Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React?

Highlights

- Fed rate cut odds fall fast as markets expect no move at January 28 meeting.

- Political scrutiny and Powell’s term raise questions about Fed independence and guidance.

- Dollar-yen intervention talks places Bitcoin at risk because of currency sensitivity and history.

The Federal Reserve meets in Washington on January 28, with markets pricing a near-certain pause. Fed Rate Cut expectations dipped as investors reassessed inflation, jobs and political pressure arround Chair Jerome Powell. The meeting involves Powell and the FOMC, as policymakers weigh prior cuts, independence concerns and market stability.

Fed Rate Cut Expectations in January Drops

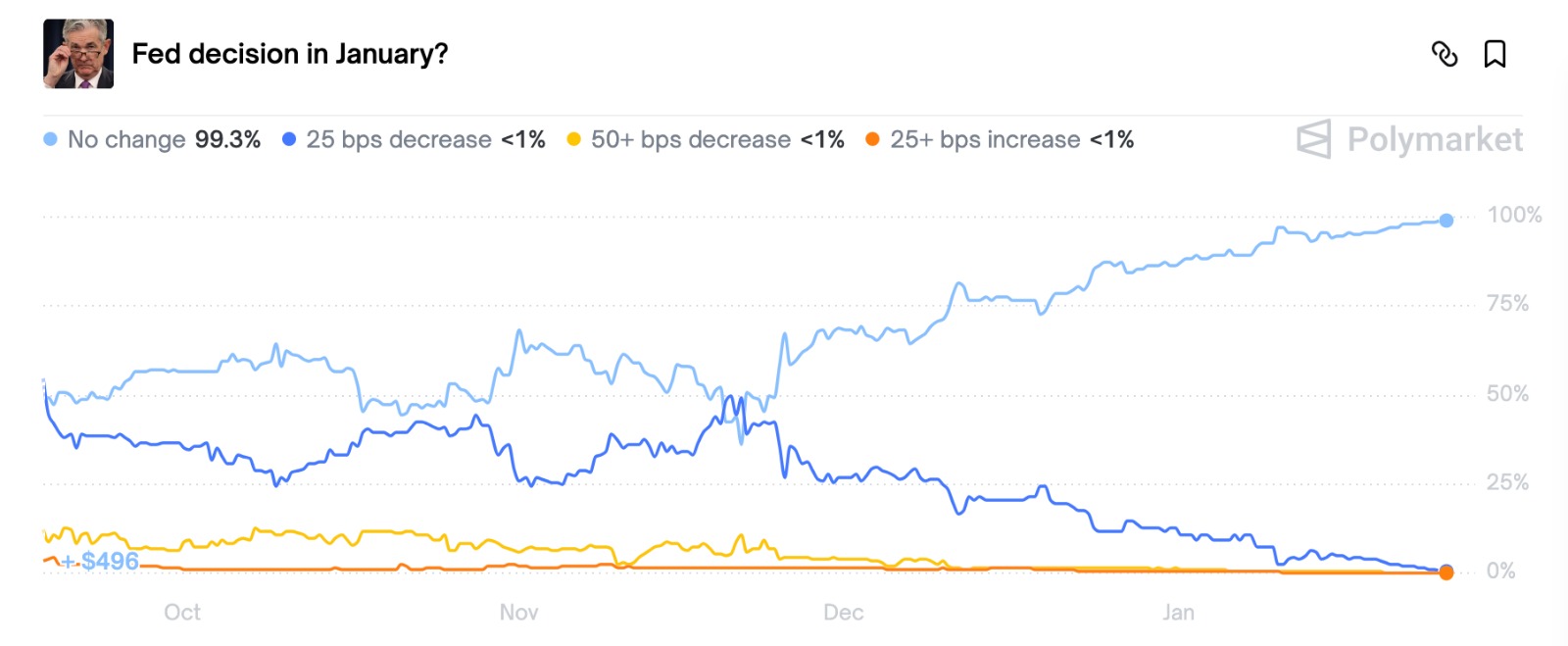

According to Polymarket data, traders see almost no chance of a January move. The no change odds are at 99.3%, 25 bps decrease under 1%, 50+ bps decrease under 1% and at 25+ bps increase also under 1%.

The Federal Reserve cut rates at the last three meetings, lowering the target range to 3.5%–3.75%. However, inflation and labor conditions changed little since December. Several officials also described policy as near neutral, limiting expectations for further easing. As a result, most officials show limited appetite for another reduction this month.

Additionally, policymakers plan to hold rates steady for several months. They want to assess how prior cuts affect inflation and employment. The Fed continues pursuing its congressional mandate of 2% inflation and maximum employment.

Political Pressure and Leadership Questions on Fed

Fed independence is in question as political scrutiny intensifies. Powell’s chair term ends in May, though he may remain a governor until early 2028. President Donald Trump will announce a nomination soon as per Treasury Secretary Scott Bessent.

Among the top candidates include BlackRock’s Rick Rieder, Former Fed Governor Kevin Warsh, Christopher Waller and Kevin Hassett. Trump has publicly urged sharp rate cuts. The administration also initiated legal actions involving Powell and Governor Lisa Cook.

While the White House denies political motives, Powell described the actions as intimidation. The Justice Department has also launched a criminal probe into Powell, creating more uncertainty around leadership stability.

Among the FOMC’s twelve members, only Governor Stephen Miran backed aggressive cuts aligned with presidential demands. Therefore, Powell faces pointed questions about resisting pressure while guiding policy continuity.

Fed Dollar-Yen Intervention Pulls Bitcoin Into Focus

Beyond rates, reports indicate the Fed may prepare coordinated dollar-yen intervention. The New York Fed reportedly conducted rate checks, a step used before intervention. Such action would involve selling dollars and buying yen, a rare move not seen this century.

Bitcoin enters this discussion due to its historical currency sensitivity. Bitcoin shows a strong inverse relationship with the U.S. dollar and a positive correlation with the yen. However, yen strength also has risk. A small Bank of Japan hike in August 2024 strengthened the yen, leading to forced unwinds of yen-funded positions. Bitcoin dropped fast during that period.

Japan faces yen weakness, high bond yields and a hawkish Bank of Japan. Solo interventions failed in 2022 and 2024. Previously coordinated U.S. and Japan actions proved more effective.

Meanwhile, rate certainty, political pressure, currency intervention signals, and Bitcoin’s exposure frame the January meeting. The Fed enters the meeting with markets expecting stability, leadership questions unresolved and global currency pressures firmly in view.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs