Here’s How Long-Term Bitcoin Holders Are Responding To The Crash

Long-term holders of Bitcoin are using the token’s latest price crash to build their holdings.

Bitcoin has slumped nearly 36% this year and is currently trading around $29,000- its lowest level since late-2020. The token has now effectively lost all of its gains through 2021- one of its best years ever.

But long-term Bitcoin holders appear to be undeterred by the recent losses. Data shows that they have used the crash as an opportunity to accumulate.

Long-term Bitcoin holders are accumulating

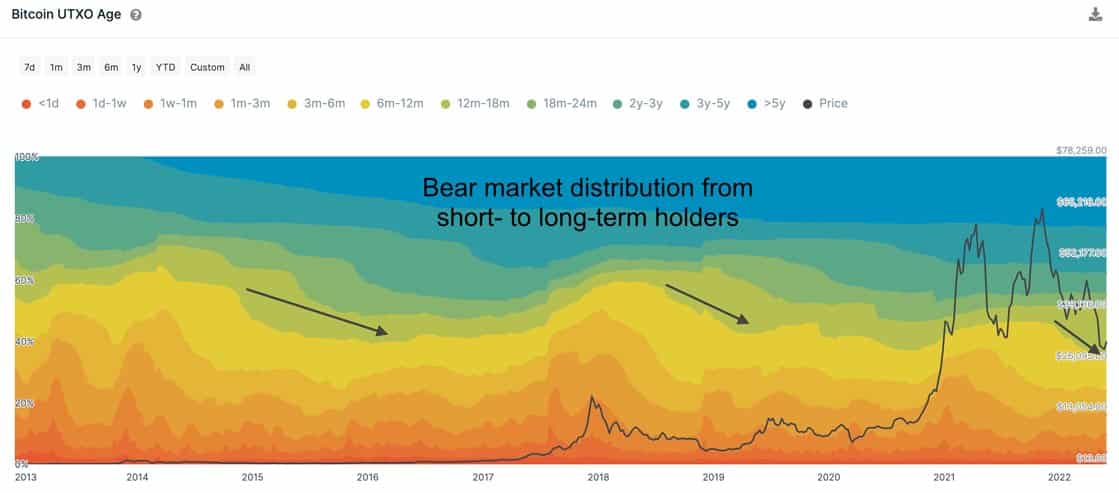

Data from blockchain analytics firm IntoTheBlock shows that long-term holders are using this bear market to increase their tokens. The trend is observed during most bear markets, given that the fall in prices makes Bitcoin far more attractive.

The percentage of $BTC owned by addresses holding one year or longer (green to blue colors) has expanded in previous bear markets – So far we’re repeating this same pattern

But this accumulation has still been unable to surpass the selling pressure experienced by Bitcoin. Amid broader dumping by institutions and short-term holders to mitigate losses, the token has marked a sharp decline this year.

Sentiment towards the crypto market has also sunk to near record lows. The crypto fear and greed index has hovered around “extreme fear” for nearly all of May.

Trading volumes skyrocket

Bitcoin’s selling has also been highlighted by a near record amount of trading volumes. Data from blockchain analytics firm Santiment shows that Bitcoin saw its second-largest total volumes since hitting an all-time-high in November 2021.

The reading highlights the massive rate at which large holders, specifically institutions, have dumped their Bitcoin holdings.

Market analysts have also expressed caution over trying to time a Bitcoin bottom. BitMex co-founder Arthur Hayes recently wrote that the token could bottom out as low as $25,000– a level it has already flirted with this year.

Hayes also noted that the token is far from ready to stage a recovery, and will only do so when its short-term holders have been liquidated.

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Breaking: U.S. CFTC Moves To Defend Polymarket, Kalshi From Regulatory Crackdown By State Regulators

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- Ripple CEO Hints Crypto Bill Is Near Deal, Sets April as Approval Timeline

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling