Cathie Wood & Elon Musk Bullish On Bitcoin, Ark Buys More ARKB ETF With BITO Holdings

Bitcoin bull Cathie Wood on Friday reiterated her bullish case on Bitcoin, with Elon Musk agreeing with her. Wood hails the Bitcoin network – much larger than the combined size of the cloud infrastructure built by Amazon, Google, and Microsoft over the last 15–20 years.

Meanwhile, Cathie Wood’s Ark fund has further offloaded holdings in ProShares Bitcoin Strategy ETF (BITO) to invest in Ark 21Shares spot Bitcoin ETF (ARKB).

Elon Musk Reacts To Cathie Wood’s Bitcoin Network Comments

Ark Invest CEO Cathie Wood on January 19 said Bitcoin is backed by the largest computer network in the world, reiterating her bullish outlook on Bitcoin. She claims that the Bitcoin network is larger than the combined size of the clouds that Amazon, Google, and Microsoft have built over the last 15-20 years.

Wow

— Elon Musk (@elonmusk) January 19, 2024

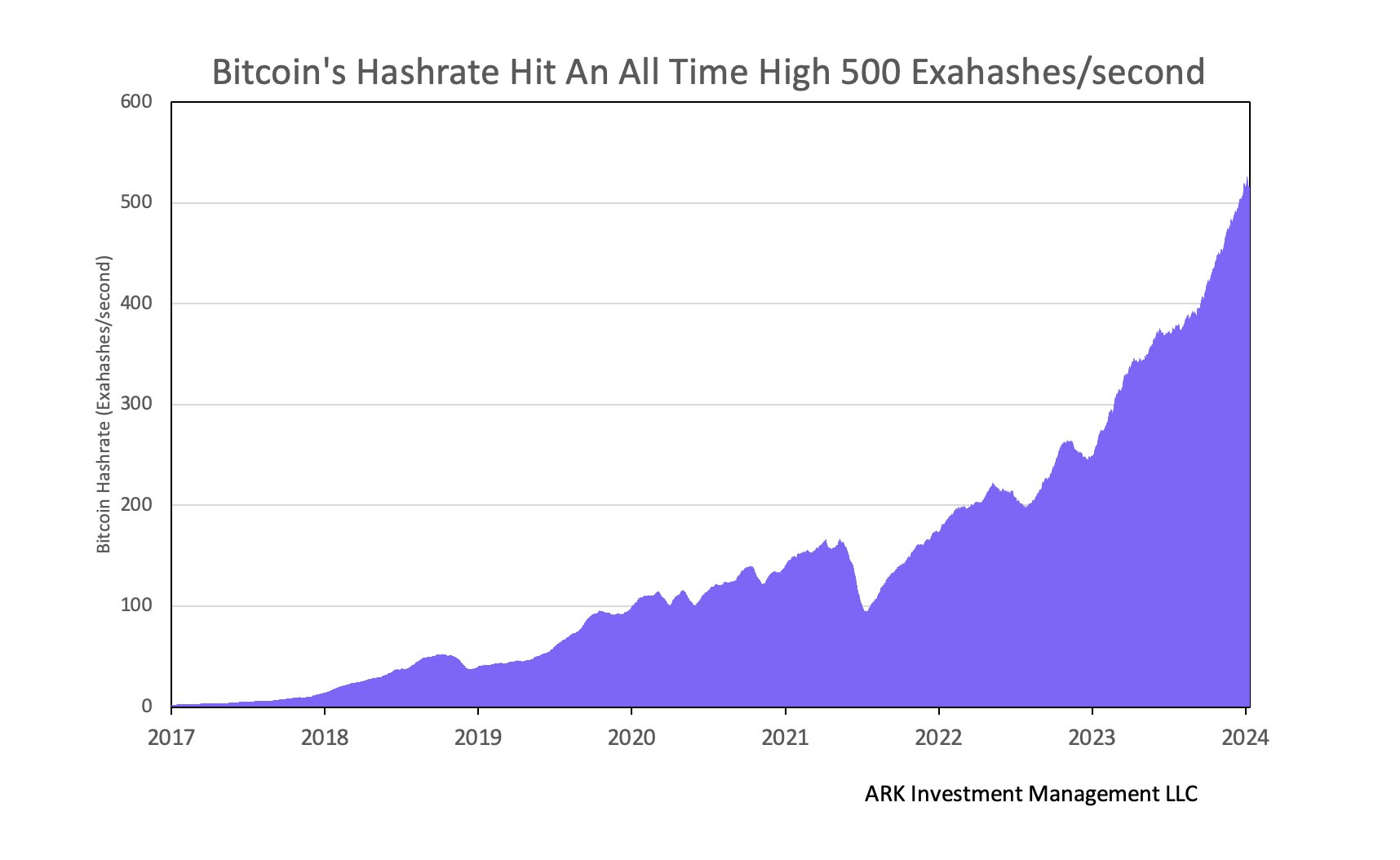

Wood cited Ark Investment director of digital assets Yassine Elmandjra’s data on Bitcoin hash rate hitting an all-time high above 500 exahashes/s in January. “For every star in our galaxy, the Bitcoin network is calculating 5 billion computations per second. It would take ~2000 years for the entire global population, each performing one hash/second, to match the Bitcoin network’s hash rate,” said Elmandjra, while sharing some factors of the magnitude of the Bitcoin network.

Also Read: Grayscale’s GBTC Records $580 Mln Net Outflow On Day 5

Ark Invest Sells BITO To Buy ARKB Spot Bitcoin ETF

On January 18, ARK Next Generation Internet ETF (ARKW) sold 758,915 shares of ProShares Bitcoin Strategy ETF (BITO) worth $15 million to buy 365,695 shares of Ark 21Shares spot Bitcoin ETF (ARKB) worth $15 million.

