Is There More Pain Ahead for Ethereum (ETH) Holders? Key On-Chain Metrics To Watch Out

The world’s second-largest crypto Ethereum (ETH) is down nearly 10% in the last 24-hours moving closer to its crucial support of $2000 levels. The broader market correction on Thursday, July 8, has resulted in a severe bloodbath in the altcoin space.

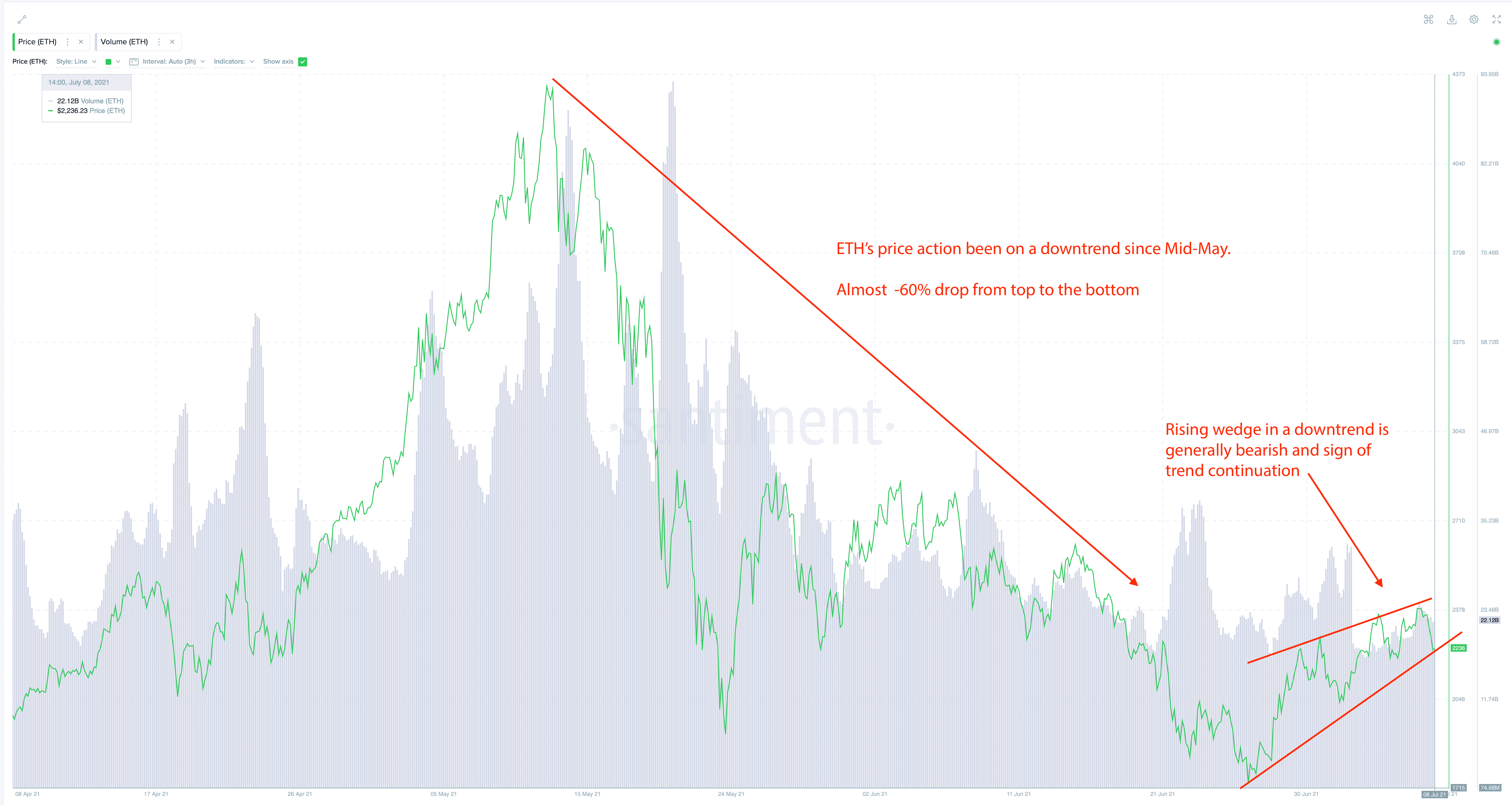

The ETH price bounced more than 20% from its $1750 lows in June end. Two days back before the recent correction, the ETH price made a momentary spike above $2400 levels. A bearish signal on the technical charts is that the ETH price is forming a rising wedge. With the overall trend staying bearish, the ETH price will break down the rising wedge and move towards $1750 levels.

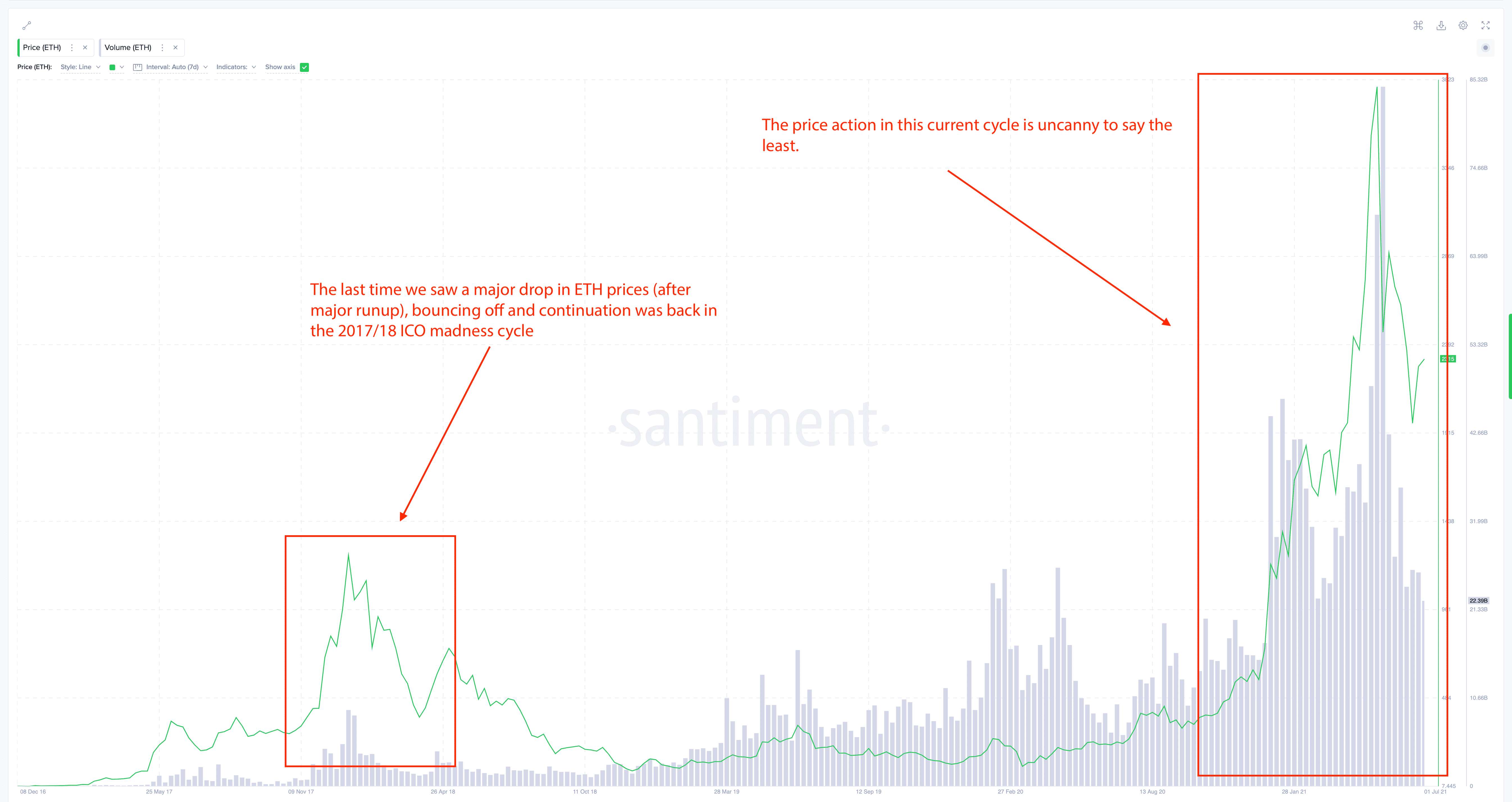

Interestingly, the recent chart pattern and the rising wedge have striking similarities with the 2017.18 ETH price movement. Thus, the bearish bias will continue to remain and we can expect deeper correction going ahead.

Read More: Ethereum (ETH) Price Recovery in Grave Danger. Here’s Why

On the other hand, the long-term holders for Ethereum on a 356 day time period continue to stay in profit. So far we have not yet hit the undervalued zone. Thus, there’s every possibility that these players can resolve to further profit booking leading to more pain.

ETH Exchange Supply Declining, More ETH Price Decline?

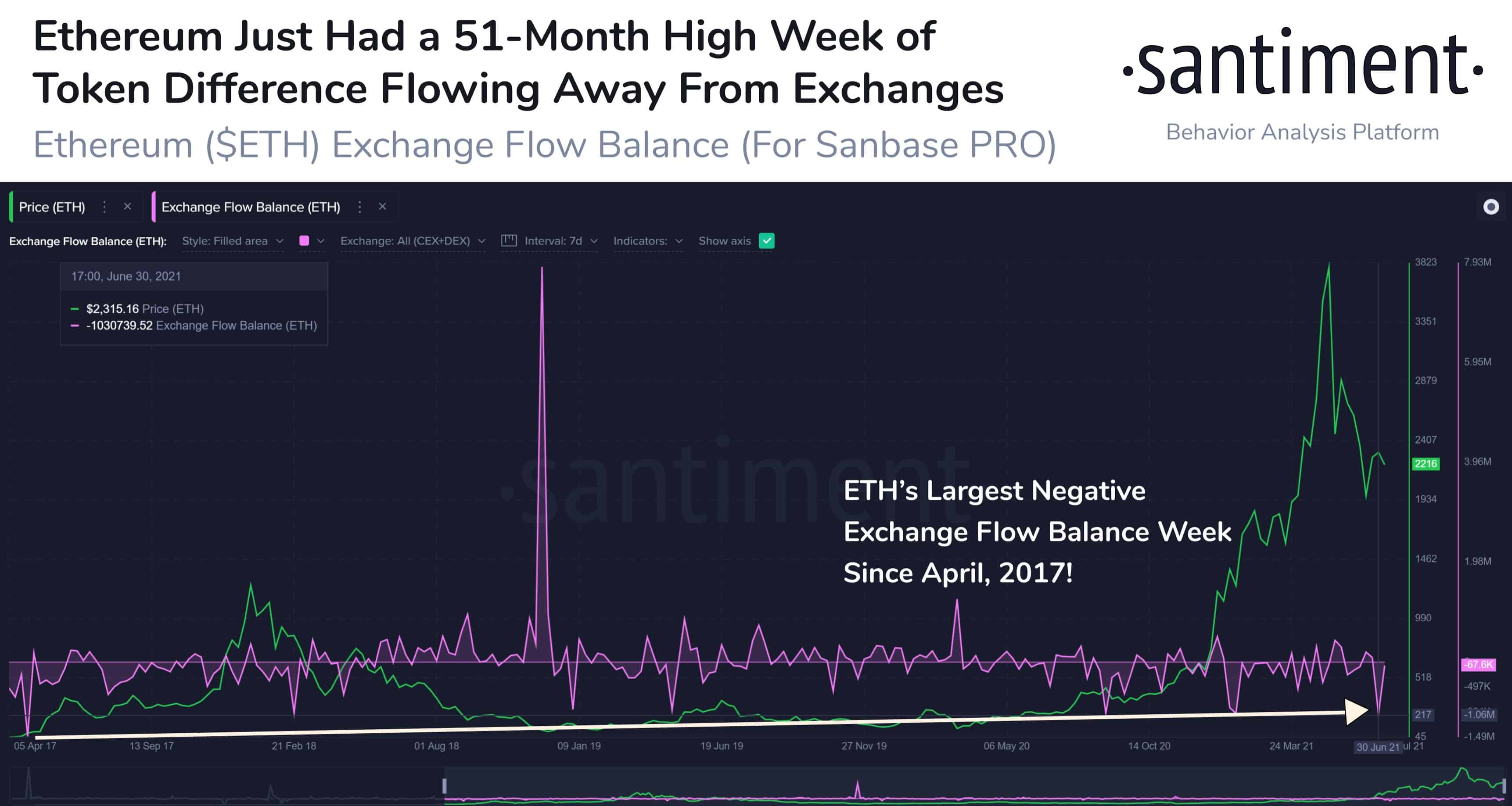

While ETH price movement is hinting at bearish momentum ahead, some of the key on-chain metrics show that there’s not much reason to panic. A large number of Ethereum coins continue to move away from the exchanges. As per data from Santiment, the first of July saw the largest-ever Ethereum exchange outflow since April 2017.

A large number of Ethereum coins have been flowing to the ETH 2.0 deposit contracts. The total number of staked Ethereum coins with ETH 2.0 has crossed more than 6 million worth a massive $13 billion.

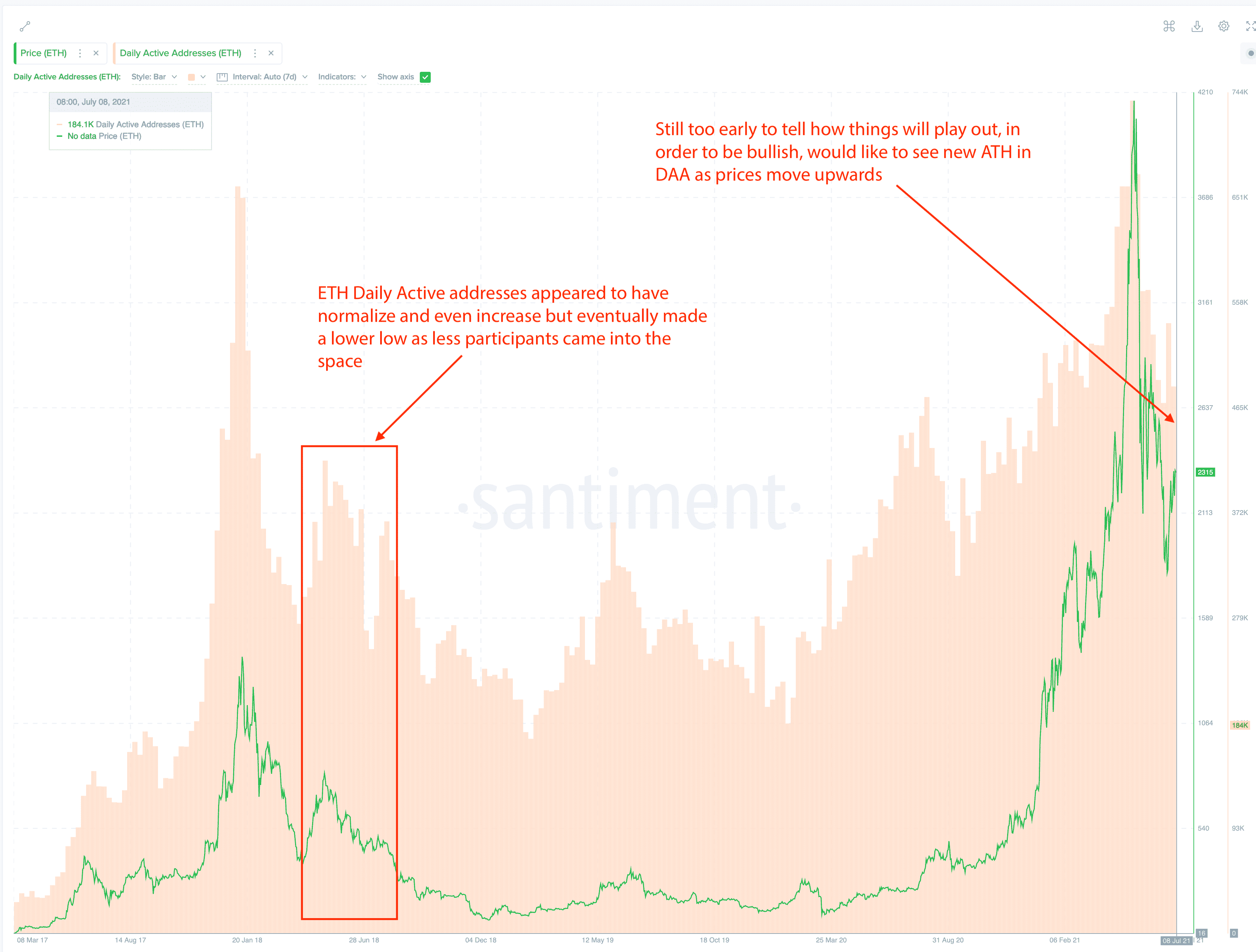

After the all-time high of May, the Ethereum active addresses dropped by 40% since then. The active addresses have once again picked up momentum to the north. However, it will be too early to confirm any bullish trend based on historical charts.

Many analysts have been betting on the upcoming London hardfork scheduled to go live next month. The EIP-1559 implementation which reduced the Ethereum gas fee is said to be the gamechanger. However, the ETH price movement surrounding it has been much speculative suggesting “buy the rumour, sell the news”.

- Crypto Regulation: Hyperliquid Launches Policy Group to Push DeFi Integration in U.S. Markets

- XRP News: XRPL Activates Permissioned DEX Upgrade to Boost Institutional DeFi Adoption

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- How XRP Price Will React as Franklin Templeton’s XRPZ ETF Gains Momentum

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks