Ethereum’s London Upgrade is Live; Here’s “WHY” It Could Boost ETH Price

Ethereum’s London Hardfork went live on blocks 12,965,000 bringing 5 key changes to the network. Among these five Ethereum Improvement Proposals (EIP) implemented today, EIP-1559 is certainly the most talked-about upgrade. While there is a common perception that EIP-1559 would reduce gas fees, the reality is it would only stabilize the transaction fee bracket to root out high fluctuation.

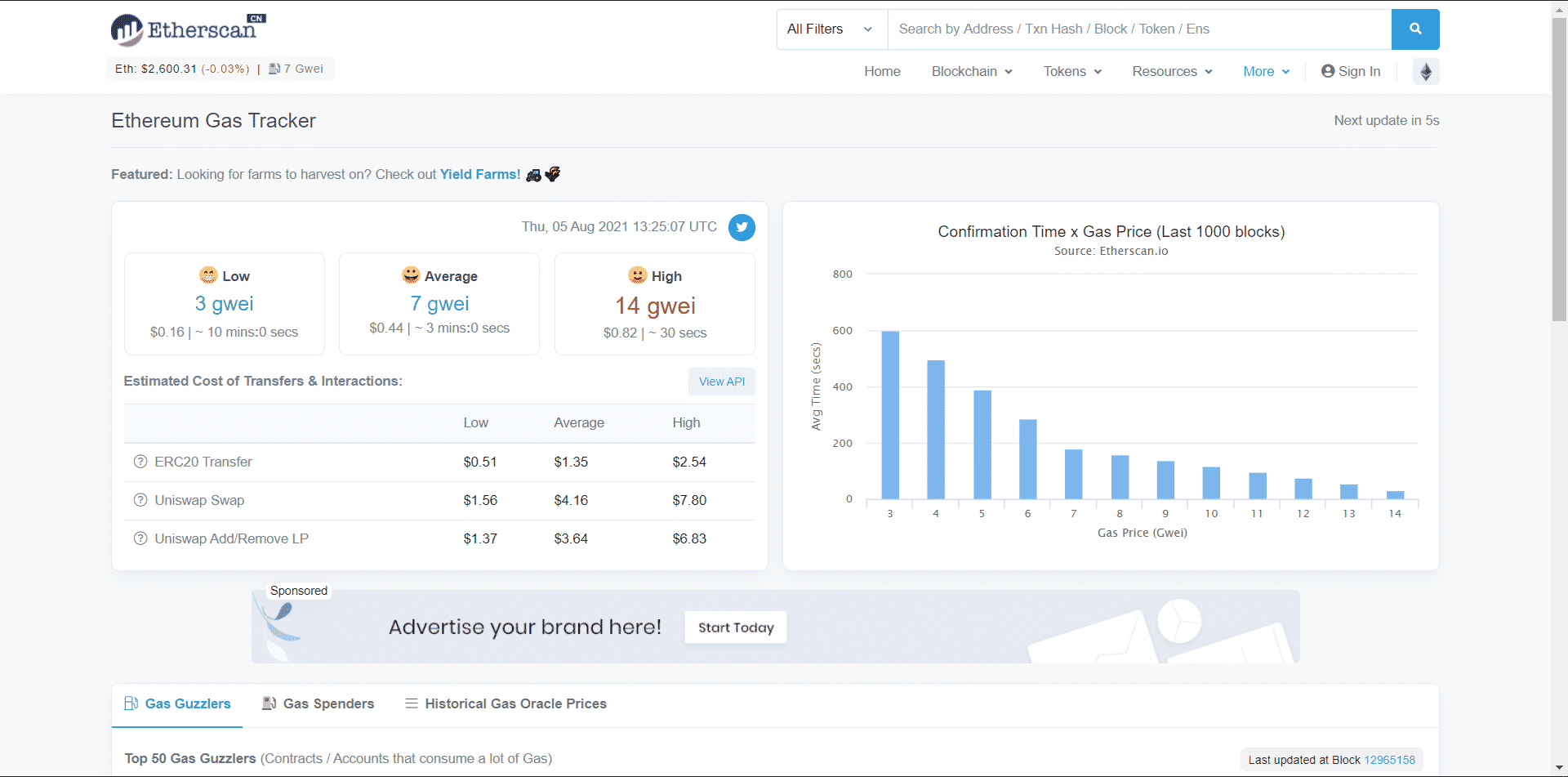

A fixed transaction fee could potentially bring down the gas fee compared to the early days of bidding by users. This was visible from the first few blocks mined after the upgrade. The current average gas fee is at 7 gwei and the lowest being 3 gwei.

The EIP-1559 would cut the direct interaction between users and miners, where earlier users used to bid higher gas fee amounts to process their transactions. Now users would have an estimate about the expected transaction cost which would be forwarded to the miners by the network. More importantly, the remaining ETH would be burnt and removed out of circulation supply. This would, in turn, make Ether a deflationary asset, increasing the value of the existing circulating supply.

Ethereum Produces First Deflationary Block

The first batch of Ether has been already burnt by the network after the upgrade. On block 12965363, the amount of ETH burnt was higher than issued.

Block #12,965,263

The first Ultra Sound block 🔥

This block burnt more ETH than it issued pic.twitter.com/qoGxoSZXRZ

— RYAN SΞAN ADAMS – rsa.eth 🦇🔊 (@RyanSAdams) August 5, 2021

At the time of writing a total of 100 ETH worth $260,000 was burnt at an average of 20 ETH every 10 minutes. The deflation of ETH supply could prove beneficial for the price of the second-largest cryptocurrency.

The amount of Ether available on centralized exchanges are on a continuous decline as a significant amount of the altcoin is being moved to ETH 2.0 stacking contracts making the market supply of ETH scarce. Now with periodic ETH burns the available supply of the altcoin could see further depletion despite growing demand, thus increasing its market value.

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Breaking: Morgan Stanley Applies For Crypto-Focused National Trust Bank With OCC

- Ripple Could Gain Access to U.S. Banking System as OCC Expands Trust Bank Services

- $2T Barclays Explores Blockchain For Stablecoin Payments and Tokenized Deposits

- Breaking: U.S. PPI Inflation Rises To 2.9%, BTC Price Falls

- XRP News: Ripple-Backed Ctrl Alt Completes $280M in Diamond Tokenization on XRPL

- Top Analyst Predicts Pi Network Price Bottom, Flags Key Catalysts

- Will Ethereum Price Hold $1,900 Level After Five Weeks of $563M ETF Selling?

- Top 2 Price Predictions Ethereum and Solana Ahead of March 1 Clarity Act Stablecoin Deadline

- Pi Network Price Prediction Ahead of Protocol Upgrades Deadline on March 1

- XRP Price Outlook As Jane Street Lawsuit Sparks Shift in Morning Sell-Off Trend

- Dogecoin, Cardano, and Chainlink Price Prediction As Crypto Market Rebounds

Buy $GGs

Buy $GGs