Crypto.com Reveals Partial Proof Of Reserves To Dispel Insolvency Rumors

Crypto.com, has become the latest crypto exchange to publish partial “Proof of Reserves,” amid the downfall of rival exchange FTX. As fear of crypto contagion from the FTX meltdown spreads, Kris, CEO of the exchange, shared links to a Nansen dashboard that shows more than $2 billion in reserves, demonstrating his eagerness to remain transparent in the industry.

He stated that while the complete Proof of Reserves audit was underway, he would be sharing their cold wallet addresses for some of the top assets on the Crypto.com platform.

Partial Data Shows Interesting Insights

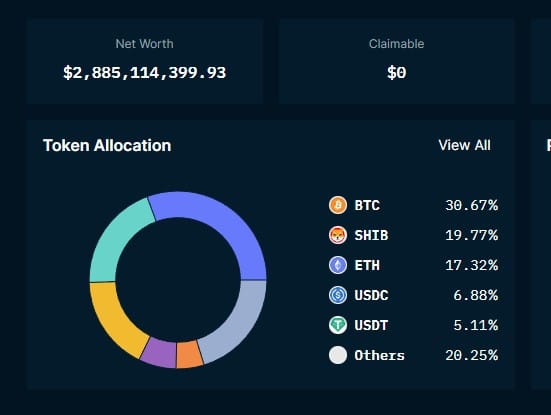

As per the data shared on Nansen, Bitcoin accounts for 30.67% of the total reserves, while Ether is 17.32%. Another 19.77% of reserves are held in DOGE-inspired SHIB cryptocurrency. Only 11.99% of the reserves are held in stablecoins like USDC and USDT.

Read More: Crypto Exchanges Rush To Provide Proof-of-Reserves Following FTX Crisis

Kris further went on to add,

“This represents only a portion of our reserves: about 53,024 BTC, 391,564 ETH, and combined with other assets for a total of ~US$ 3.0b”

Please expect a full audited Proof of Reserves from us in the next couple of weeks, confirming the full 1:1 reserve of all customer assets.

— Kris | Crypto.com (@kris) November 11, 2022

Origin of Proof Of Reserves

This comes after, CZ, CEO of Binance, touched on the issue of crypto exchanges using fractional reserves like traditional banks.

Instead, he suggested using “Merkle Tree Proof of Reserves” in order to remain transparent in the public domain. Merkle Trees, in reality, refers to a data structure authenticated by cryptographic means. Presumably, this way of disclosing Proof of Reserves represents an audit trail that cannot be tampered with.

Read More: Binance To Start Proof Of Reserves For Full Transparency

Market Reaction

Crypto.com’s native toke, CRO, fell sharply after Kris announced his partial disclosure statement on Crypto.com’s reserves. Currently, CRO is trading at $0.08, down by1.4% in the past 1 hour at the time of writing.

- BitMine Keeps Buying Ethereum With New $84M Purchase Despite $8B Paper Losses

- Polymarket Sues Massachusetts Amid Prediction Market Crackdown

- CLARITY Act: Bessent Slams Coinbase CEO, Calls for Compromise in White House Meeting Today

- Crypto Traders Reduce Fed Rate Cut Expectations Even as Expert Calls Fed Chair Nominee Kevin Warsh ‘Dovish’

- Crypto, Banks Clash Over Fed’s Proposed ‘Skinny’ Accounts Ahead of White House Crypto Meeting

- Cardano Price Prediction as Bitcoin Stuggles Around $70k

- Bitcoin Price at Risk of Falling to $60k as Goldman Sachs Issues Major Warning on US Stocks

- Pi Network Price Outlook Ahead of This Week’s 82M Token Unlock: What’s Next for Pi?

- Bitcoin and XRP Price Prediction as China Calls on Banks to Sell US Treasuries

- Ethereum Price Prediction Ahead of Feb 10 White House Stablecoin Meeting

- Cardano Price Prediction as Midnight Token Soars 15%