ProShares Bitcoin Strategy ETF (BITO) price closed on Thursday at $19.72, down 4.64%. Whereas, Ark 21Shares Bitcoin ETF (ARKB) price also closed 4.46% lower at $40.95.

Cathie Wood continues to double down on its recently listed spot bitcoin ETF as part of the strategy to increase holdings in its Ark 21Shares spot Bitcoin ETF. On Jan 16, ARKW sold 757,664 shares of ProShares Bitcoin Strategy ETF (BITO) valued at approximately $15.8 million to purchase 365,427 Ark 21Shares Bitcoin ETF (ARKB) worth $15.8 million.

ARKB recorded $41.8 million inflow, as per the data by BitMEX Research. Total outflow for 11 spot Bitcoin ETF was $131.6 million on day 5, with massive $579.6 million outflow in GBTC.

In December, ARKW bought 4.32 million shares of ProShares Bitcoin Strategy ETF (BITO) by completely offloading its holdings in Grayscale Bitcoin Trust (GBTC).

Also Read: Crypto Market Selloff — Here’s Why BTC, ETH, SOL, XRP, LUNC Falling Today

- U.S. Government Shutdown Odds Hit 84%, Will Bitcoin Crash Again?

- Wall Street Giant Citi Shifts Fed Rate Cut Forecast To April After Strong U.S. Jobs Report

- XRP Community Day: Ripple CEO on XRP as the ‘North Star,’ CLARITY Act and Trillion-Dollar Crypto Company

- Denmark’s Danske Bank Reverses 8-Year Crypto Ban, Opens Doors to Bitcoin and Ethereum ETPs

- Breaking: $14T BlackRock To Venture Into DeFi On Uniswap, UNI Token Surges 28%

- Ethereum Price at Risk of a 30% Crash as Futures Open Interest Dive During the Crypto Winter

- Ethereum Price Prediction Ahead of Roadmap Upgrades and Hegota Launch

- BTC Price Prediction Ahead of US Jobs Report, CPI Data and U.S. Government Shutdown

- Ripple Price Prediction As Goldman Sachs Discloses Crypto Exposure Including XRP

- Bitcoin Price Analysis Ahead of US NFP Data, Inflation Report, White House Crypto Summit

- Ethereum Price Outlook As Vitalik Dumps ETH While Wall Street Accumulates