Ethereum Exchange Supply Drops 52% as $3,700 Liquidation Risk Grows

Highlights

- Ethereum exchange balances plunge 52% to nine-year low, tightening market liquidity.

- Analyst Ted warns that the $3,700 liquidation cluster could trigger heavy forced selling.

- Whales buy $1.73B ETH from Kraken, BitGo, Galaxy Digital, FalconX, and OKX.

Ethereum’s exchange supply has dropped by more than 52% from their 2016 levels, hitting a low of about 14.8 million ETH. In addition, a respected market analyst has predicted a growing liquidation risk near the $3,700 price level. He has identified this as a critical support level. This creates a mix of long-term bullish signals and short-term downside pressure.

Ethereum Exchange Balances Hit Nine-Year Low While $3,700 Becomes Critical Support

Data from Glassnode confirms that balances held on exchanges have fallen sharply from a peak of roughly 31 million ETH to just 14.8 million ETH today, marking a 52% drop. This is the lowest level since 2016 and suggests investors are moving their coins elsewhere.

This could be staking contracts, cold wallets and institutional custody. The launch of the first Ethereum staking ETF has also boosted demand for the coin. Hence, this makes sudden price swings more likely when demand or sell pressure rises.

In addition, crypto analyst Ted (@TedPillows) has highlighted growing liquidation risks around $3,700 to $3,800. He noted that this price zone could be tested again before Ethereum finds stability.

If ETH drops below $3,700, large amounts of leveraged positions may be wiped out, creating a wave of forced selling. This low supply and concentrated leverage have weakened Ethereum’s short-term outlook. Using Pillows analysis, the bulls need to defend the $3,700 to USD 3,800 to ensure there are no further losses.

$ETH liquidity heatmap is showing decent long liquidations around the $3,700-$3,800 level.

This level could be revisited again before Ethereum shows any recovery. pic.twitter.com/SQTbfrujAa

— Ted (@TedPillows) September 27, 2025

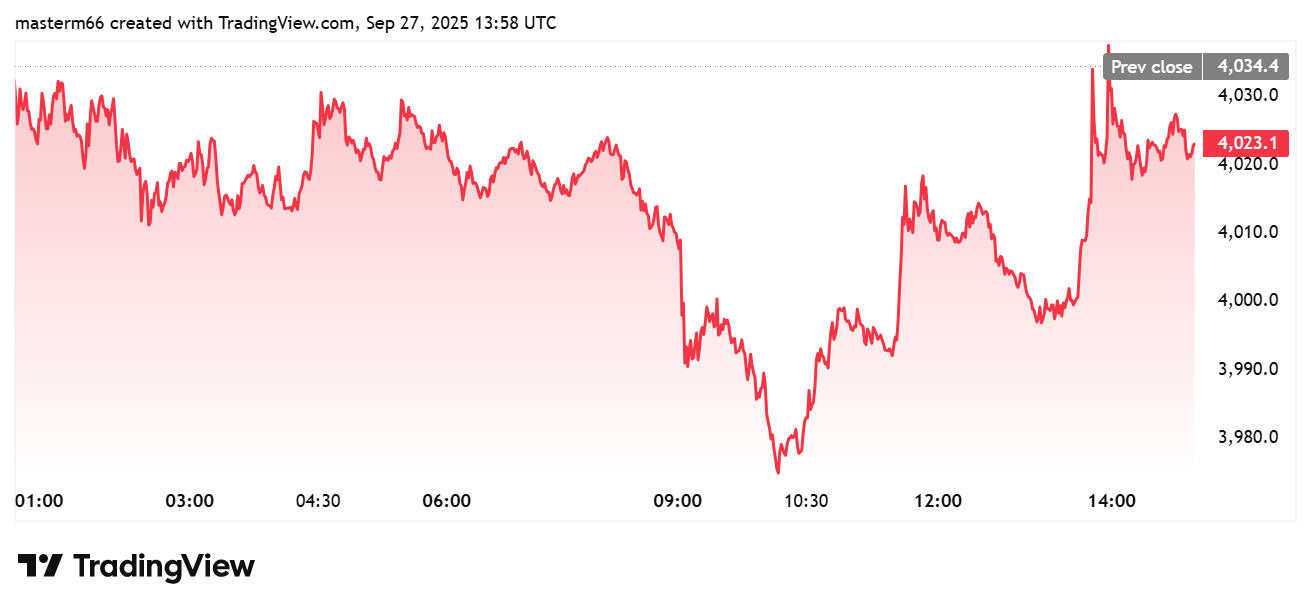

According to current TradingView data, ETH price is at $4,011, down nearly 0.33% in the past 24 hours and more than 10% over the past week. The price briefly dipped below $3,980 earlier in the session before recovering. However, it remains under its recent close of $4,034.

Whales Accumulate $1.73B in ETH as Institutions Buy the Dip

The supply drop and liquidation risk create a double-edged scenario. On one hand, record low balances show conviction among holders. It also proves Ethereum’s growing role in decentralized finance and institutional portfolios.

Meanwhile, 16 wallets bought 431,018 ETH from September 25 to 27 for a total of $1.73 billion, as Lookonchain data shows. Similar Ethereum whale activity was seen earlier, when $204 million worth of the token was accumulated.

These inflows poured in from Kraken, Galaxy Digital, BitGo, FalconX and OKX. Also, they highlight how deep-pocketed buyers are positioning during the current market pullback. The scale of these transactions shows that retail sentiment may be cautious. However, institutional and whale demand for ETH remains strong.

Whales keep accumulating $ETH!

16 wallets have received 431,018 $ETH($1.73B) from #Kraken, #GalaxyDigital, #BitGo, #FalconX and #OKX in the past 3 days.https://t.co/0DPxgZMGN7 https://t.co/xtPLBKo9LZ pic.twitter.com/oEXZKIErmr

— Lookonchain (@lookonchain) September 27, 2025

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs