB saw outflow of $86.29 million, $113.85 million, and $212.55 million, respectively. Also, Franklin EZBC saw a $5.58 million in outflow.

Grayscale’s GBTC also witnessed an outflow of $125.45 million. Flows were zero for Invesco, Valkyrie, VanEck, and Grayscale Mini.

According to Farside Investors, the total net inflow for Bitcoin spot ETFs reached $52.4 million. The iShares Bitcoin Trust by BlackRock saw a net inflow of $596.1 million. Whereas, other ETFs experienced varying degrees of outflow.

Bitcoin and Crypto Market Crash On Macro Concerns

According to the U.S. Bureau of Labor Statistics, the JOLTS jobs openings increased by 259,000 to 8,098 million in November 2024, Also, ISM Services PMI came in higher than expected, which shows the resilience of the U.S. economy currently. This caused Bitcoin price to crash by more than 5%.

In fact, the US dollar index (DXY) holds its advance above 108.50 today, after a two-day low move that caused a recovery in Bitcoin price. Also, the 10-year US Treasury yield increased to a 35-week high of 4.68%. The strong US economic data reduced expectations for further rate cuts by the Federal Reserve.

Whereas, BTC price continues to fall despite better performance by BlackRock Bitcoin ETF. The price currently trades at $96,259. The 24-hour low and high are $96,132 and $102,022, respectively. Furthermore, the trading volume has decreased by 23% in the last 24 hours.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale