Crypto Lawyer Reveals Key Drawback with Tether’s USDT, Says Ripple’s RLUSD Is Better

Highlights

- Bill Morgan said that Ripple's RLUSD reserve custody with BNY Mellon brings greater transparency.

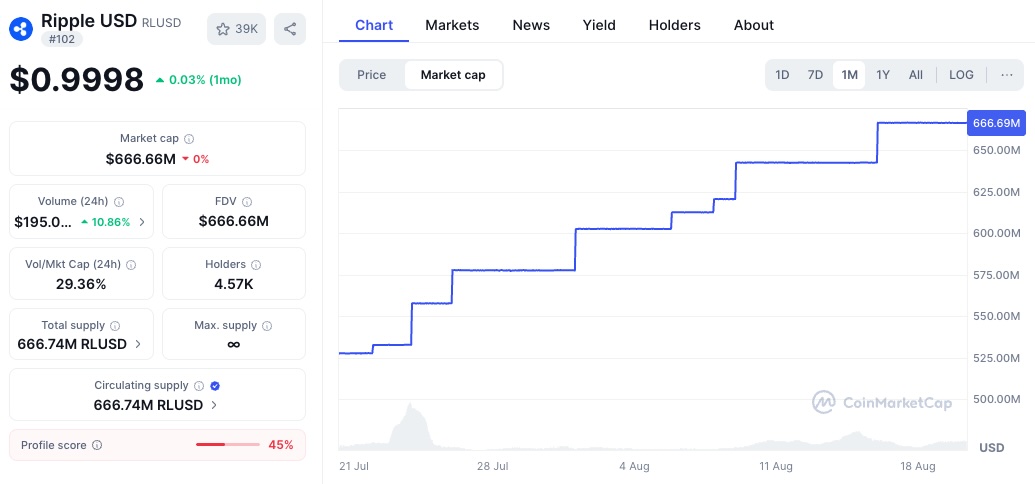

- Ripple’s RLUSD stablecoin saw a 26% increase in market share over the past month and is positioned to benefit from new OCC rules.

- Tether is expanding into the U.S., hiring former White House Crypto Council executive Bo Hines.

Bill Morgan, the pro-XRP lawyer, is defending Ripple RLUSD stablecoin against the largest stablecoin issuer Tether, on the matter of third-party reserves. Morgan’s comments come at a time when Tether prepares for US expansion by hiring Bo Hines, the former executive director at the White House Crypto Council. The Ripple stablecoin is steadily gaining market share with a 25% surge in market cap over the past month.

Bill Morgan: RLUSD Has Better Reserve Management Than USDT

On Tuesday, Tether announced hiring Bo Hines as the company’s crypto strategic advisor with the goal of enhancing U.S. compliance. With Trump’s pro-crypto policies and the passing of the GENIUS Act last month, the USDT stablecoin issuer plans for a US expansion. Market analysts noted that Tether has successfully tackled the FUD over its reserves, now verified by investment banking firm Cantor Fitzgerald.

However, pro-XRP lawyer Bill Morgan stated that the one thing he doesn’t like about Tether is the company’s reserve management practice. Morgan pointed out that the stablecoin issuer does not use an independent third-party custodian to hold its reserves.

On the other hand, Morgan highlighted Ripple’s RLUSD, which relies on BNY Mellon for reserve custody. According to him, this arrangement makes RLUSD a more reassuring option compared to Tether. One of the users on the X platform, responded to Morgan, stating that Tether has also never agreed to “credible audits” from an independent outside firm. That’s “Negative fact no.2,” wrote Morgan.

“To be fair there is one fact I like about Tether which is that it has never lost its peg to the dollar,” added Morgan in another message.

Paolo Ardoino’s stablecoin firm Tether has been on a strong footing recently, clocking $2.6 billion in profits during Q2 2025, while revealing its Gold and Bitcoin reserves. Furthermore, the firm also issued a total of $13.4 billion worth of USDT during the same quarter.

Ripple Stablecoin Expanding Its Market Shares

On the other hand, the Ripple stablecoin is also systematically expanding its stablecoin market share. Over the past month, its market share has grown from $527 million to $666 million, reflecting a 26% jump.

Recently, the proceeds of the Bullish IPO last week were settled in RLUSD stablecoin, minted on the XRP ledger. Speaking on the development, Jack McDonald, the Senior Vice President of stablecoins at Ripple, stated:

“RLUSD on XRPL is only becoming more integrated in traditional financial rails – from its usage as good collateral to cross-border settlement, and now for the first time, as IPO proceeds payment! Even before the GENIUS Act passed, RLUSD was repeatedly recognized across both crypto and TradFi as the gold standard in compliance – and now, the floodgates are opening”.

The U.S. Office of the Comptroller of the Currency (OCC) has announced that community banks are now permitted to collaborate with stablecoin firms. This development is expected to benefit Ripple’s RLUSD, with the firm also applying for a U.S. banking license to strengthen stablecoin integration into traditional finance.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Peter Schiff Predicts BTC to Fall, Gold to Rise as Markets Price in Prolonged Iran War

- Institutional Re-Accumulation Signs Emerge as Bitcoin ETFs See $1.1B Net Inflows Since Iran War Began: Glassnode

- From Mining Pool to Infrastructure Platform: Nine Years of EMCD

- U.S.-Iran War: U.S. Oil Prices Spike To One-Year High, Bitcoin and Gold Dip

- Crypto Traders Bet Against U.S.-Iran Ceasefire This Month as Iran Denies Peace Talks

- HOOD Stock Targets $100 as Robinhood Unveils Platinum Card and Advance Dividend Feature

- Bitcoin Price Prediction if Donald Trump Signs the CLARITY Act on April 3, 2026

- Pi Network Price As BTC Rallies Above $74K: Can PI Coin Extend Gains to $0.30?

- XRP Price As Bitcoin Reclaims $74K- Is $5 Next?

- Dogecoin Price Outlook as BTC Recovers Above $73,000

- XRP Price Prediction as Iran-U.S. Peace Talks Trigger a Crypto Rally

Buy $GGs

Buy $GGs