Here’s What Led to the $300 Billion Crypto Market Sell-Off Today

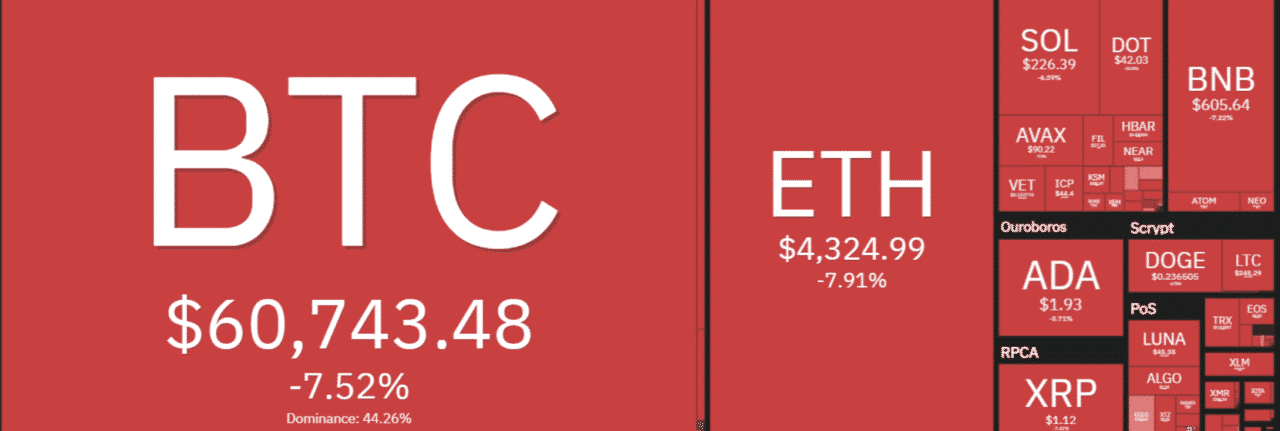

The cryptocurrency market registered a sharp correction earlier today where the top-10 cryptocurrencies lost 7-10% of their market cap within minutes. The market correction led to nearly $300 billion getting whipped off the crypto market as its valuation fell from $3 trillion to $2.65 trillion at the time of writing. This is the second flash crash in two weeks despite many market pundits predicting November to be a bullish month.

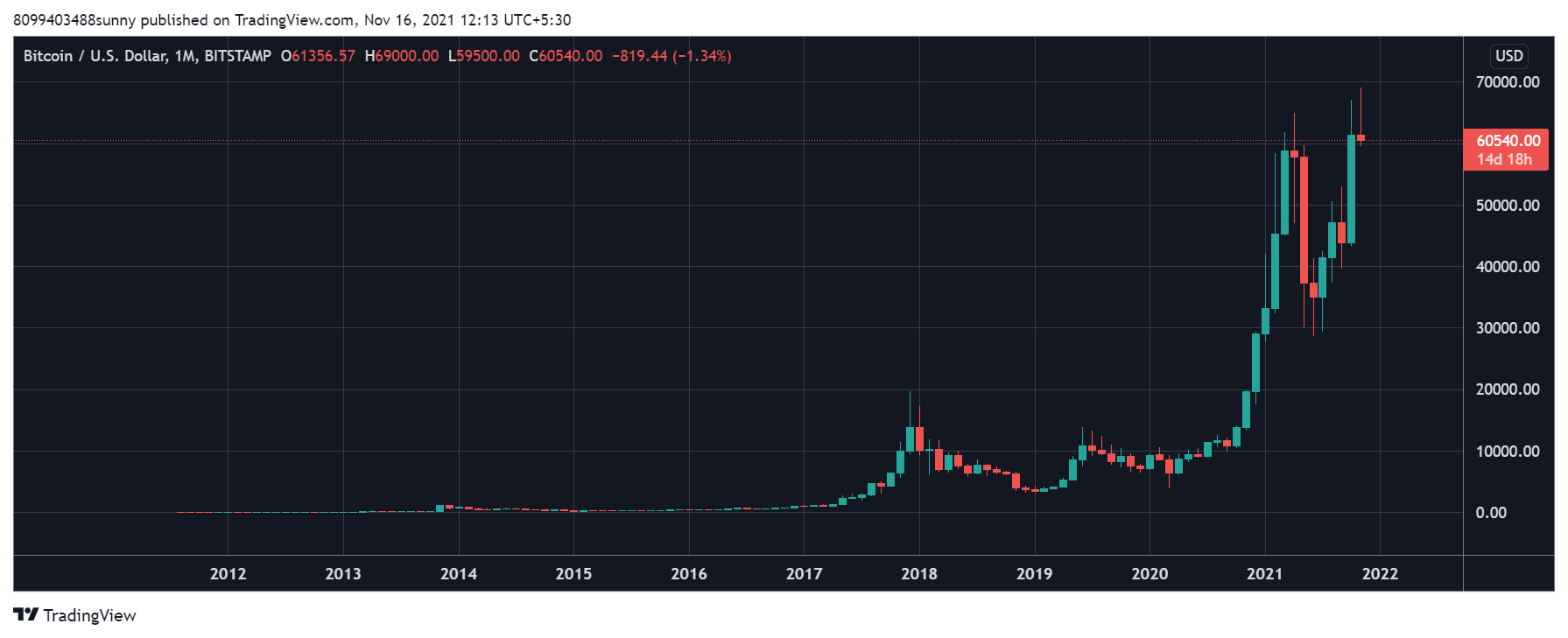

Bitcoin (BTC) wiped off the majority of its gains from November as the price of the top cryptocurrency fell to near $60K. The top cryptocurrency was trading above $66K in the morning before recording a weekly low of $60,583. As visible on the monthly candle, the market sell-off has turned it red from green.

Apart from BTC major altcoins including Ether registered a steeper decline in price as ETH fell to a daily low of $4,271. However, ETH’s monthly chart still has a green candle thanks to its mammoth rise this month, rising from just under $4K to set several new ATHs.

Apart from the stablecoins, the majority of the volatile crypto market bled in red and wiped off major gains from the month of November. Nearly $500 million worth of leveraged positions also got liquidated.

Did Passing of $1 Trillion Infrastructure Bill Lead to the Market Wipe-Off?

The traditional financial market is suffering due to high inflation caused by overprinting by the feds, but governments continue to print more money to restrict the damages caused by the printing of money. Many believe the sudden decline in the crypto market came because of the approval of the controversial infrastructure bill that turned into law earlier today.

The crypto taxation part in particular divided the senate at the time of discussion, where those who are not well versed with a decentralized market called for a total surveillance system and impossible tax reporting demands, while a few Republican senators opposed it tooth and nail and suggested for a more inclusive law.

- Will Bitcoin Crash Again as ‘Trump Insider’ Whale Dumps 6,599 BTC

- XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral

- Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week

- $40B Bitcoin Airdrop Error: Bithumb to Reimburse Customer Losses After BTC Crash To $55k

- ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance

- Cardano Price Prediction as Midnight Token Soars 15%

- Bitcoin and XRP Price Outlook Ahead of Crypto Market Bill Nearing Key Phase on Feb 10th

- Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry

- Ethereum Price Outlook as Vitalik Buterin Sells $14 Million Worth of ETH: What’s Next for Ether?

- Solana Price at Risk of Crashing Below $50 as Crypto Fear and Greed Index Plunges to 5

- Pi Network Price Prediction Ahead of PI KYC Validator Reward System Launch