Breaking: Indian Securities Regulator Bars Financial Advisors From Advising on Crypto

The Securities and Exchange Board of India (SEBI) has issued a circular addressed to investment financial advisors in the country, barring them from offering any financial advice on cryptocurrencies and similar unregulated markets.

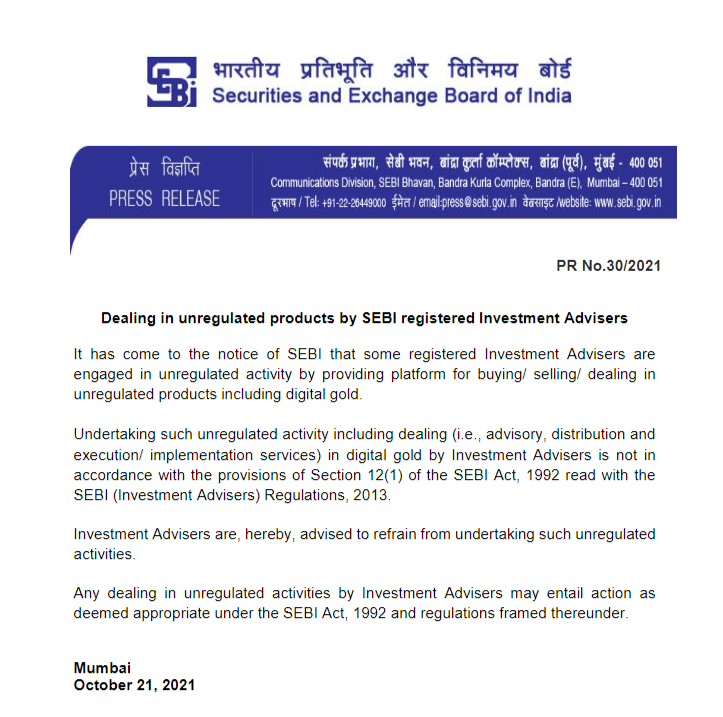

SEBI in its circular noted that investment advisors have been found involved in unregulated activity by advising clients on crypto market investment. The circular warned of possible legal action under the SEBI act 1992.

“It has come to the notice of SEBI that some registered Investment Advisers are engaged in unregulated activity by providing a platform for buying/ selling/ dealing in unregulated products including digital gold. Investment Advisers are, hereby, advised to refrain from undertaking such unregulated activities. Any dealing in unregulated activities by Investment Advisers may entail action as deemed appropriate under the SEBI Act, 1992 and regulations framed thereunder.”

The warning from the chief securities regulator in India comes at a time when the country has risen to the second spot in terms of global crypto adoption. One chainalysis report claimed that Indian invested over $4 billion in the crypto market in 2021 compared to just $20 million last year.

Indan Crypto Ecosystem Booms Despite Regulatory Unclarity

The state of crypto regulations in India remains undetermined despite numerous insider reports of possible framework finalization this year. However, the state of regulations doesn’t seem to have impacted the general population as evident from the massive growth in their crypto investment. Apart from a monumental growth in crypto investment, Indian crypto companies are making a name world over with two unicorns in the form of CoinDCX and CoinSwitch Kuber coming this year itself.

Major venture capital firms have their eyes set on India be it a16z or the investment arm of Coinbase and several others. The last report regarding crypto regulations indicated the government would take a measured step and treat Bitcoin as an asset.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs