Breaking: GBTC Bitcoin ETF Fees to Drop Soon, Says Grayscale CEO

Highlights

- Grayscale Bitcoin Trust (GBTC) Bitcoin ETF fees will reduce gradually over time, says CEO Michael Sonnenshein

- Grayscale earlier defended its higher than market charges for Bitcoin ETF.

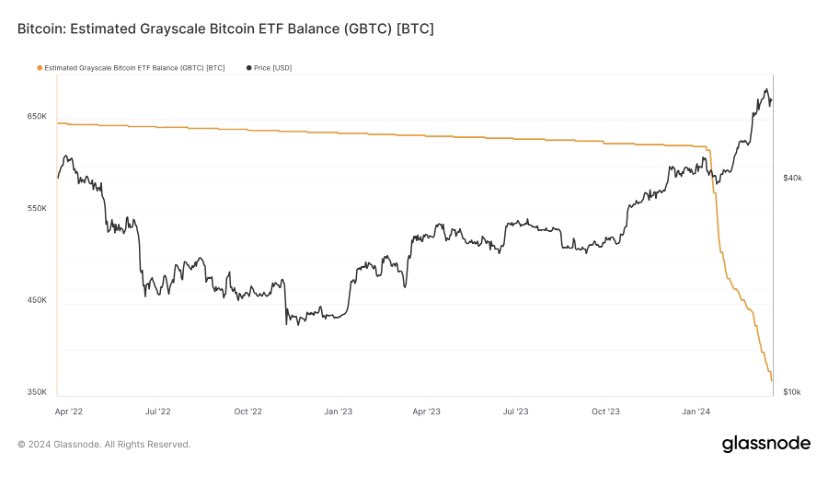

- GBTC outflows has reached over $12 billion.

Michael Sonnenshein, chief executive offer of crypto asset manager Grayscale, discloses that fees on its flagship Grayscale Bitcoin Trust (GBTC) Bitcoin ETF will reduce gradually over time. Sonnenshein said the fees will drop after GBTC outflows reached over $12 billion, backtracking from defending its higher charges.

Grayscale to Reduce GBTC Fees

Grayscale CEO Michael Sonnenshein said the company expects to reduce fees on its GBTC Bitcoin ETF in the months ahead. The move likely comes as GBTC continues to witness outflows while other competitors such as BlackRock and Fidelity grab massive market share from Grayscale.

“I’ll happily confirm that, over time, as this market matures, the fees on GBTC will come down,” Sonnenshein told CNBC in an interview on March 18. He added that fees tend to be higher during the initial stages and gradually come down as the market matures and demand for the products rises.

GBTC has witnessed over $12 billion in net outflows since the conversion to spot Bitcoin ETF. GBTC saw its highest-ever outflow of $643 million on Monday, with a total spot Bitcoin ETF outflow of $154.4 million despite BlackRock iShares Bitcoin ETF’s (IBIT) $451.5 million inflow.

Also Read: Empower Oversight Sues SEC Over Refusing FOIA Compliance, ETHGate

GBTC charges a 1.5% management fee for holders, which is significantly higher than other Bitcoin ETF providers, including BlackRock and Fidelity. Meanwhile, VanEck has waived fees on its Bitcoin ETF amid fierce competition in the BTC ETF market.

Vetle Lunde, senior analyst at K33 research, said GBTC still holds 368,600 BTC. “Going to stabilize eventually, there are def. idle holders not aware of the massive fee premium compared to other issuers.”

Grayscale softening from its earlier stance of defending its higher fees could definitely have an impact on Bitcoin ETF inflows and BTC price in the coming months.

BTC price currently trades at $62,891, down over 8% in the last 24 hours. The 24-hour low and high are $62,478 and $68,552, respectively. However, trading volume has increased by 62% in past 24 hours, indicating traders actively reshuffling their positions.

Top analyst Markus Thielen earlier predicted further correction in Bitcoin and Ethereum prices, with meme coins rally has topped.

Also Read: Ripple, Coinbase CLO Call Out SEC for “Misleading” Courts In Other Crypto Suits

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Breaking: U.S. CFTC Moves To Defend Polymarket, Kalshi From Regulatory Crackdown By State Regulators

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling