Decentralized Exchanges (DEX) Trading Volumes Soared To An ATH of $668 Mn in March 2020

The combined trading volumes from Ethereum-based decentralized exchanges (DEXes) rose 53% to an all-time high of $668 million in March 2020. This is according to analytics from Dune.

Interest in DEXes on the rise

At the time of writing, the total trading volumes from DEXs stood at slightly over $9 million, pushing weekly volumes to $70.7 million.

Combined, this is down 54% if measured as a trailing 7-days growth.

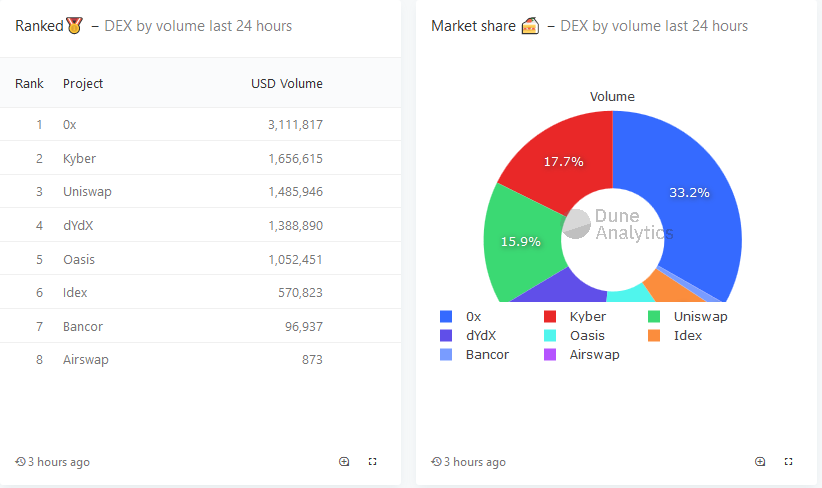

The three most active DEXes are OX, Kyber Network, and Uniswap, drawing over $6 million in USD terms.

This finding is consistent with a parallel finding from DappRadar that confirmed that Ox, Uniswap, and Kyber Network were the most active.

To be specific, OX had over $3.1 million worth of digital assets traded in the last 24 hours. This represents a market share of 33 percent, almost twice that of Kyber Network which stood at 17.7 percent.

Ox, Uniswap, and Kyber Network are dominant

However, the most interesting observation was the consistency of DEX trading. Over the last year, its growth has been linear and positive sloping.

For example, over the last nine months, volumes have almost doubled from $289 million of July 2019 to $668 million by the end of March.

“DEX volumes landed at an all-time high of $668 million for March! Up 53% from last ATH in February. Interestingly, it’s the first time DEX volumes are soaring on a falling ETH price.”

DEX volumes landed at an all-time high of $668 million for March!? Up 53% from last ATH in February. Interestingly, it's the first time DEX volumes are soaring on a falling ETH price. Might be a sign of DEXs solving a real problem, not just a toy anymore? https://t.co/ifsecZBNmz pic.twitter.com/QTtBoQDWJy

— Dune Analytics (@DuneAnalytics) April 1, 2020

During this time, ETH prices fluctuated widely. After peaking in June 2019, bears took charge and forced a sell-off towards $130.

However, prices recovered in Dec 2019, rallying to around $290 before falling back to lows of $110 in March.

The growth, therefore, is amid a steep decline in ETH prices, a positive development.

Coincidentally, the drop was at the backdrop of drying liquidity in centralized exchanges.

DEX challenges and benefits

Although dominant and scalable unlike DEXes, most of which are based in Ethereum and its scalability dependent on the network’s throughput, traders seem to have refrained from placing orders as asset prices took a beating from Mar 12-13.

Nonetheless, DEXes are secure than centralized versions as Binance or Coinbase. Traders have full control of their assets.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- XRP Price Dips on US-Iran Conflict, But Capitulation Signals March Rebound

- Crypto Market at Risk as U.S.–Iran War Threatens Inflation With Oil Price Surge

- Polymarket U.S.–Iran Strike Bets Fuel Insider Trading Speculation as Crypto Traders Net $1.2M

- Cardano’s DeFi TVL Climbs as USDCx Stablecoin Launches on Network

- Gold vs. Bitcoin: Can Gold Outperform BTC Amid US–Iran Conflict?

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs