Crypto Market Crash Erases Fed Rate Cut-Driven Bitcoin, ETH, XRP, SOL, ZEC Gains

Highlights

- Crypto market crash erases gains in Bitcoin, ETH, XRP, SOL, ADA, DOGE, ZEC, and other altcoins.

- Crypto market braces for Yen carry trades unwind as Japan's long-term bond yield hits new high.

- Investors liquidates $200 billion ahead of ISM US Manufacturing PMI data and Jerome Powell's speech today.

- Tether FUD adding more selling pressure to crypto market crash.

Crypto market crash starting in Asia hours on Monday wiped out $200 billion in market cap. Massive liquidations across Bitcoin (BTC), Ethereum (ETH), XRP, BNB, Solana, and other altcoins erased all recent gains driven by hopes of a December Fed rate cut.

Bitcoin (BTC) faces resistance at $92.000 and plunges more than 6% to below $85,653 today. On the other hand, Ethereum (ETH) fell 8% to a 24-hour low of $2,807. This happened despite a much-needed rebound in the Crypto Market Fear & Greed Index from 11 last week to 24 today.

Meanwhile, top altcoins XRP, BNB, Solana (SOL), Dogecoin (DOGE), Cardano (ADA), and Hyperliquid (HYPE) fell 6-10% over the past 24 hours. Zcash (ZEC), Ethena (ENA), and AI coins led the crypto market crash, with ZEC price tanking 21%.

BOJ Rate Hike and Record High Bond Yields Caused Crypto Market Crash

The crypto market crash is driven primarily by Bank of Japan (BOJ) Governor Kazuo Ueda’s comments on December 1, hinting at another interest rate hike in December. Ueda claimed the BOJ expects to raise the policy interest rate by examining the economy, inflation, and financial markets.

As a result, Japan’s 30-year, 10-year, and 2-year Government Bond yields rise to the highest levels since 2008. Meanwhile, Japan’s 20-Year Government yield (JP20Y) jumps to 2.888%, marking the highest level since 1999.

The increase in Japanese interest rates and strengthening of the Yen can lead to the unwinding of carry trades. It could result in a major global market crash as institutional investors such as hedge funds borrow in Yen to buy risk assets.

Bitcoin and the broader crypto market crash happened due to panic over the potential unwinding of Yen carry trades. Notably, global yen carry trade exposure accounts for $20 trillion, which can shake markets, including Bitcoin.

ISM US Manufacturing PMI Data Release and Jerome Powell Speech Today

The Institute for Supply Management to release the US Manufacturing PMI data today, which will reveal the health of the manufacturing sector in the United States.

Notably, the ISM US Manufacturing PMI has contracted for the 8th consecutive month. The market expects the date to come in at 48.6, spotlighting economic weakness amid the prolonged government shutdown.

Moreover, Fed Chair Jerome Powell is scheduled to speak at the Hoover Institution in California at 8:00 pm ET. All eyes are on Powell’s speech today for any hints or comments on the December Fed rate cut.

At the time of writing, the CME FedWatch Tool showed 87.4% odds of a 25-bps Fed rate cut on December 10. The macro events could significantly shift the rate cut odds this week before the FOMC meeting.

Massive Bitcoin, ETH, XRP, SOL, ZEC Liquidations Amid Crypto Market Crash

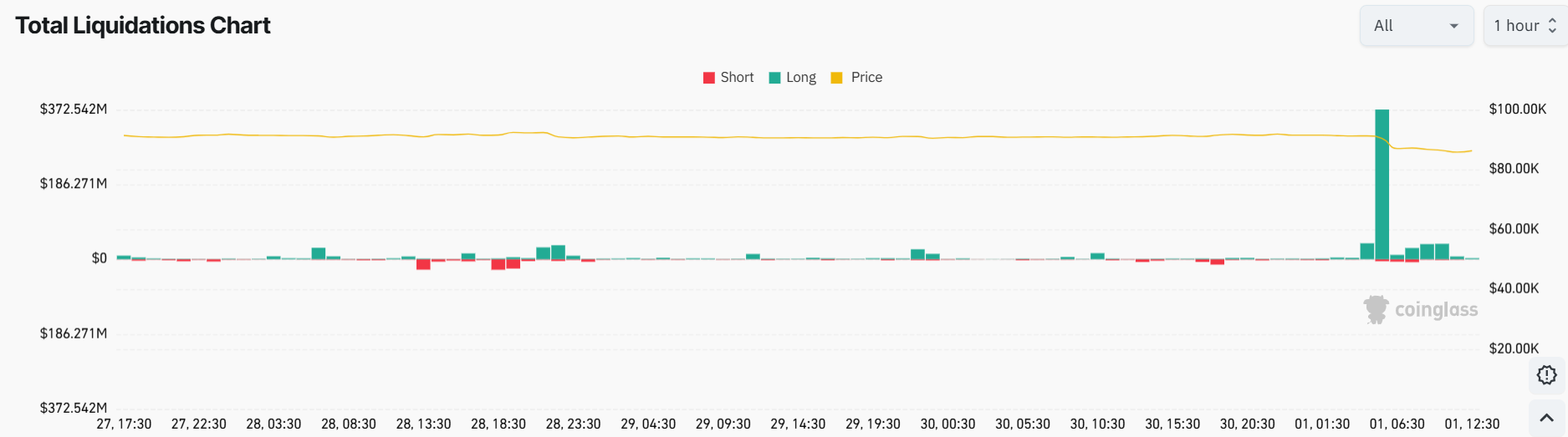

CoinGlass data indicates almost $700 million in total liquidations over the last 24 hours, led by Bitcoin (BTC), Ethereum (ETH), XRP, Solana (SOL) Zcash (ZEC), Dogecoin (DOGE), and Hyperliquid (HYPE). Over 219K traders were liquidated, with the largest single liquidation order of ETHUSDC valued at $14.48 million occurring on Binance.

Notably, almost $600 million in long positions and $90 million in short positions got liquidated. Bitcoin price crashes to $85K as investors liquidated over $200 million in BTC holdings over the last 24 hours. The crypto market crash saw $372 million in longs liquidated in just an hour as BOJ Governor Ueda hinted at a rate hike.

Matrixport claimed a dovish Fed may not be enough to offset tightening signals, causing institutional investors to continue reducing their Bitcoin exposure. Meanwhile, Tether’s significant shift into gold and Bitcoin to offset declining interest income has raised concerns in the crypto community.

Also Read: Best Crypto Tools for Research, Trading and Analysis 2025

- Sony Bank Joins Ripple, Circle to Launch USD-Pegged Stablecoin in the U.S. by 2026

- XRP News: Ripple Broadens Payment Offerings in Singapore with MPI License Expansion

- Grayscale Cleared to Launch First Spot Chainlink ETF This Week Amid Rising Demand

- Kevin Hassett Opens Door to Fed Chair Role as Markets Show 87% Odds of Third Rate Cut

- Elon Musk Says Bitcoin Is True Energy Currency as Peter Schiff Labels It ‘Fake Asset’

- Will Fusaka Upgrade Push Ethereum Price to New Highs?

- Bitcoin Price Poised for a $100k Run as Coinbase Premium Turns Positive

- XRP Price Prediction: Why XRP Could Rally to $3 This Week?

- Ethereum Price Prediction 2025: How High Can ETH Go by Year-End?

- CoinShares Withdraws Staked Solana ETF Proposal: What’s Next for Solana Price?

- XRP Price Forms Alarming Death Cross Amid Intense Whale Dumping