BTC Price Upside Momentum Blasts Past $26k, Bullish Move Or Bull Trap?

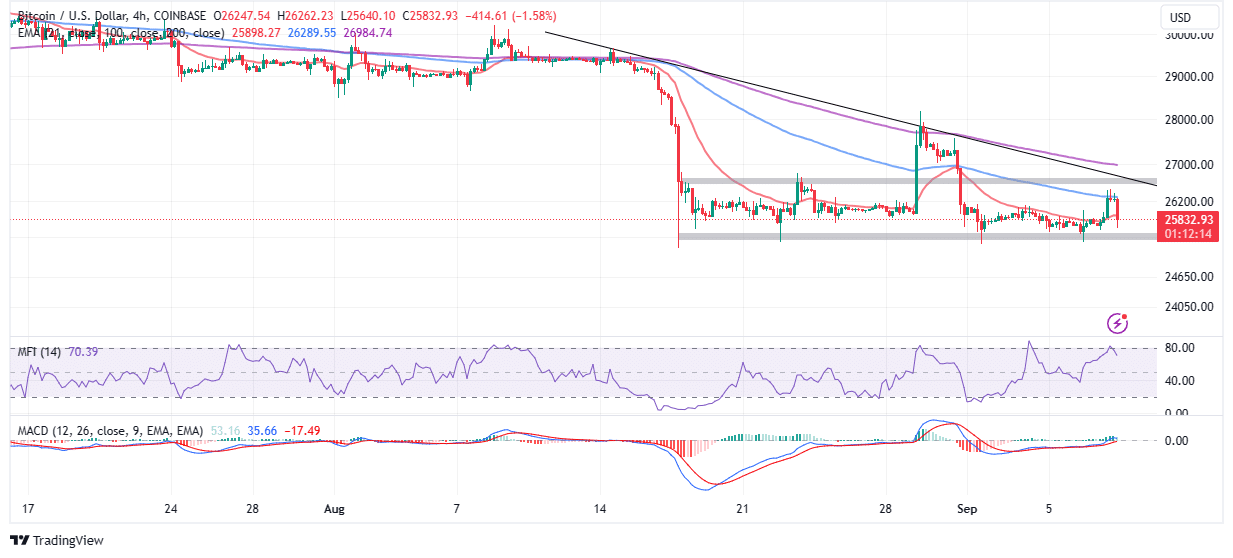

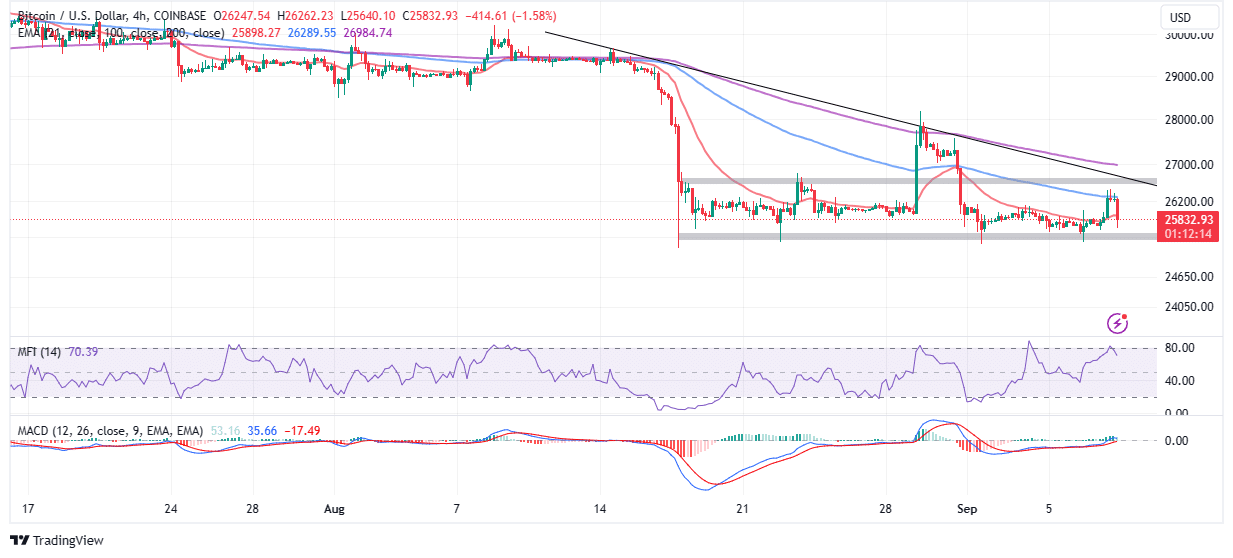

BTC price took down resistance at $26,000 turning it into a short-term support although briefly before sliding to trade at $25,688. Investors anticipating a much bigger breakout to $30,000 are being forced to deal with more pain and unmet expectations.

The buyer congestion at $25,500 allowed for stability this week, and investors slowly gained confidence in the possibility of a breakout to $30,000.

Declines in the price of Bitcoin needed not to stretch below $25,000, a move likely to validate a double top pattern followed by another sweep through liquidity below $20,000 and more precisely test a much lower BTC support area around $15,500.

Why Is BTC Price Vulnerable To Overhead Pressure

The Moving Average Convergence Divergence (MACD) has sustained a relatively bullish outlook since the weekend, calling on buyers to consider buying the dip. However, unfavorable regulatory news in the US coupled with uncertain economic factors hinged on high inflation levels continues to dampen the market.

From the time Blackrock filed with the Securities and Exchange Commission (SEC) in June intending to offer a spot BTC ETF product, investors believed in the likelihood of approval.

The decision by the agency to delay the approval despite Grayscales’ win in the appeals court left investors disappointed and disinterested in seeking exposure to BTC price. Subsequently, the largest crypto trimmed gains after Grayscale’s win confirming fears that an immediate recovery beyond $30,000 was a pipe dream in the short term.

A stubborn fight with inflation in the US is another factor that is keeping risk assets like Bitcoin depressed. After pausing interest rate hikes in June, the Federal Reserve resumed the rate increases despite the chair’s deflationary remarks.

Investors are not fond of the Fed’s hawkish stance, with the bank maintaining that it has an absolute grip on inflation but is guided by data. In the latest edition of the Chicago Fed Letter, the two authors, Stefania D’Amico and Thomas King reckoned that the hikes from March 2022, accumulating to 500 basis points have greatly impacted the economy. They argue that this is enough to bring inflation to the Fed’s target of 2% without further hikes.

“A strong expectations channel also means a more powerful monetary policy, so the estimated effects not only occur faster but also are bigger than typically estimated,” the letter stated. “This implies that the effects that are yet to come may still be big enough to bring inflation near target reasonably quickly.”

Are Bulls Ready To Buy The Dip?

Investors, especially short-term holders had to capitulate in August as BTC price retraced further below $30,000. Due to this pain, they are unlikely to seek more long positions until the uncertainty in the market fades.

Until then, it would be prudent to tread carefully since losses below $25,000 cannot be ruled out. The Fed would also make the next decision on interest rate hikes in September. A pause would be bullish for BTC price but continued hikes could mean a sell-off to test support at $24,000 and $20,000, respectively.

The path with the least resistance is currently downward as the Relative Strength Index (RSI) validated the bearish grip as it recoils from a failed move into the positive region. Bulls must also move fast to keep the support at the 21-day Exponential Moving Average (EMA) intact, otherwise, overhead pressure might keep rising and increasing the risk of losses extending below $25,000.

Related Articles

- XRP Community Backs LBRY As It Decides To Appeal Against US SEC

- CFTC Cracks Down on DeFi Platforms for Illegal Trading of Crypto Derivatives

- Breaking: JPMorgan Forges Ahead with Blockchain Deposit Tokens for Settlements

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs