Breaking: Grayscale’s $GDLC Fund is now an SEC Reporting Company

Grayscale’s Digital Large Cap Fund ($GDLC) has become an SEC reporting company, making it more attractive for regulatory-focused institutional investors. Grayscale filed for the Registration Statement on Form 10 with the SEC in May to obtain the regulatory clearance. The digital asset management firm also revealed that they have filed three additional Registration Statements for its Bitcoin Cash (BCH) Trust, Litecoin (LTC) Trust, and Ethereum Classic (ETC) Trust.

MILESTONE: $GDLC has become an SEC reporting company and we just filed three additional Registration Statements on Form 10 with the SEC for each $BCHG, $ETCG, and $LTCN. Read more: https://t.co/QSCrKL40be pic.twitter.com/7PcMgPB8Od

— Grayscale (@Grayscale) July 12, 2021

“Grayscale aims to provide the investment community with a higher level of disclosure and reporting on top of the already stringent obligations to which our products adhere,” said Craig Salm, Vice President of Legal at Grayscale

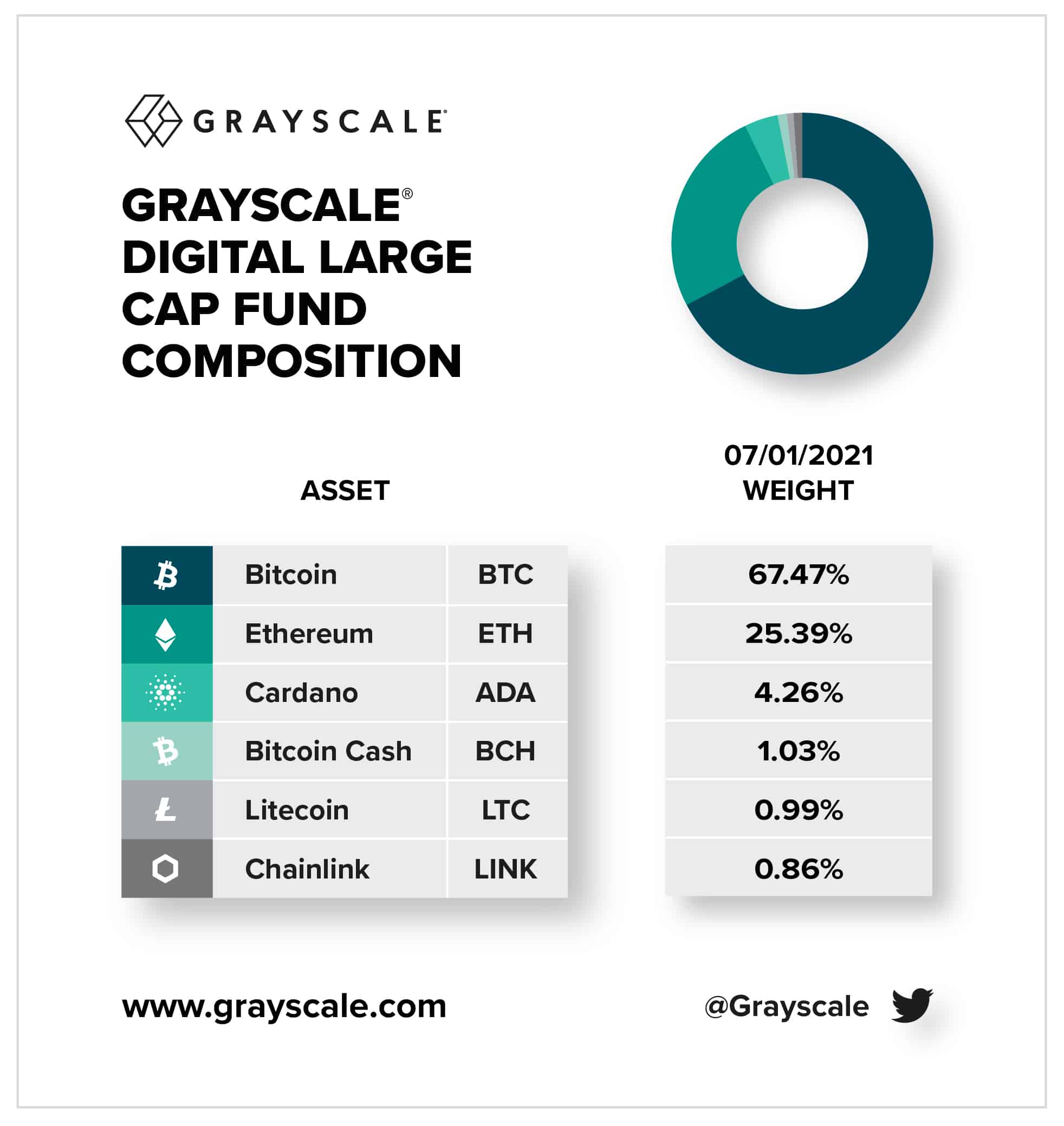

The approval of Grayscale Digital Large Cap fun makes it the third SEC reporting product for the digital asset management firm. The $GDLC fund comprises Bitcoin, Ethereum, Cardano, Chainlink, Bitcoin Cash, and Litecoin.

The digital large-cap fund would now allow institutional investors to liquidate their shares in the fund on the retail market in 6 months rather than 12 months. The new regulatory approval would also see Grayscale filing standard quarterly and annual reports known as 10-Qs and 10-Ks.

Grayscale Plans to Convert $GBTC Fund into a Bitcoin ETF

The latest SEC approval for Grayscale’s GDLC funds comes as a major milestone given it is preparing to convert its GBTC fund into a Bitcoin ETF in near future. The approval also highlights SEC’s focus on regulating the crypto market amid growing demand from current and former lawmakers. Former CFTC chair and current SEC commissioner have called upon SEC to approve the Bitcoin ETF.

The SEC has delayed its decision on three Bitcoin ETF proposals till now and has left Bitcoin out of its yearly regulatory agenda.

Recently, US Senator Elizabeth Warren wrote to SEC giving them a July 28 deadline to share measures they have taken to ensure investors’ protection. The call for regulating the crypto market has increased in recent times with the SEC chief Gary Gensler himself advocating for implementing traditional markets like investor protection norms on the crypto platforms. However, SEC is yet to offer any framework or guidelines to implement the same.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Ripple Bets On AI Boom With Strategic Investment In AI Agent Infrastructure Startup

- Prediction Market News: Kalshi Fines MrBeast Associate Over Insider Trading Amid State Crackdown

- CLARITY Act: Banks, Crypto Yet To Agree On New Crypto Bill Draft As March 1 Deadline Looms

- Michael Saylor Predicts $50T From Bonds Could Flow Into Bitcoin Ecosystem as Digital Credit Evolves

- Bitcoin Treasury Firm GD Culture Authorizes Sale of 7,500 BTC as Expert Warns Of More ‘Pain’

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

- Will Solana Price Rally to $100 If Bitcoin Reclaims $72K?

- XRP Price Eye $2 Rebound as On-Chain Data Signals Massive Whale Accumulation

- Ethereum Price Reclaims $2K- New Rally Ahead or a Temporary Bounce?

- COIN Stock Price Prediction as Wall Street Pros Forecast a 62% Surge

- Cardano Price Signals Rebound as Whales Accumulate 819M ADA

Buy Presale

Buy Presale