Odds Surge Against January Fed Rate Cut — BTC, ETH, XRP Tumble

Highlights

- Fed rate cut odds drop sharply for January and March.

- Bitcoin, Ethereum, and XRP post notable losses.

- Constrained liquidity pressures the broader crypto market.

The crypto market opens this week with a cautious note as the odds of the Federal Reserve’s interest rate cut plunge significantly. Experts believe that the central bank is likely to keep the interest rates unchanged in January and March.

While the projection seems reassuring for traditional markets, the crypto industry is bleeding. Leading assets such as Bitcoin, Ethereum, and XRP are now under pressure, posting notable declines. As the Fed is expected to hold the rates steady, the crypto space is poised to face increasing volatility, potentially leading to another major crash.

Will the Federal Reserve Reduce Interest Rates?

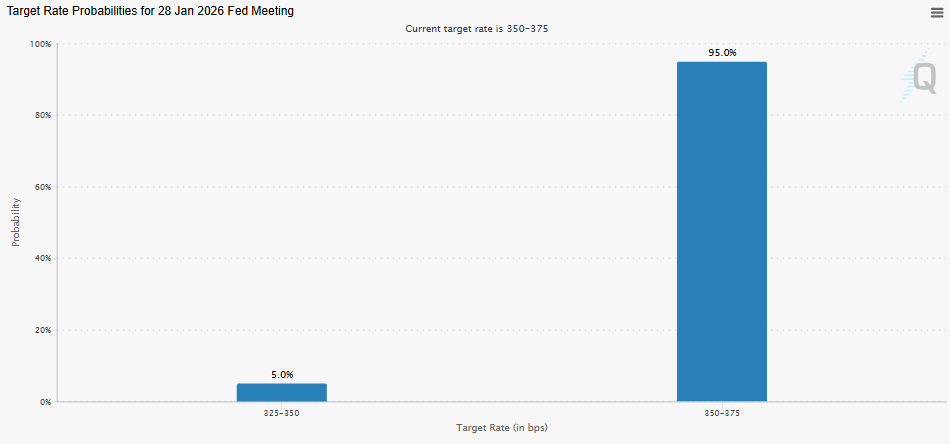

According to the CME FedWatch Tool, the Federal Reserve is less likely to cut interest rates. With 95% odds, the central bank is expected to maintain the rate at the current 3.50%-3.75% level. There is only 5% possibility for the Fed to lower the rates in January.

At the same time, expectations for March also remain largely unchanged. The CME FedWatch Tool data reveal that the probability of the Fed rate remaining unchanged in March stands around 75%. This indicates that a Fed rate cut in March is less likely, with odds at 25%.

Amid these speculations, President Donald Trump has been calling for lower interest rates. As CoinGape noted, Trump urged the Federal Reserve to lower the rate significantly, citing the “great” inflation figures.

However, the Fed’s stance is unclear. During a recent press conference in Washinton DC, Chair Jerome Powell hinted at the central bank’s cautious stance. He noted, “We’re well positioned to wait and see how the economy evolves.”

Crypto Market Bleeds: BTC, ETH, and XRP at Risk

Significantly, the higher odds of the Federal Reserve keeping interest rates unchanged are having a notable impact on the crypto market. As reported by coingape, crypto market is dumping this morning and the overall market is down by 2.8%, reaching $3.13 trillion. Major players like Bitcoin, Ethereum, and XRP are riding this negative wave, facing severe losses over the past 24 hours.

As of press time, Bitcoin is trading at $92,454. Although the crypto stays above the critical support at $90k, it is still down from the weekly high of $97.6K. Thus, the BTC price has fallen signaficantly by 2.75% in a day, 1.2% in a week, despite a 4.6% surge in a month. If the current scenario continues, and the Federal Reserve rate hold odds surge, BTC is expected to face increasing pressure.

Ethereum, currently trading at $3,193, is down by 3.56% in a day. This slump follows the altcoin’s recent surge above $3,300. Despite the daily decline, the token has seen marginal upticks of 1.35% and 5% over the past week and month, respectively.

XRP is one of the biggest losers as it has fallen from a high of $2.39 secured earlier this month. As predicted by Coingape, XRP price is showing resilience towards weak geopolitical news and institutional adoption is on rise. But, retail involvement still remains a concern and any unfavorable policy changes may further crash the crytocurrency. XRP is currently marked at $1.95, marking significant declines of 4.81% and 5.8% in a day and week, respectively. However, the token has surged by 1.5% over the past month.

This crypto market performance indicates that the growing odds of the Federal Reserve maintaining the interest rates are shaping a cautious outlook. While rate cut odds fade, liquidity expectations remain constrained, posing risks to assets such as BTC, ETH, and XRP.

- Saylor’s Strategy Hints at Bigger Bitcoin Buy Amid $5B Unrealized Losses

- Crypto Market Today: Pi, Pepe, DOGE, and XRP Post Double-Digit Gains

- Trump-Backed American Bitcoin Reserves Surpass 6,000 BTC, Now Worth $425.82M

- Expert Predicts Bitcoin Dip to $49K as ‘Trump Insider’ Whale Dumps 5,000 BTC

- Bitcoin Price Rebounds $70K, Here are the Top Reasons Why?

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)

- XRP Price Prediction Ahead of Potential U.S. Government Shutdown Today

- Bitcoin Price Outlook As Gold And Silver Lose $3.6 Trillion in Market Value

- XRP and Ethereum Price Prediction as Trump Seeks to Lower Key Tariffs