Ethereum (ETH) Needs To Confirm This Bullish Pattern For A Recovery

Ethereum (ETH) slumped in line with broader crypto markets this week, amid concerns over slowing economic growth and rising inflation. But the token appears to be trading in a bullish technical pattern, which if confirmed, could bring about a price recovery.

ETH slumped 14% in a week to around $3,019, briefly breaking below the key $3000 level. The token had initially logged strong gains in March on anticipation of a shift to a proof-of-stake (PoS) model later this year.

The move to a PoS model is also expected to attract institutional investors to the token, which could spur another rally this year. But for now, ETH has to contend with volatile market forces.

ETH retesting an Ascending Triangle

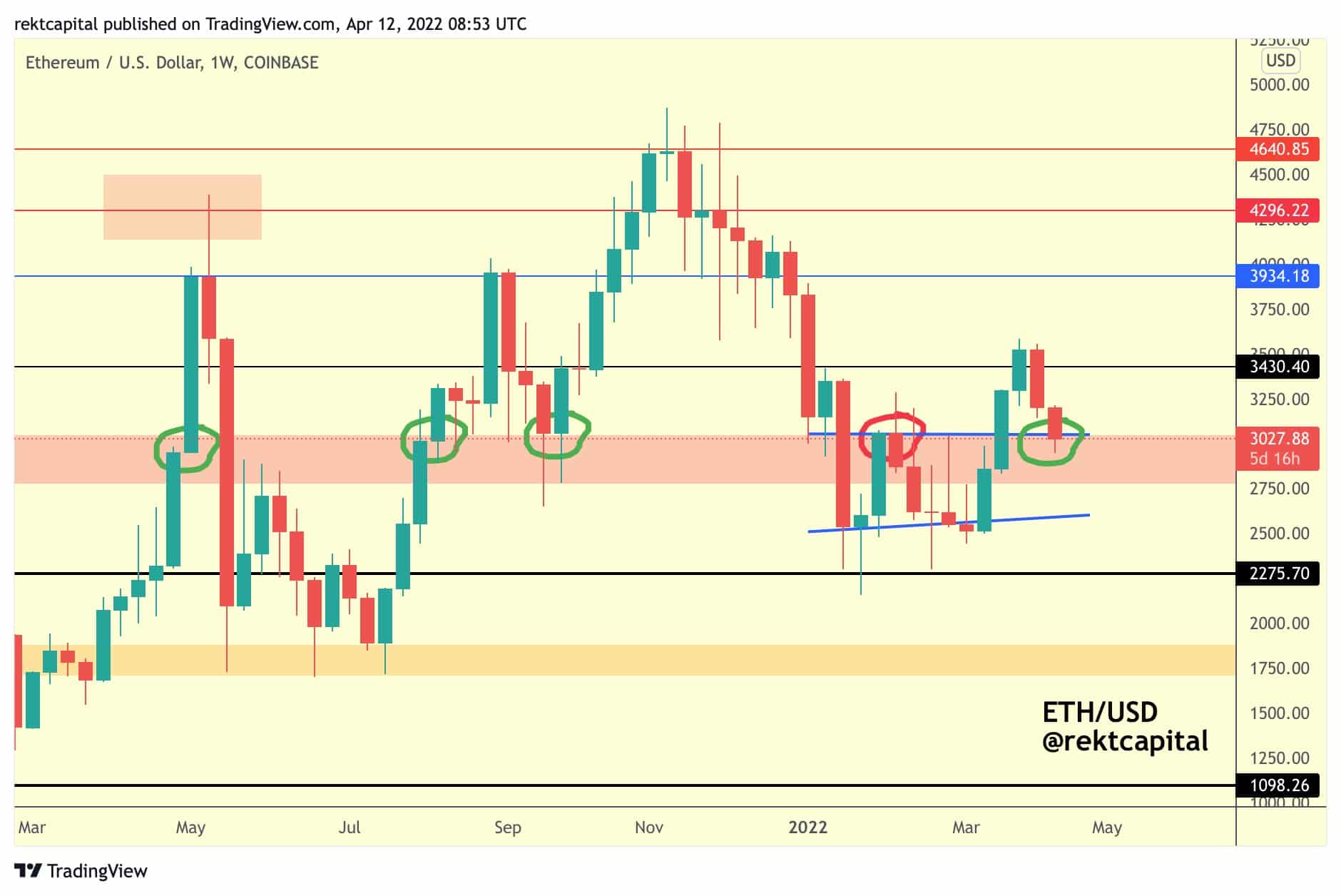

Crypto analyst @rektcapital said the token was in the process of retesting an ascending triangle top to establish a new support level, which is slightly above $3000. If the token is able to stay above the level for an extended period, it could signal a price breakout, eventually resulting in a price recovery.

An ascending triangle is a typically bullish pattern that shows a currency may be positioned for a breakout. In ETH’s case, the breakout level would be around $3030.

But the analyst also noted that because Bitcoin (BTC) had recently failed to confirm its own ascending triangle breakout, it appeared likely that ETH would as well.

Crypto markets struggle against selling pressure

Recent losses have seen crypto markets virtually erase all of their gains made during a stellar rally in late-March. ETH has tumbled as much as 20% from a high of $3,550 hit earlier this month.

A bulk of the selling pressure has come from concerns over rising U.S. inflation. A reading for March, due later in the day, is expected to come in at a 40-year high.

The Federal Reserve has also outlined sharp interest rate hikes in response to rising prices. This is expected to reduce the viability of investing in several risk-driven asset classes, including crypto.

- Is Trump Launching a New Coin? TMTG Teases Token Debut as Traders Turn Bullish

- Grayscale Insiders Are Quietly Selling XRP and Solana amid ETF Outflows: Report

- XRP Price Rebounds from 2-Year Low: Here’s Why

- Bitcoin Price Rebounds to $78K as BTC ETFs Flip Back to $561M Inflows

- Ethereum Slips as Vitalik Buterin Moves 5,493 ETH, Trend Research Dumps 20K ETH

- HYPE Price Outlook After Hyperliquid’s HIP-4 Rollout Sparks Prediction-Style Trading Boom

- Top 3 Meme coin Price Prediction: Dogecoin, Shiba Inu And MemeCore Ahead of Market Recovery

- Here’s Why Pi Network Price Just Hit an All-Time Low

- Crypto Events to Watch This Week: Will the Market Recover or Crash More?

- XRP and BTC Price Prediction if Michael Saylor Dumps Bitcoin Following Crypto Market Crash

- Here’s Why MSTR Stock Price Could Explode in February 2026