Experts Reveal Actual Reasons Behind Sudden Bitcoin and Crypto Market Crash

Highlights

- QCP Capital revealed the options market provided early signals to a sharp downside.

- Crypto market saw over $500 million liquidation in 24 hours.

- US dollar and 10-Year Treasury yield jump exerts more pressure on Bitcoin prices ahead halving.

Crypto market saw a sudden downfall on Tuesday, plunging the global crypto market cap by more than 4% from $2.64 trillion to a low of $2.50 trillion. Bitcoin (BTC) and Ethereum (ETH) prices tumbled 5% within hours, triggering a market-wide selloff.

Altcoins including Solana (SOL), BNB, XRP, and Cardano (ADA) also fell, while meme coins Dogecoin (DOGE) and Shiba Inu (SHIB) prices failed to sustain and dropped over 8%. The weak market sentiment continues since the crypto market witnessed the largest-ever options expiry. Analysts believe it is the pre-halving market correction similar to other pre-halving corrections seen historically, as CoinGape reported.

Experts Unveil Why Crypto Market Fell

QCP Capital revealed the options market provided early signals to a sharp downside, particularly the downside skew in risk reversals. Bitcoin and Ethereum options volatility have continued to remain high, with selling pressure rising amid weak sentiment.

BTC price broke $70k and traded below $66k and ETH traded to $3320 lows. However, the sudden downfall came due to large liquidations on retail investors-heavy crypto exchanges such as Binance which saw perpetuals funding rates go from as high as 77% to flat.

This brings spot prices right back to risk levels of $63K seen in mid-March. With a decline in trading volumes signaling a further drop in prices.

“While perp funding has compressed, the rest of the forward curve remains very elevated. Will this be the move that brings the whole curve back down?”, questioned QCP Capital.

Matrixport further questioned the crypto market uptrend after today’s intra-day correction. It highlights Bitcoin has struggled as some argue this is due to the typical pre-halving drop and others say it’s happening due to repricing of US interest rate expectations.

Coinglass data shows more than $500 million were liquidated across the crypto market amid this strong correction. Of these, $414 million long positions liquidations were liquidated and $85 million short positions were liquidated in the last 24 hours.

Over 139K traders were liquidated and the largest single liquidation order happened on crypto exchange OKX as someone swapped ETH to USD valued at $7.48 million.

10x Research disclosed an urgent update to its clients that Bitcoin and Ethereum are breaking crucial support levels. Top analyst Markus Thielen, CEO of 10x Research, earlier warned that Bitcoin price can rally if it stays above the $68,330 level. However, the critical level was broken and the market failed to reclaim the price level.

It added that “Some growth and inflation data were also stronger, which could lead to a repricing of interest rate cut expectations. Crypto might be quicker than other asset classes to recognize with this.”

Bitcoin Price to Recover?

Analysts and the market were already aware of the key level and that;s what caused a freefall in prices across the cryptocurrencies.

On Monday, crypto analyst Ali Martinez again warned the investors about the critical support level at $68,300, emphasizing that a breach could trigger a downward spiral toward the $65,250 to $63,150 range. Notably, this range, where 760,000 wallets hold 520,000 BTC, presents a significant psychological threshold for Bitcoin’s trajectory.

