Putin’s Nuclear Decree Crashes Stocks, Will Crypto Market Fall?

Highlights

- Bitcoin, Ethereum, Solana, XRP and the wider crypto market fell suddenly.

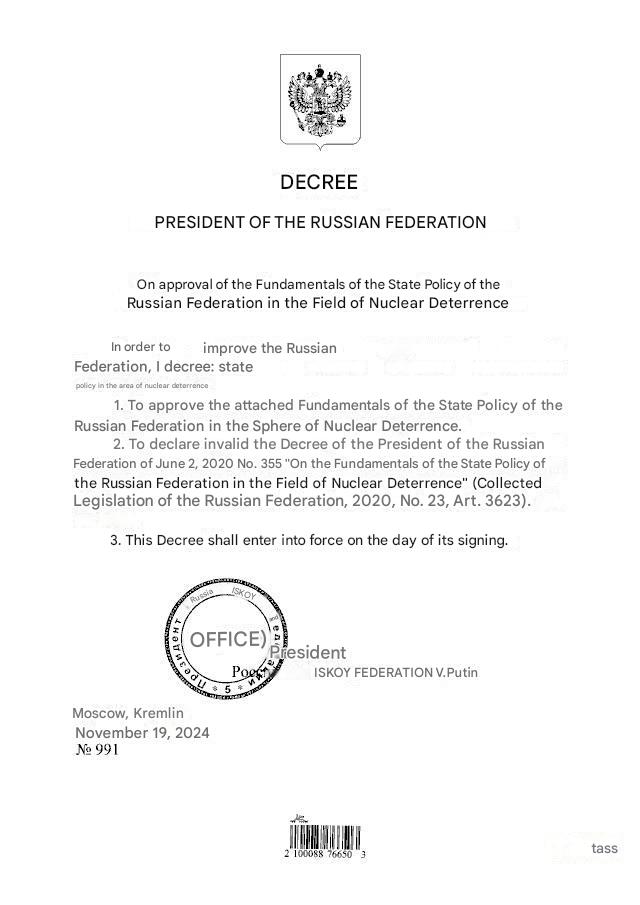

- Russian President Vladimir Putin signed a decree allowing use nuclear weapons against a non-nuclear state.

- Stocks and Bitcoin price pares earlier gains.

Bitcoin, Ethereum, Solana, XRP and the wider crypto market fell suddenly on Tuesday as Russian President Vladimir Putin signed a decree allowing wider use of nuclear weapons. Stock markets around the globe also saw sharp fall amid the reports. The move comes in response to US President Joe Biden’s authorization to Ukraine to strike Russia with US missiles.

Putin Approves Nuclear Decree, Dumps Stocks and Crypto Market

On November 19, Russian President Vladimir Putin signed a decree allowing Moscow to use nuclear weapons against a non-nuclear state if it is supported by nuclear powers. “Any attack by a nation in a military bloc will be considered an attack by the entire bloc,” as per the reports.

Stock markets around the world fell suddenly, reversing recent gains and creating a panic selling. Joe Biden’s approving Ukraine using missiles inside Russia has washed away President-elect Donald Trump’s push to bring peace between the nations.

The crypto market saw a selloff in the last few hours as longs were liquidated, as per Coinglass data. Bitcoin (BTC) and Ethereum (ETH) saw a nearly 0.50% drop, while altcoins XRP, Dogecoin (DOGE), Cardano (ADA) and others saw a more than 1% drop in an hour.

PNUT, RAY, XTZ, AKT and other recent gainers were the leading losers in the last few hours. PNUT price dropped 5% to $1.68.

Will Further Panic Trigger BTC Price Selloff to $82K?

US stock futures tied to S&P 500, Dow Jones Industrial Average and Nasdaq Composite also fell as trades took cues from European stock markets. In the pre-market hours Coinbase stock price fell 3% to $315.50 and MicroStrategy (MSTR) price dropped 1.31% to $379.76.

CoinGape reported that Bitcoin on-chain metrics and market sentiment suggested a 10% correction to drop to $80,000. The next key Bitcoin support zones are at $85,800-$83,250 and $75,520-$72,880.

Moreover, profit bookings are expected as the Crypto market fear and greed index indicates extreme greed, which could result in profit booking.

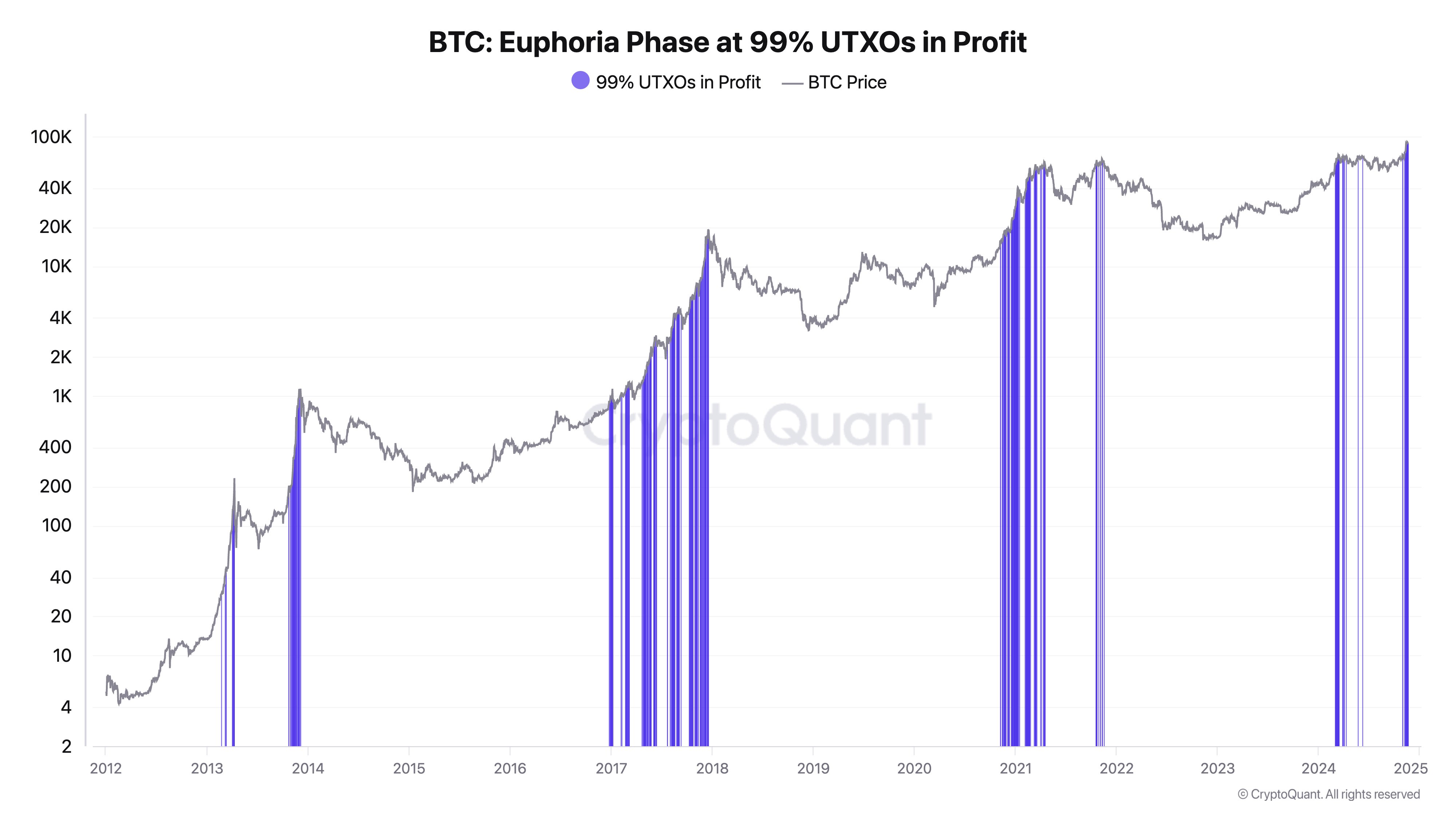

CryptoQuant CEO Ki Young Ju revealed that 99.3% of UTXOs are in profit now. “Everyone’s happy. This euphoric phase typically lasts 3–12 months (except Nov ’21 bull trap).”

BTC price fell 0.86% in the past 24 hours, with the price currently trading at $$91,274. The 24-hour low and high are $89,393 and $92,596, respectively.

- XRP News: XRPL Activates Permissioned DEX Upgrade to Boost Institutional DeFi Adoption

- WLFI Token Sees 19% Spike Ahead of World Liberty’s Mar-a-Lago Forum Today

- Veteran Trader Peter Brandt Predicts Bitcoin Price Rebound, Gold Fall to $4000

- Peter Thiel Exits ETHZilla as Stock Slides 3% Amid Token Launch

- Bitwise, Granitshares Eyes $63B Sector With New Prediction Markets ETF Filing

- Will Sui Price Rally Ahead of Grayscale’s $GSUI ETF Launch Tomorrow?

- Why Pi Network Price Could Skyrocket to $0.20 This Week

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k