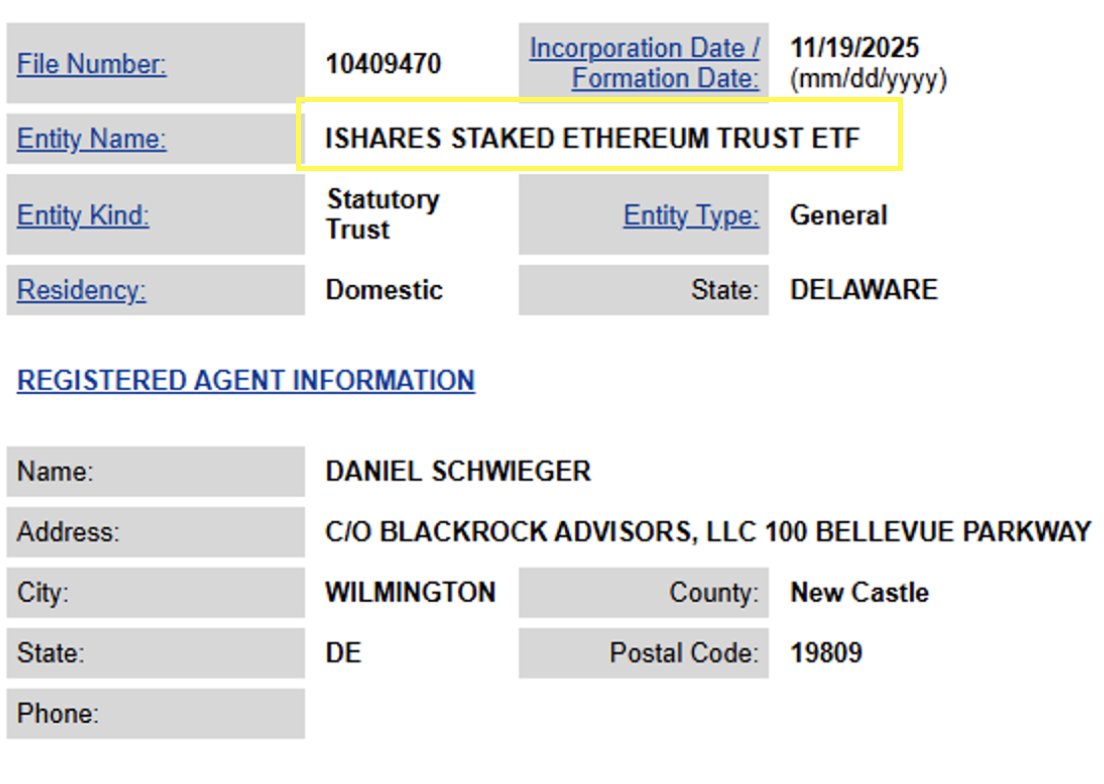

BlackRock Boosts ETF Portfolio by Registering iShares Staked ETH Trust in Delaware

Highlights

- BlackRock regsitered for the iShares Staked Ethereum Trust in Delaware.

- The firm will be able to stake ETH held in the fund if approved.

- BlackRock’s ETHA remains the largest ETH ETF.

BlackRock is preparing to introduce a new Ethereum-based investment vehicle that includes staking. This comes after a recent Delaware filing highlighted the move by the asset manager.

BlackRock Moves Closer to a Staked Ethereum ETF

The asset manager has filed a new statutory trust in Delaware called the iShares Staked Ethereum Trust. Bloomberg ETF analyst Eric Balchunas pointed out the registration and said a formal filing under the Securities Act of 1933 should be imminent.

The firm filed similar corporate entities a few days before it submitted its spot Bitcoin and Ethereum ETFs.

This comes after the SEC officially acknowledged Nasdaq’s request to permit staking within BlackRock’s existing Ethereum ETF. The regulator, though, had delayed its decision on the product’s progress in September.

With the commission’s approval, the asset manager will be able to stake the ETH held in the fund and distribute the resulting rewards to the investors.

This also comes after the SEC withdrew the 19b-4 filing requirement for crypto ETPs that meet new generic listing standards. The move could make progress easier for Ethereum-related products, including staking-based ETFs.

Robert Mitchnick, BlackRock’s Head of Digital Assets, described staking approval as “the next phase” for Ethereum ETF development.

Growing Staking ETF Ecosystem Suggests Maturing Market

A set of asset managers, including the likes of 21Shares, Fidelity, and Franklin Templeton, have already filed to add staking into their Ethereum ETFs.

The U.S. market also saw its first ever dedicated staking ETF launch recently. REX Shares launched the REX-Osprey ETH + Staking ETF (ESK). The product offers spot ETH exposure, with on-chain staking rewards. The fund has, however, only recorded $2.4 million in assets.

That momentum continued when Grayscale announced staking capabilities for its Ethereum funds, ETHE and ETH. It collectively staked 32,000 ETH on launch day alone.

BlackRock’s ETHA is already the largest Ethereum ETF with over $11.5 billion under management. However, amid the market crash, the product has consistently seen outflows. Yesterday, ETHA saw almost $200 million in outflows.

Staking has become a key part of how Ethereum’s economy works. Every time a user locks up their ETH to aid in transaction verification, they are, in turn, rewarded, decreasing the total ETH circulating in the market. That makes staking a very attractive option for funds seeking additional ways to earn money.

However, staking carries certain regulatory and operational risks. Slashing penalties, validator selection policies, and more complex asset management being just a few of them. The issuers must be clear about these issues in their filings.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Indiana Signs Bitcoin Bill Into Law Allowing Crypto in Retirement Plans

- ‘Time to Act Is Now’: CFTC Chief Pushes Swift Passage of CLARITY Act

- Trump Tells Congress to Pass Crypto Market Bill ‘ASAP,’ Blasts Banks for Stalling

- BTC Price Bounces as Spot Investors Buy The Dip Amid Iran War Jitters

- CFTC Chief Mike Selig Signals US Crypto Perpetual Futures Rollout in Coming Weeks

- Gold Price Prediction March 2026: Rally, Crash, or Record Highs?

- RIOT Stock Prediction as Needham, Piper Sandler Slash Target After Earnings

- Cardano Price Outlook As Charles Hoskinson Warns Over CLARITY Act

- Circle Stock Price Climbs 15% to $96, Can Rally Continue in March 2026?

- Bitcoin Price Prediction as US-Iran War Enters 4th Consecutive Day

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

Buy $GGs

Buy $GGs