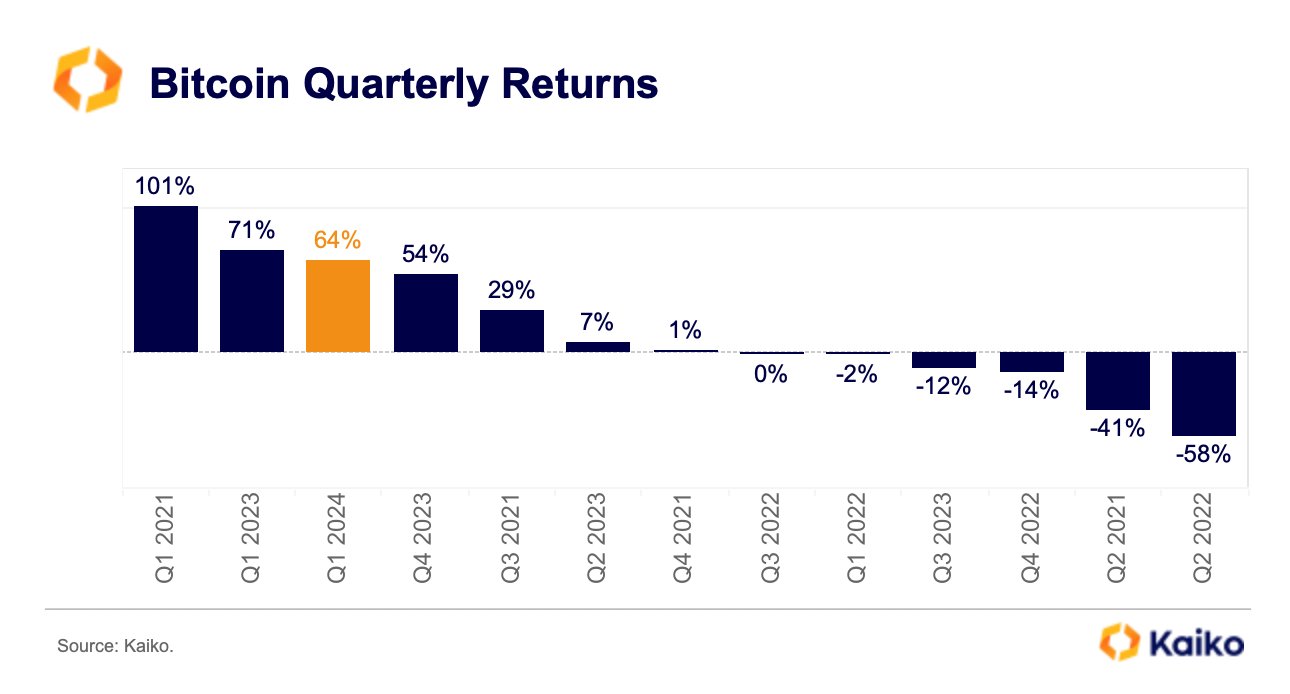

BTC price is still preparing to hit $100K in this bull market. Bitcoin has closed 64% up in the first quarter over the past three years, reported Kaiko. Also, spot Bitcoin ETF inflows are set to rebound soon from low inflows.

Macro Factors Impacting Bitcoin

On the macro front, US dollar index (DXY) rises to 105, the highest level since mid-February, as traders anticipated key US economic indicators due this week. Traders pared some bets as the Fed will ease monetary policy in June after a stronger-than-expected ISM manufacturing PMI.

Moreover, the US 10-year Treasury yield rises to 4.341%, its highest level since the start of the year after hot PCE data diminished optimism on early rate cuts by the Fed.

Also Read:

- Crypto Derivatives Exchange Deribit Gets License in Dubai

- Binance Burns 4.17 Billion Terra Luna Classic (LUNC)

- Sam Bankman-Fried Will Be On Supervised Release For Years After Prison Term

- Fed’s Chris Waller Says Support For March Rate Cut Will Depend On Jobs Report

- Breaking: Tom Lee’s BitMine Adds 51,162 ETH Amid Vitalik Buterin’s Ethereum Sales

- Breaking: Michael Saylor’s Strategy Makes 100th Bitcoin Purchase, Buys 592 BTC as Market Struggles

- Satoshi-Era Whale Dumps $750M BTC as Hedge Funds Pull Out Billions in Bitcoin

- XRP Sees Largest Realized Loss Since 2022, History Points to Bullish Price Run: Report

- Top 3 Meme Coins Price Prediction As BTC Crashes Below $67k

- Top 4 Reasons Why Bitcoin Price Will Crash to $60k This Week

- COIN Stock Price Prediction: Will Coinbase Crash or Rally in Feb 2026?

- Shiba Inu Price Feb 2026: Will SHIB Rise Soon?

- Pi Network Price Prediction: How High Can Pi Coin Go?

- Dogecoin Price Prediction Feb 2026: Will DOGE Break $0.20 This month?