BTC Price Prediction As Bulls Defend $25k S/R, Wise Move Or Trap?

Bitcoin, down 11% in a week, is hovering at $26,000 with limited action to the upside. Short-term holders whose supply was already trading in unrealized loss before last week’s deleveraging event in BTC futures are likely to be confronted by a gloomy future, considering the possibility of declines extending toward $20,000.

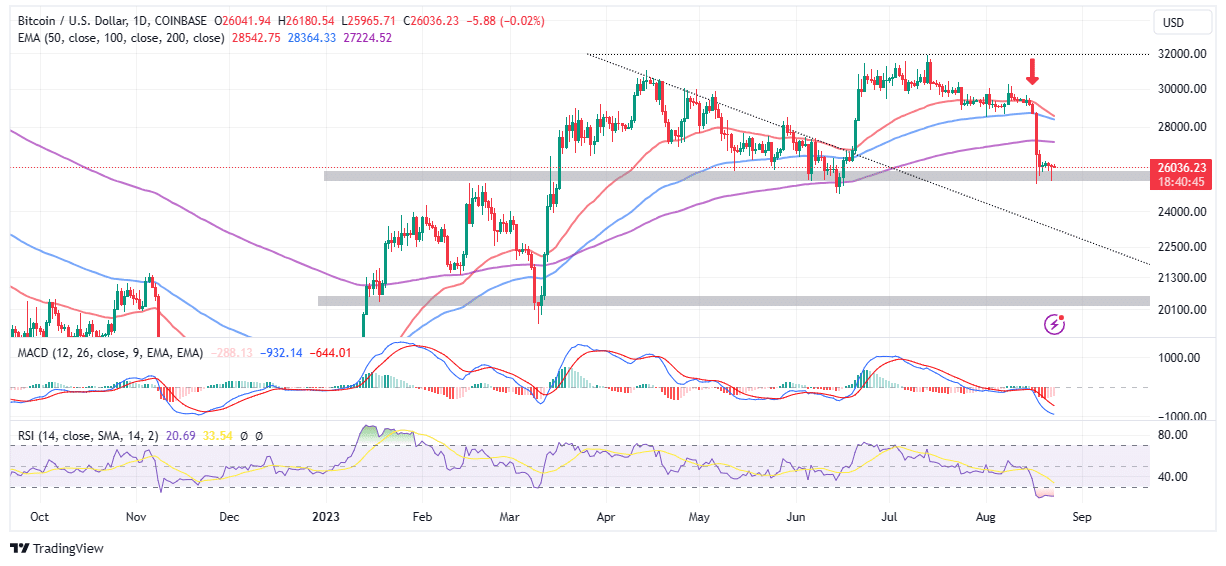

BTC Price Bulls Move To Defend $25k S/R

Without enough momentum, bulls brave enough to stay in the dilapidated market have resolved to defend support/resistance at $25,000. Bitcoin is back to trading at $25,981, slightly below the pivotal $26,000 following a few days of loss consolidation.

Most indicators, including the Relative Strength Index (RSI), show that the path with the least resistance is stuck to the downside, with Bitcoin expected to dip further. Holding at 20, the RSI is at its lowest level since March 2020, when crypto crashed due to the Covid pandemic.

Experts believe that BTC price can pull a surprise breakout, considering it launched itself into a bull run from lows around $3,800 to the current all-time high of almost $70,000.

Nevertheless, the daily chart with the Moving Average Convergence Divergence (MACD) indicator affirms the bearish outlook. The sell signal at hand implies that short positions in BTC may remain profitable until bulls build enough momentum to reverse the trend.

Bitcoin Short-Term Holders Feel The Pinch

According to on-chain analytics firm Glassnode, Friday’s deleveraging event in the BTC futures market saw the biggest single-day sell-off in 12 months. The pain according to on-chain insights, is not over, considering short-term holders had 88.3% of the supply they hold in unrealized loss.

Investors who purchased Bitcoin as it rallied to $32,000 are in addition to the supply that was previously in profit, counting losses. The increase in BTC supply facing unrealized loss came as a result of the “top-heavy market,” a phrase used to describe the situation where investors buy Bitcoin near or above the current market price.

“Sharp upticks in STH Supply in Loss tend to follow ‘top heavy markets’ such as May 2021, Dec 2021, and again this week,” Glassnode opined. “Out of the 2.56M BTC held by STHs, only 300k BTC (11.7%) is still in profit.”

If short-term holders continue to buy near the top, there is the possibility of the market becoming top-heavy for extended periods. Glassnode believes last week’s fall is one to pay attention to because historical data especially on what occurred in May and December 2021 shows that such a drop is often followed by “more violent downtrends.”

Despite the negative outlook of the market, @AltcoinSherpa, a renowned trader and analyst encourages investors to stay the course and focus on surviving the bear market.

He argues that “the worst of it has already happened, $BTC went from 70k->15k. If you’ve survived this long, don’t fumble the rest of your bag before the bull market truly comes.”

Related Articles

- BNB Coin Hits One-Year Low As US DoJ Investigates Binance

- Just In: Binance’s Alleged Bitcoin Sales Aim to Boost BNB Price

- XRP Price Analysis: Can 200-day EMA Breakdown Push Prices Below $0.5?

Recent Posts

- Crypto News

Aave DAO Saga Deepens as Alignment Proposal Moves to Snapshot; AAVE Price Down 7%

After a new governance alignment proposal was moved to a Snapshot vote, the Aave DAO…

- Crypto News

Fed’s Stephen Miran Urges More Rate Cuts In 2026 To Avoid U.S. Recession

Federal Reserve Governor Stephen Miran warned that the U.S. risks a recession without further interest…

- Crypto News

Breaking: $4T JPMorgan Explores Crypto Trading for Institutional Clients as U.S. Banks Embrace Crypto

The world's largest U.S. bank, JPMorgan, is reportedly exploring crypto trading for institutional clients even…

- Crypto News

Bitcoin and Ethereum ETPs See $1B in Outflows as Institutions Rotate into XRP

Crypto investment products saw $952 million in net outflows last week as investors reduced exposure.…

- Crypto News

Michael Saylor’s Strategy Pauses Bitcoin Buying as Crypto Market Anticipates a ‘Santa Rally’

Michael Saylor's Strategy has halted its weekly Bitcoin purchase, failing to buy any BTC last…

- Crypto News

Bitcoin and Ethereum Options Traders Turn Slightly Bullish, Santa Claus Rally?

Bitcoin and Ethereum price direction remain uncertain amid lower trading volumes and volatility ahead of…