Despite ETH Price Volatility, Ethereum Whales Continue Holding Strongly

While Ethereum (ETH) was subjected to massive price volatility, the fundamentals of the world’s largest cryptocurrency continue to remain strong. As a result, Ethereum has regained its levels above $3500 with its market cap soaring past $405 billion. As CoinGape reported, ETH has formed a bullish pattern on the technical chart and is eyeing a move to $4000.

As per on-chain data provider Santiment, as the ETH price crashed under $3200, the Ethereum whales continued it holding stronger. There’s been a very drop in the Ethereum mega whale addresses holding over 10K ETH coins. On the other hand, ETH whale addresses holding 100-10K ETH were at a three-year low.

🐳👍 #Ethereum's largest addresses have not budged on the recent volatility that dropped the price to as low as $3,144 today. There are just 8 less addresses with 10k+ $ETH than there were a week ago, while addresses with 100-10k $ETH are at a 3-year low. https://t.co/Tt1OfhjGb8 pic.twitter.com/c0swYSvJ0D

— Santiment (@santimentfeed) May 18, 2021

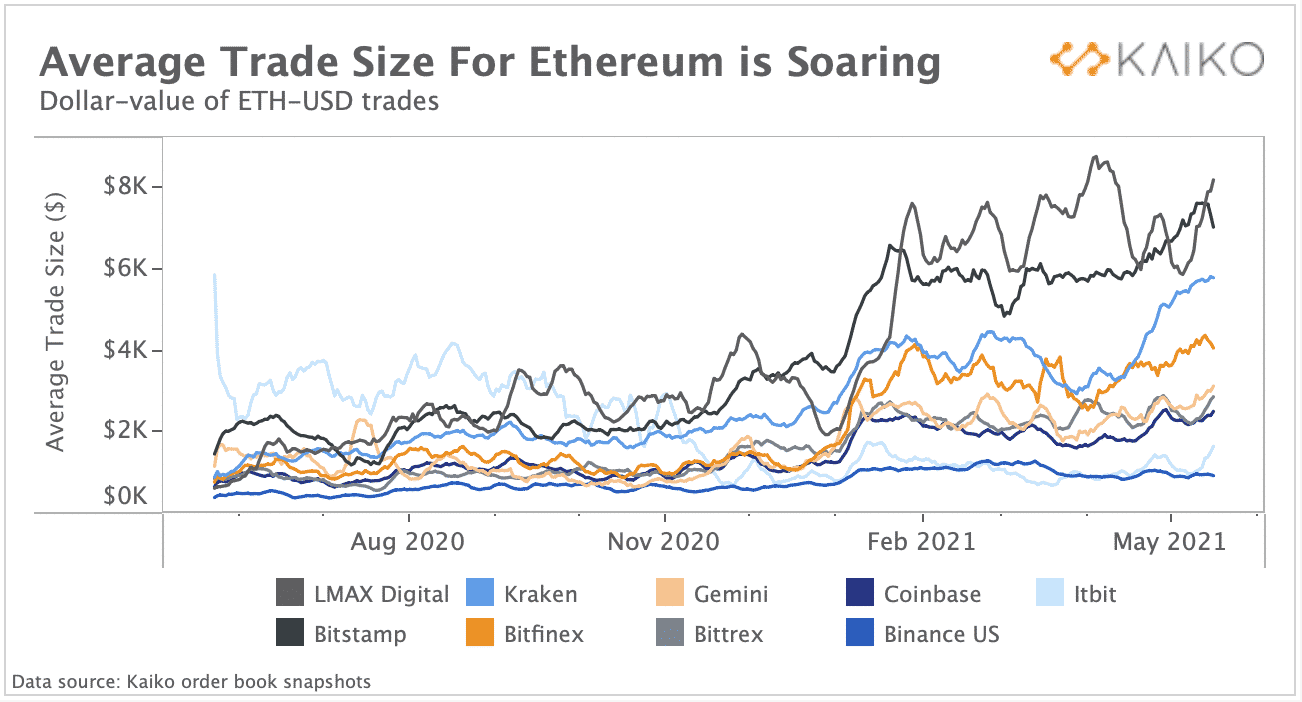

Also, Ethereum continues to remain the top choice for investors. As per Kaiko Research, the average size of the ETH/USD trading pair has doubled over the last year. As the report mention:

“Since last May, the average trade size on LMAX Digital has jumped from just $1k to $8k. On Bitstamp, from $1.5k to $7k. On Kraken, from $1k to $6k, and so on. The surge in trade sizes comes amidst Ethereum’s record-setting bull run to all time highs.”

Ethereum DeFi Shows Resilience Over Binance Competitor

With Monday’s selldown, the Ethereum-based DeFi protocol and tokens showed major resilience to the market crash whereas DeFi tokens on the Binance Smart Chain (BSC) went with the market flow falling further, notes Messari Research.

$ETH-DeFi has been much more resilient than $BNB-DeFi names in this selldown pic.twitter.com/lkqTLoBliU

— Mira Christanto (@asiahodl) May 17, 2021

On the other hand, the Ethereum network has been winning on multiple ends. The Ethereum user growth over the last year has surged 1300%, the total value locked in Ethereum smart contracts has surged a whopping 9000%, and the Ethereum-based DEX volumes have also surged a massive 8500%.

Growth of ethereum defi in past months. pic.twitter.com/HzUdiz0RzZ

— Documenting Ethereum 🧾 (@DocumentEther) May 17, 2021

Ethereum has been showing strength over BTC continuously over the last year. While the Bitcoin market dominance has tanked to a three-year low of 40%, Ethereum (ETH) dominance has surged to nearly 20%.

- OpenAI Introduces Smart Contract Benchmark for AI Agents as AI and Crypto Converge

- Goldman Sachs CEO Discloses Bitcoin Stake, Backs Regulatory Push Amid Industry Standoff

- FOMC Minutes Signal Fed Largely Divided Over Rate Cuts, Bitcoin Falls

- BitMine Adds 20,000 ETH As Staked Ethereum Surpasses Half Of Total Supply

- Wells Fargo Predicts Bitcoin Rally on $150 Billion ‘YOLO Trade’ Inflow

- BMNR Stock Outlook: BitMine Price Eyes Rebound Amid ARK Invest, BlackRock, Morgan Stanley Buying

- Why Shiba Inu Price Is Not Rising?

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand