Extreme Bitcoin (BTC) Losses Not A Danger For Now, Says Analyst

Popular crypto analyst PlanB said on Friday that they did not see Bitcoin’s (BTC) price tumbling to realized levels, despite recent weakness.

Their comments come as the world’s largest cryptocurrency marked a sharp fall from 2022 highs earlier this month. BTC is now trading at $40,000, about 20% below its year’s highs, and has slumped over 40% from a record high hit in November.

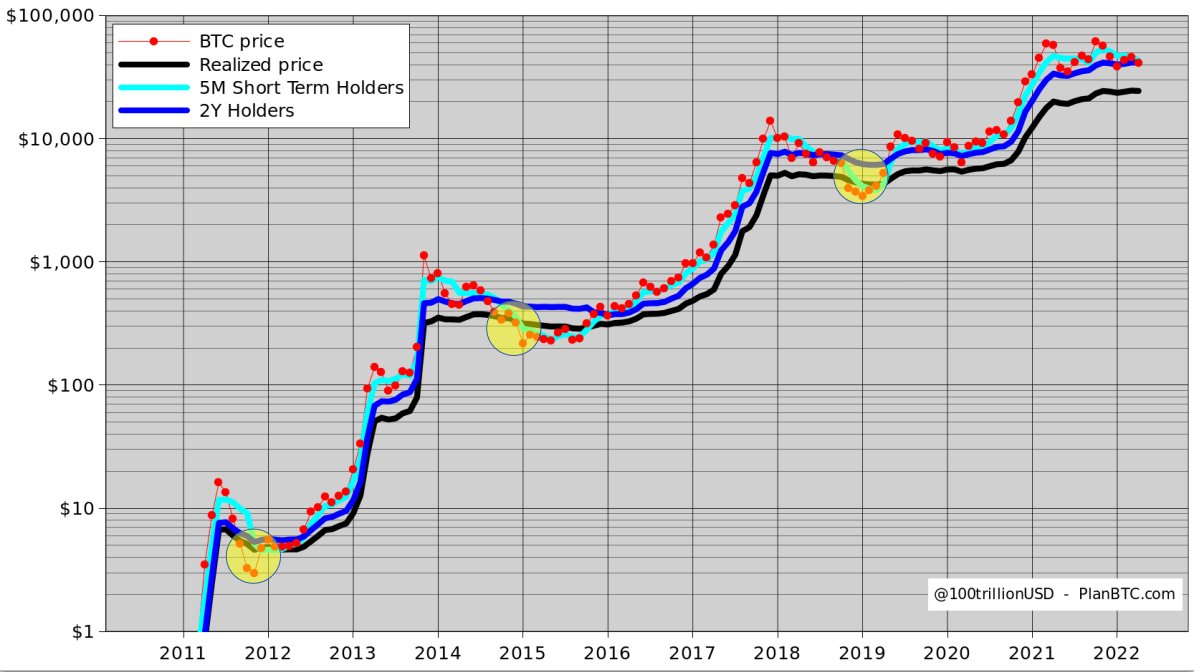

The token appears to have found a bottom at $40,000, for now. However, BTC’s realized price- an important indicator of a worst-case scenario support level, is at around $24,000.

The realized price is the average price at which most tokens in circulation were purchased. It represents the lowest possible price most market holders can tolerate while still trading in profit.

BTC not tumbling to realized price any time soon

PlanB largely dismissed fears that BTC could slump sharply to $24,000. They noted that the last three times such an even occurred was in tandem with a BTC-linked “black swan” event. The analyst implied that it would take an event of extreme negative sentiment to drive a tumble to realized levels.

The last time such a capitulation occurred was in 2018, during the infamous Bitcoin Satoshi Vision (BSV) fork. The creation of the hard fork in 2018 had nearly split the BTC community in half, resulting in large price fluctuations, as well as the creation of the BSV token.

The other two occurrences of BTC capitulation had been exchange hacks, a common source of BTC FUD.

PlanB is one of the most popular BTC analysts, with over 1.7 million followers on Twitter. They are credited with inventing the stock-to-flow price model for BTC, which uses token supply to gauge value.

Crypto market in a holding pattern

While BTC appears to have established a support level at $40,000, it is still trading in a limited range seen for most of the year. The broader crypto market, for most part, also appears to be following this range.

A host of macroeconomic concerns, coupled with monetary tightening by central banks have dented sentiment in recent months. Investors are also fearing the economic aftershocks of the Russia-Ukraine conflict, with high oil prices being only part of the problem.

Still, major altcoins appear to be performing better than BTC for now. The token’s total market dominance was close to its lowest levels this year, at 41%.

- Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k