Crypto Market Weakness: Bitcoin Falls Under Its 200-Week MA, ETH Trading Sentiment Negative

After a strong show last week, the broader cryptocurrency market has come under selling pressure once again. Over the weekend, BTC has shown signs of selling pressure and is currently trading 1% down at a price of $22,060 and a market cap of $424 billion.

Popular market analyst Rekt Capital explains: “BTC needs to Weekly Candle Close above $22800 to begin a reclaim of the 200-week MA as support”. However, BTC is likely to close this week under the 200 WMA support.

This would mean that bears still have a strong grip over Bitcoin and crypto and last week’s bounce back wasn’t a formidable trend reversal.

If the broader macro environment continues to disappoint going further, we could probably see BTC taking a dive under $20,000 once again.

Altcoin Market: Ether (ETH) Trading Sentiment Turns Negative

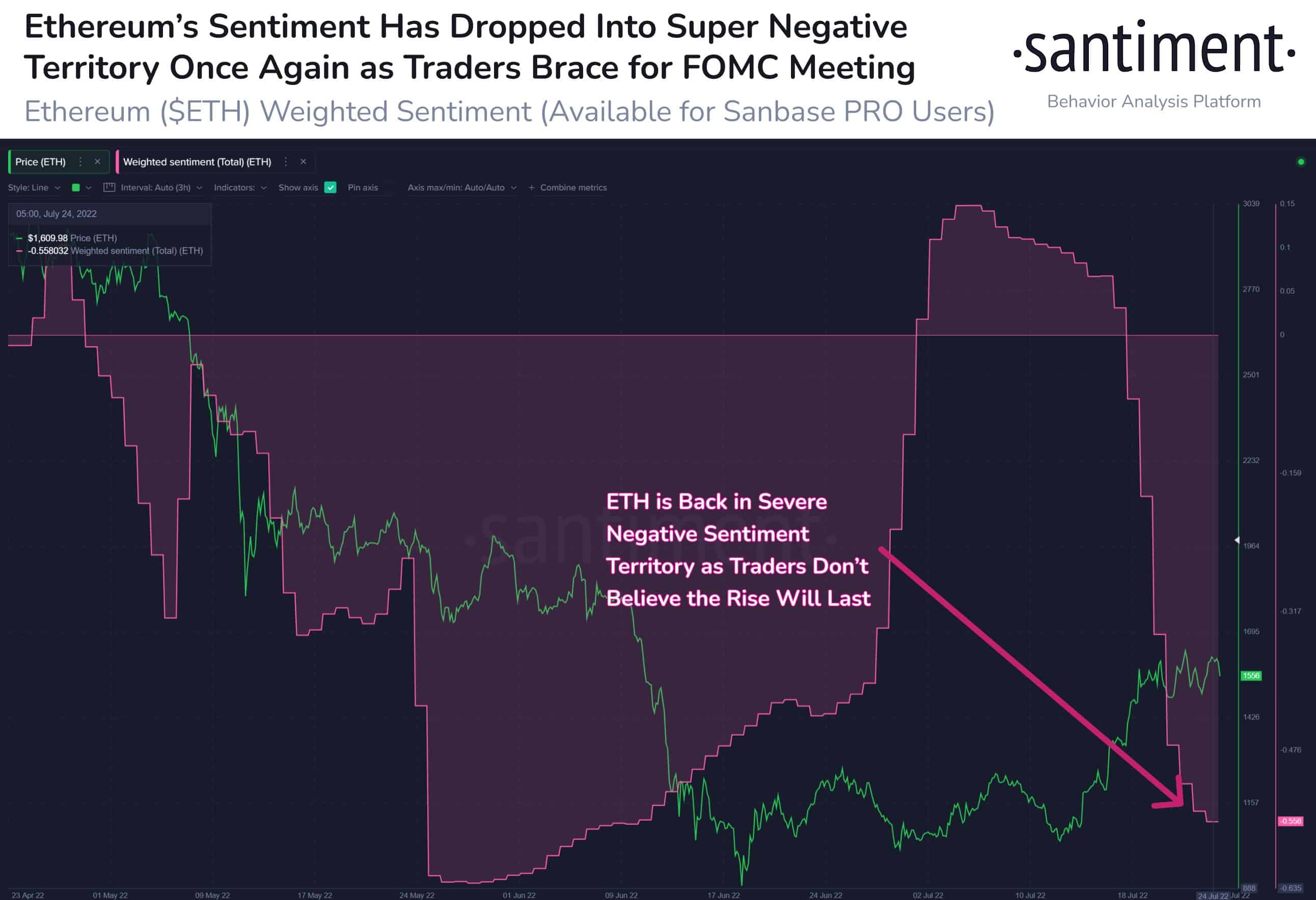

Last week, Ethereum posed a strong relief rally moving past $1,600 over the last weekend. However, it has now corrected partially from the top and is currently trading at $1,528 levels. On-chain data provider Santiment explains that the ETH trading sentiment has now dropped into negative territory. The data provider writes:

Ethereum had an up and down Sunday, jumping above $1,640 before dipping back down to $1,540. The trading crowd continues to not believe the hype, and is expecting prices to fall heading into the #FOMC meeting. $ETH should continue to stay volatile.

On the other hand, the ETH gas fee has dropped significantly. Citing data from Glassnode, crypto analyst Colin Wu explains:

Ethereum’s 7-day average gas fee reached 25.825 Gwei, a record low in a year. Yesterday, the minimum gas fee was reduced to 3gwei, the current gas fee is 4gwei, the ETH transfer cost is $0.51, and the ERC20 transfer cost is $1.

📉 #Ethereum $ETH Median Gas Price (7d MA) just reached a 1-year low of 20.880 GWEI

View metric:https://t.co/6QGDfZoULY pic.twitter.com/zavslWfv64

— glassnode alerts (@glassnodealerts) July 25, 2022

Other altcoins like Cardano (ADA) and Polygon (MATCI) have been doing relatively well registering double-digit returns last week. But if the selling pressure continues, the broader crypto market cap might tank under $1 trillion.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs