On-Chain Data Suggests Bitcoin Price In Early Bull Market Cycle

Bitcoin price continues its strong upside momentum, with an over 15% rally in the last week. BTC price is now reaching the crucial 200-WMA level just above $25,000. Meanwhile, traders are speculating whether the recent rally is a “bull trap” and should avoid or jump in to buy Bitcoin at the current level. The following five on-chain metrics indicate that Bitcoin’s cycle bottom has already been reached.

Also Read: Will Bitcoin Price Rally Above Key 200-WMA Level? Or It’s A “Bull Trap”

5 On-Chain Metrics Confirm Bitcoin Cycle Bottom

1. MVRV Ratio

The MVRV Ratio metric is the ratio of a coin’s Market Cap to its Realized Cap. It indicates whether Bitcoin’s price is overvalued or undervalued. Historically, values below 1 indicate BTC price bottom.

The MVRV ratio for Bitcoin started to rise above 1 in mid-Jan, which indicates Bitcoin price has already bottomed and entered a bull market cycle. The ratio is currently at 1.22, still low for investors to take the opportunity.

2. Supply in Loss (%)

The Supply in Loss is a ratio of the sum of UTXO value in loss to the total sum of UTXO value. It indicates the percentage of Bitcoin held at a loss by investors, reflecting market sentiment.

The Supply in Loss (%) is decreasing rapidly since January, which indicates BTC price has bottomed.

3. SOPR Ratio

The SOPR Ratio is calculated as long term holders’ Spent Output Profit Ratio (SOPR) divided by short term holders’ SOPR. Higher value of the ratio means higher spent profit of long term holders over short term holders. It is usually useful for finding market tops and short-term market behavior. The SOPR ratio also confirms the bullish Bitcoin scenario.

4. Net Unrealized Profit/Loss (NUPL)

Net Unrealized Profit and Loss (NUPL) is the difference between market cap and realized cap divided by market cap. It indicates the total amount of profit and loss in all BTC in circulation. Values over ‘0’ indicate investors are in profit and an increasing trend in value means more investors are beginning to be in profit. Currently, the value in at 0.18.

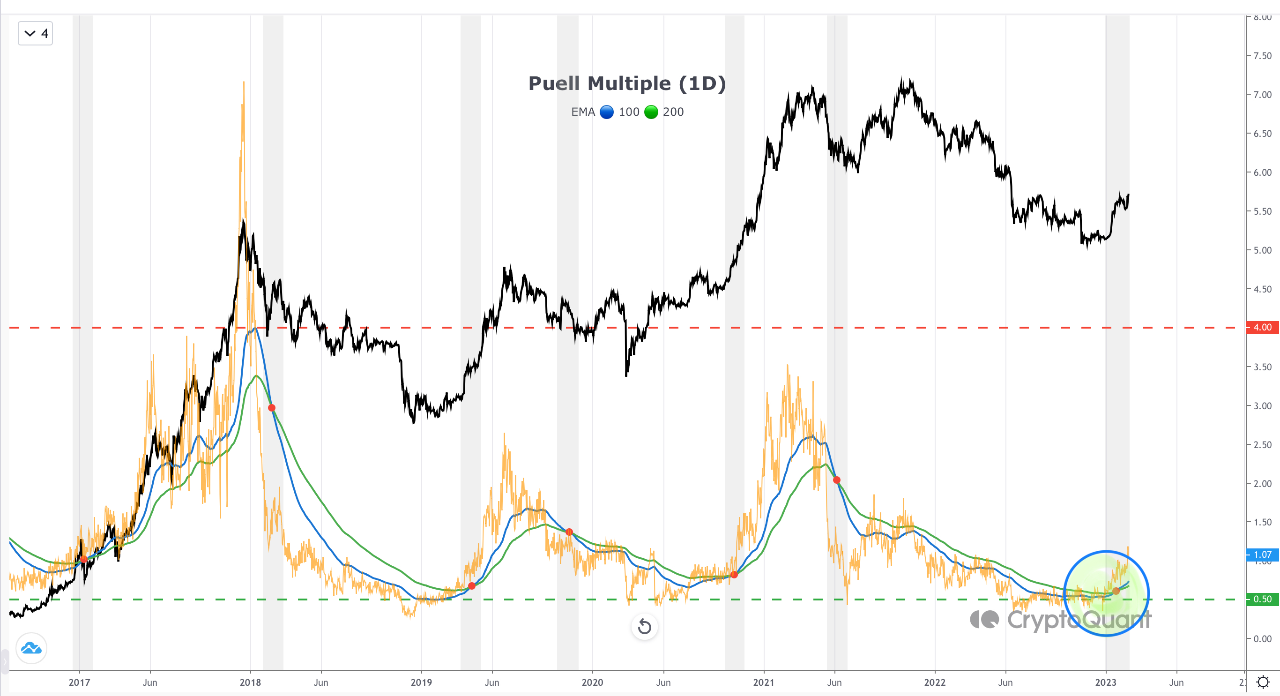

5. Puell Multiple

The Puell Multiple measures the ratio of daily issuance to the moving average of daily issuance. It confirms if the Bitcoin price is overvalued or undervalued relative to historical issuance rates. Values below 0.5 indicates bottom formation. Currently, Puell Multiple is 1.07, indicating a bullish momentum after a bottom formation in January.

Also Read: CZ Takes On Kraken Boss Over “Offshore Exchanges”

- XRP Tops BTC, ETH in Institutional Flows As Standard Chartered Lowers 2026 Forecasts

- Bitcoin vs. Gold: Expert Predicts BTC’s Underperformance as Options Traders Price in $20K Gold Target

- CLARITY Act: White House to Hold Another Meeting as Crypto and Banks Stall on Stablecoin Yield Deal

- Bitcoin as ‘Neutral Global Collateral’? Expert Reveals How BTC Price Could Reach $50M

- XRP Ledger Validator Spotlights Upcoming Privacy Upgrade as Binance’s CZ Pushes for Crypto Privacy

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?