Core CPI Forecast Surges Ahead US CPI Data Release On June 11

Highlights

- Core CPI forecast rises, dimming hopes for June Fed rate cuts.

- Bitcoin surges as global liquidity grows, ignoring potential Fed policy tightening.

- Investors await CPI data to guide summer market moves and rate expectations.

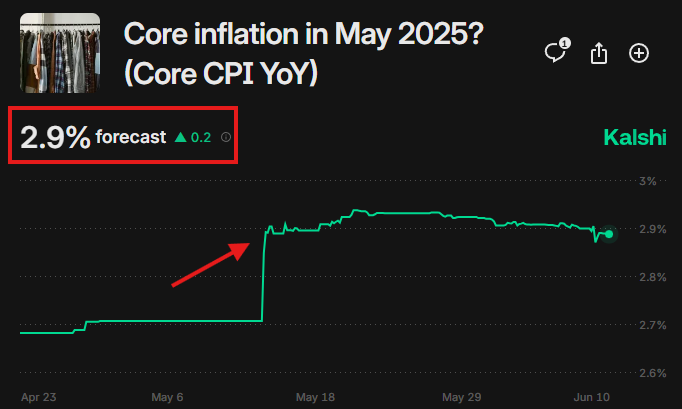

According to predictions, inflation rates might start to rise once more. A rise in core CPI data could be happening again since January 2025.

The Chances for a Fed Rate Cut Vanish as CPI Data Is Due for Release

Experts believe that the May Core CPI will increase by 2.9% based on odds from Kalshi’s prediction website. Many have almost ruled out a rate cut after the FOMC meeting, which comes up next week.

This happens even as President Trump proposes 100bps interest rate cuts to boost the economy. The stock market and real estate have reacted differently to this prediction. But cryptocurrencies have experienced a strong surge.

For example, the price of Bitcoin jumped 4% to $109,500 because of the skyrocketing global money supply. The positive mood in the market also helped Ethereum and Solana record larger gains.

Analysts observed that the price of Bitcoin moved 71 days in sync with changes in the M2 money supply worldwide. Crypto markets seem to be reacting more to changes in liquidity than they do to changes in Fed policies.

With core inflation potentially rising and US job markets remaining strong, most expect rates to hold steady between 425-450 basis points.

Investors Brace for Clarity on Inflation and Fed’s Path

Market participants will scrutinize whether the expected inflation increase proves temporary or signals a worrying trend. The analysis of the data might determine if the Fed continues being cautious or succumbs to calls for rate cuts.

Due to the conflicting signs, investors are not sure how to act. Assets such as bonds could face risks due to inflation, while crypto could keep benefitting from the extra liquidity around the globe.

All eyes now turn to tomorrow’s CPI release, which may set the tone for summer financial markets. The numbers could either calm nerves about inflation or confirm fears of renewed economic challenges ahead.

Core CPI Uncertainty Clouds Analysts’ Outlook

Market analysts offer mixed views on this inflation trend. An X user mentioned that both the Core CPI and PCE figures remained steady as of late, with April numbers going down, which encouraged short-term risk taking. But a different user noted that tomorrow’s expected rise in the Core CPI indicates tariffs may be one of the main reasons.

He further pointed out that a hotter data could make the Fed wait before cutting interest rates, but this would benefit Bitcoin and not increase demand for stablecoins.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs