Ethereum Shanghai Upgrade Progress: Will ETH Price Rise Or Fall?

Ethereum Shanghai upgrade news: The network’s highly anticipated upgrade is set to go live sometime in March or April. It will allow ETH stakers to withdraw their cryptocurrency currently locked in the ETH 2.0 smart contract. But the question is, will unlocking this amount cause immense selling pressure?

A dress rehearsal (Zhejiang testnet) for the Ethereum Shanghai upgrade is about to begin. It serves to replace the Shandong testnet because when the latter was launched, it included several EIPs that will not be rolled out with the upgrade.

According to Paritosh, Developer at the Ethereum Foundation, the Zhejiang testnet is a great opportunity for all tools to test out how they want to collect, display and use the withdrawal information. Making the experience smooth for users is one of our highest priorities now!

How Ethereum Shanghai Upgrade Will Impact ETH’s Price?

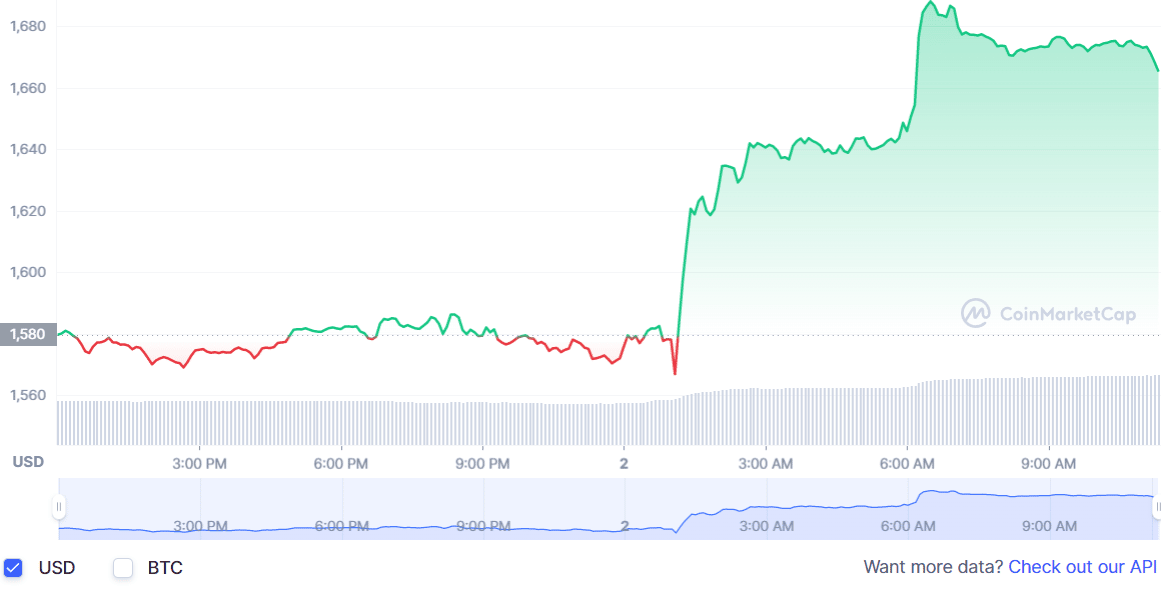

At the time of writing, the current price of Ethereum is $1,667.61 with a one-day trading volume of $9,876,481,170. ETH has risen by nearly 5.51% during the past 24 hours. The coin strongly holds the second position on CMC, with a live market cap of $204,071,388,357.

The implementation of the Shanghai network upgrade is expected to drive Ethereum’s staking ratio up so that stakers can enjoy additional yield without the downside of lower liquidity. From lowered gas fees to fewer failed transactions, it is expected that ETH will surge amid the network upgrade.

On the bearish side of things, the cryptocurrency market is still at the edge of a bullish-bearish trend. There are many reasons for it like many investors are not over with Terra Luna and FTX contagion. Also, macroeconomic factors are bearish that might pressure original Ethereum stakers to sell their staked ETH.

In conclusion, Shanghai Network Upgrade can lead Ethereum toward a massive surge, or investors can witness the price dump. It is just a matter of time until we find out!

Also Read: How Ethereum Shanghai Upgrade Will Impact ETH Holders?

Note: The information in this article is solely the author’s opinion and not investment advice – it is provided for educational purposes only.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs