Will Bitcoin Price Drop To $50,000 Soon? Here’s All

Highlights

- Bitcoin price dropped below the $59,000 mark in the last 24 hours.

- The recent market trends hints at a potential drop in BTC price to $50K.

- Top analysts warns over significant liquidation if Bitcoin soars past $63.7K mark.

The recent decline in Bitcoin price below the $59,000 mark has reignited debates about its future trajectory. As the market grapples with potential downturns, analysts are questioning whether Bitcoin could plunge further to $50,000 or even $45,000.

Meanwhile, market sentiment, fueled by a mix of fear and strategic maneuvers, suggests that investors are bracing for more turbulence in the coming weeks.

Market Trends Signals At Further Downturn

The popular on-chain analytics firm 10X Research has highlighted concerns over Bitcoin’s current performance. Their analysis suggests that Bitcoin is facing a critical phase, marked by decreasing liquidity and increased market apprehension.

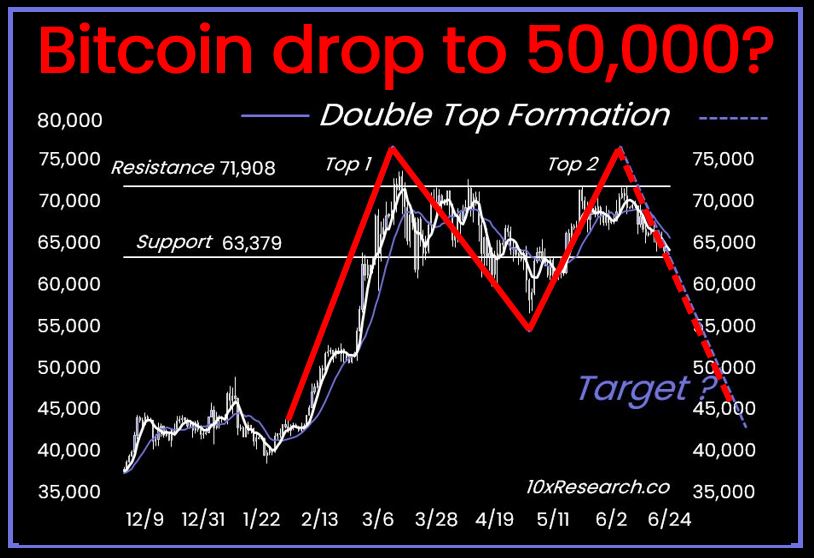

A recent post by 10X Research on X shows a price chart indicating a possible drop to $50,000 or even lower to $45,000. They cautioned investors about the potential risks of a “double top” formation, a chart pattern that often precedes a significant price drop.

Meanwhile, this pattern indicates that Bitcoin, after failing to surpass a key resistance level, may have reached a peak and could be headed for a steeper decline. “As Bitcoin continues to struggle, liquidity is drying up,” they noted.

In addition, the analysis highlights the importance of risk management, particularly in such volatile periods. Their previous warnings about Ethereum and Solana have been validated by recent price declines, suggesting a broader trend of caution among digital assets.

Also Read: Bitcoin Crashes 30% Against Gold, Here’s Why Peter Schiff Warns Further Dip

External Factors Weighing On Bitcoin Price

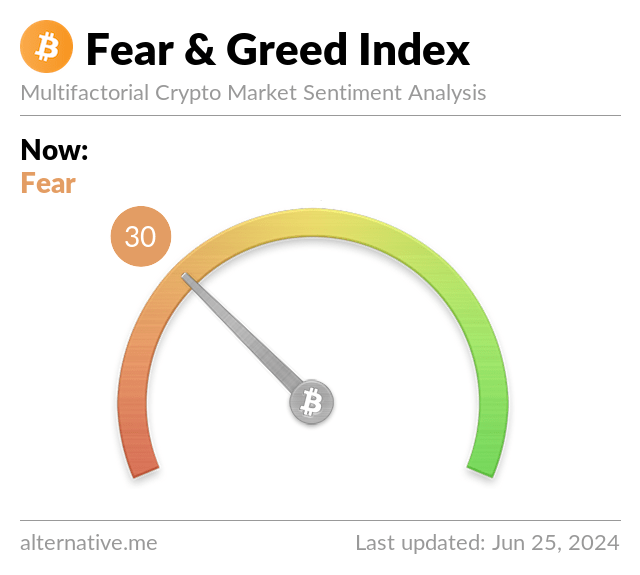

Several external factors have contributed to Bitcoin’s sluggish performance recently. The Bitcoin Fear and Greed Index, a tool that measures market sentiment, has dropped to 30, indicating a prevailing sense of fear among investors. This is the lowest level since September 2023, reflecting growing concerns about the market’s direction.

Adding to the uncertainty, the long-defunct crypto exchange Mt. Gox announced that it will begin repaying creditors in Bitcoin and Bitcoin Cash starting next week. This development is a significant step in resolving issues that date back to Mt. Gox’s collapse in 2014.

However, the potential influx of Bitcoin into the market could exacerbate volatility, posing further challenges to price stability. In other words, the development has fueled concerns among the market participants over a further drop in Bitcoin price.

In addition, Germany’s government recently deposited nearly 400 Bitcoins, worth approximately $25 million, into exchanges Kraken and Coinbase. This move follows a similar transfer of about 1,700 Bitcoins, heightening concerns about increased supply and potential market impacts.

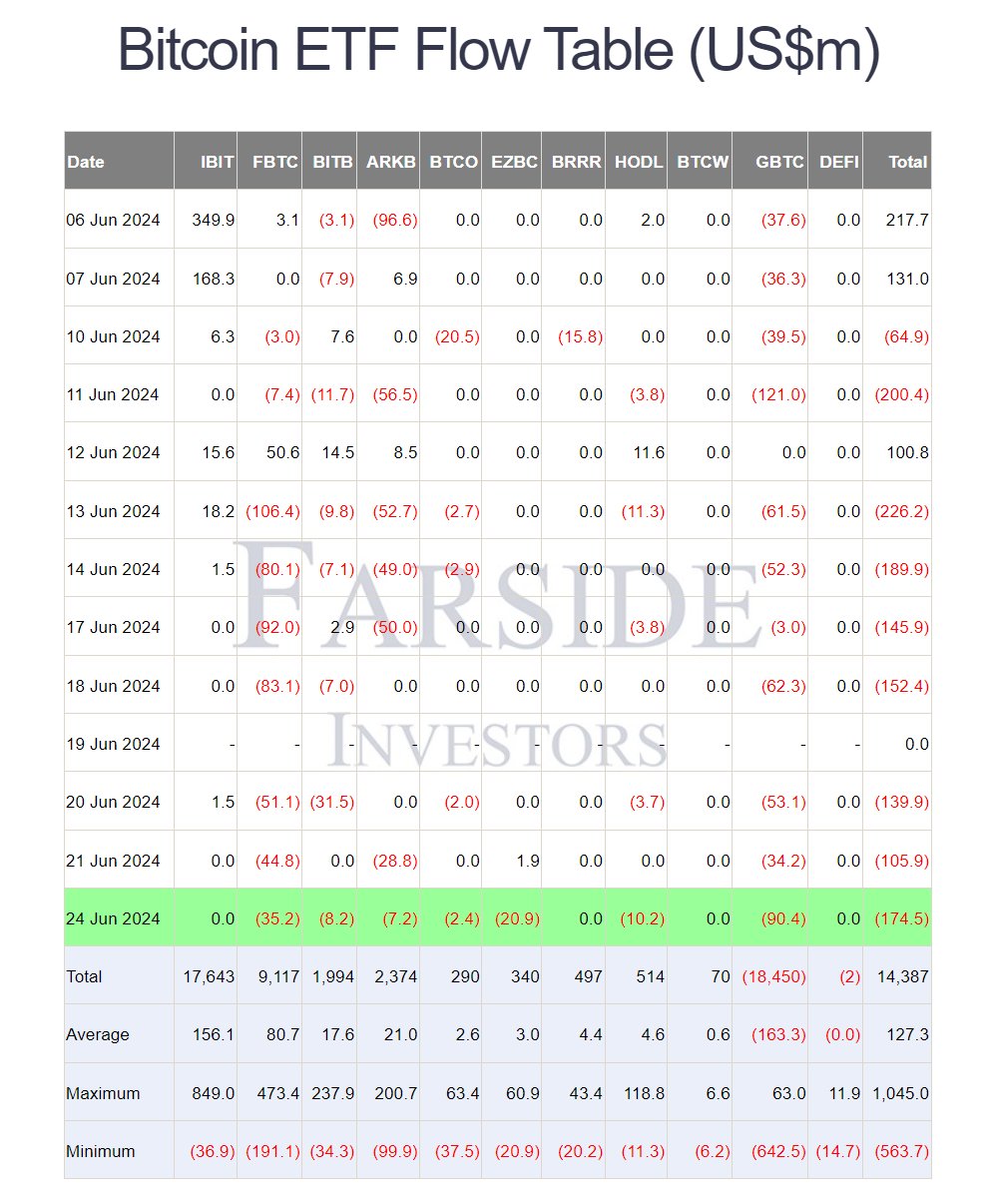

Amid this, the continued outflow from the U.S. Spot Bitcoin ETF has also weighed heavily on investor sentiment, contributing to the overall bearish outlook. According to recent data, the U.S. Spot Bitcoin ETFs recorded an outflow of $174.5 million on June 24.

Also Read: Toncoin Price Regains Support After 5% Surge, What’s Coming Next?

What’s Next?

As Bitcoin navigates this turbulent phase, investors are closely watching for signs of a bottom. The potential for Bitcoin to dip to $50,000 remains a real possibility, driven by both internal market dynamics and external pressures.

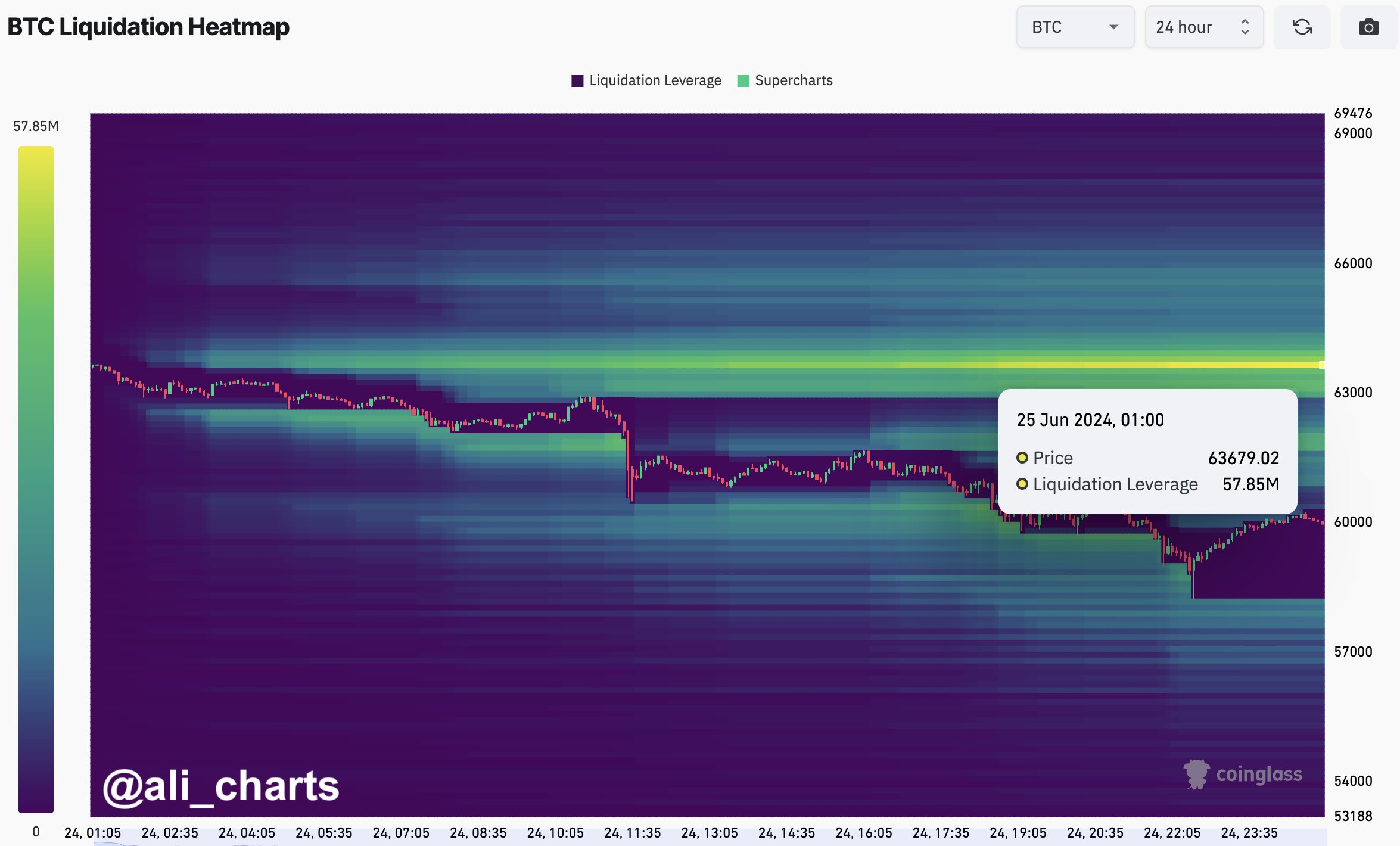

However, some market pundits are still bullish on Bitcoin price’s trajectory in the long run. The experts have argued that the recent BTC dip would provide more buying opportunities for investors, which in turn could potentially drive the Bitcoin price higher. Despite that, it’s worth noting that popular crypto market analyst Ali Martinez warned of over $57.85 million liquidation if Bitcoin price hits the $63,700 mark.

Meanwhile, as of writing, Bitcoin price traded near the flatline in the last 24 hours and crossed the $61,000 mark. The 24-hour high for BTC was $62,900.83, while a low of $58,601 was noted in the same time frame, indicating the heightened volatile scenario in the market.

Furthermore, CoinGlass data showed that Bitcoin Futures Open Interest (OI) rose 0.84% to $32.62 billion in the four-hour time frame.

Also Read: Shiba Inu Coin & Pepe Coin Whales Offload $26M In SHIB & PEPE, What’s Next?

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs