Grayscale Executives, Parent Firm Trim Holdings in XRP, Solana, & Chainlink ETFs

Highlights

- Grayscale Chairman Barry Silbert and CLO Craig Salm sold XRP ETF (GXRP) shares.

- DCG International Investments liquidated holdings in GXRP and Solana ETF (GSOL).

- Grayscale's parent Digital Currency Group trimmed holdings in Grayscale Chainlink Trust ETF.

Executives from crypto asset management company Grayscale and its parent Digital Currency Group (DCG) and related investment firm have sold shares in XRP, Solana, and Chainlink ETFs. The selloffs occur amid capital outflows from the crypto market into safe havens such as gold and silver.

Grayscale parent DCG and Executives Sold XRP, Solana and Chainlink ETFs Holding

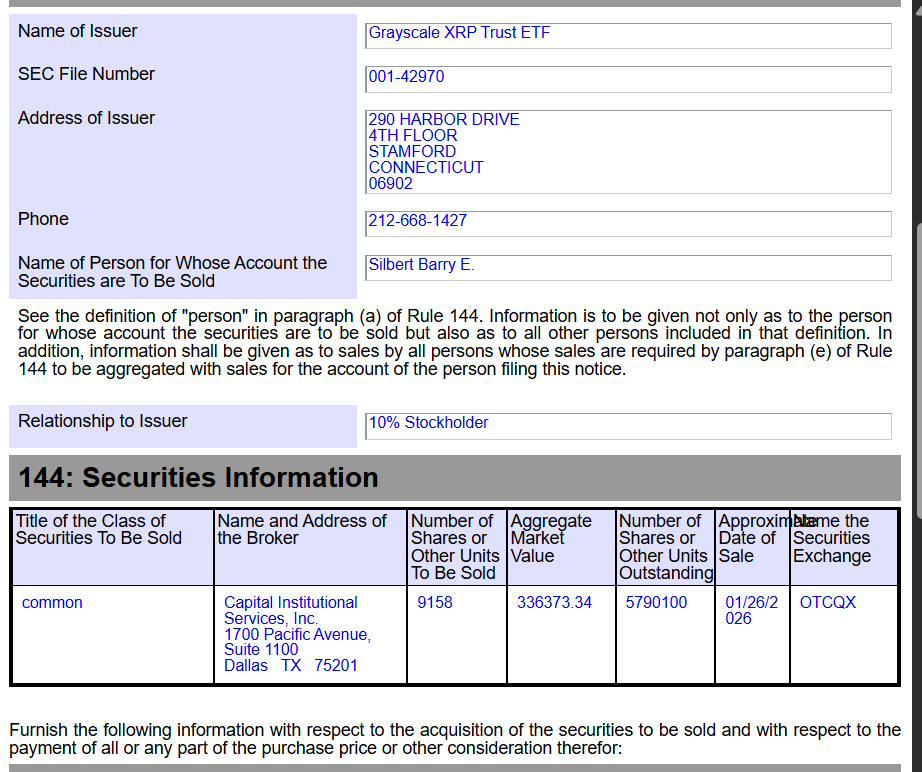

According to two Form 144 filed with the US SEC, Grayscale chairman Barry Silbert and CLO Craig Salm have reduced their holdings in the Grayscale XRP Trust ETF (GXRP). Silbert sold 9158 shares of GXRP and Salm sold 7123 GXRP shares.

Moreover, DCG International Investments sold 3000 shares of Grayscale XRP Trust on January 26. The firm acquired the shares in September 2024 in a privately negotiated transaction from the issuer for cash.

DCG International Investments also liquidated holdings in Grayscale Solana Staking ETF (GSOL). It sold 18,862 GSOL shares, which were also acquired in September 2024. In addition to the recent sale, DCG International Investments liquidated GSOL holdings twice in the past 3 months.

Digital Currency Group (DCG) also filed Form 144 to reveal that it trimmed holdings by 2,822 shares in the Grayscale Chainlink Trust ETF (GLNK). Shares were acquired in September 2023 and October 2024 via privately negotiated transactions from the issuer.

This comes despite multiple positive developments related to Chainlink. It includes Bitwise launching Chainlink ETF and CME plans to offer Chainlink futures, expanding altcoin access for institutional traders.

XRP, SOL and LINK Prices Fall

XRP pared earlier gains and fell to $1.88. The 24-hour low and high are $1.88 and $1.94, respectively. As CoinGape reported earlier, technical and on-chain data signaled selling pressure on XRP.

Also, SOL price has dropped nearly 1% in the past 24 hours, with the price currently trading at $123.56. The intraday low and high were $122.28 and $125.06, respectively. Trading volume decreased by nearly 45% over the last 24 hours.

XRP and Solana ETFs continue to record inflows, but inflows have dropped significantly in the past few weeks. Spot XRP ETFs saw $7.76 million in inflows on Monday, whereas spot Solana ETFs saw $2.46 million in inflows.

LINK remains under selling pressure, with the price currently trading at $11.87. The 24-hour low and high were $11.79 and $12.10, respectively. Trading volume has declined by 42% over the past 24 hours.

- XRP Ledger Validator Spotlights Upcoming Privacy Upgrade as Binance’s CZ Pushes for Crypto Privacy

- Harvard Management Co (HMC) Cuts BlackRock Bitcoin ETF Exposure by 21%, Rotates to Ethereum

- Morgan Stanley, Other TradFi Load Up SOL as Solana RWA Tokenized Value Hits $1.66B ATH

- Trump’s WLFI Slides 8% as Senators Tell Bessent To Review World Liberty’s UAE Stake

- XRP Price Slides Under $1.5 Amid $50M Market Dump on Upbit

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling

- Crypto Price Prediction For This Week: Dogecoin, Solana and Cardano

- Bitcoin Price Prediction: How Could Brazil’s Strategic Bitcoin Reserve Proposal Impact BTC?

- 3 Top Reasons Pi Network Price Surging Today (14 Feb)