GEMI Stock Rises Over 20% Following Gemini’s Debut on Nasdaq

Highlights

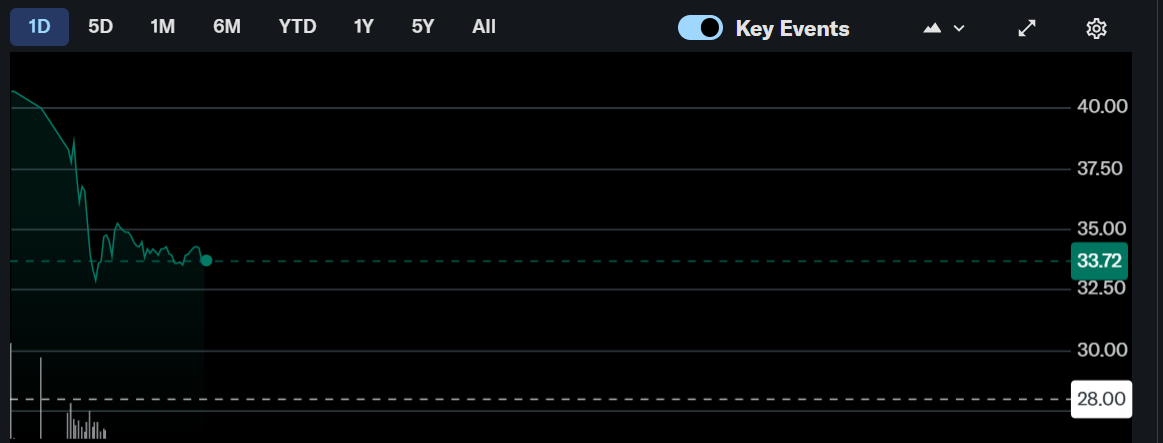

- The GEMI Stock rose above $40 following its debut on the Nasdaq.

- This represents a double digit gain from the IPO price of $28.

- Gemini's successful IPO continues the hot streak of crypto IPOs.

The GEMI stock has begun trading on the Nasdaq following Gemini’s successful IPO. The stock rose above $40 following its listing, recording a double-digit gain in the process.

GEMI Stock Rises Following Gemini IPO

Yahoo Finance data shows that the Gemini stock surged above $40 at the start of trading on the Nasdaq. The stock is still up over 20%, currently trading at around $34 at press time.

The GEMI stock gains represent a significant increase from the IPO price of $28 per share. As CoinGape reported, the Gemini IPO was 20 times oversubscribed, which led the crypto exchange to raise the share price to $28 just ahead of the Nasdaq listing.

Thanks to this, the Winklevoss-backed exchange ended up raising $425 million from an earlier target of around $300 million. This development marks another successful crypto IPO following earlier IPOs by stablecoin issuer Circle and crypto exchange Bullish. Both IPOs were also oversubscribed.

Just like the GEMI stock, the CRCL and BLSH stocks surged following their respective listings. The CRCL stock notably surged to almost $300 from an IPO price of $31 in the weeks following its listing.

With the Gemini IPO done and dusted, attention will now turn to Grayscale and BitGo IPOs, which are the other crypto firms that have declared their intention to go public. Both firms have yet to reveal further details about their respective IPOs besides the draft registration statement with the SEC.

Fourth Publicly-Listed Crypto Exchange In The US

Gemini becomes the fourth publicly-listed crypto exchange after Robinhood, Coinbase, and Bullish. The exchange is currently behind these exchanges in terms of market cap. Robinhood boasts a market cap of $102 billion, with the HOOD stock currently trading at $115, and Coinbase has a market cap of $83 billion, with the COIN stock currently trading at around $323.

Bullish boasts a market cap of $7.6 billion, with its stock price currently trading at around $52. Meanwhile, with the GEMI stock trading at around $33, Gemini boasts a market cap of almost $4 billion.

Meanwhile, three crypto exchanges besides Robinhood are public Bitcoin treasury companies. Coinbase, Bullish, and Gemini hold 11,776, 24,000, and 4,002 BTC, respectively. Bullish is the fifth-largest Bitcoin treasury company, Coinbase is the 10th largest, while Gemini is the 22nd largest public Bitcoin treasury company.

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Breaking: U.S. CFTC Moves To Defend Polymarket, Kalshi From Regulatory Crackdown By State Regulators

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- Ripple CEO Hints Crypto Bill Is Near Deal, Sets April as Approval Timeline

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling