‘I Won’t Back Down,’ Michael Saylor Reinforces Strategy’s Bitcoin Mission

Highlights

- Saylor reaffirms the long-term Bitcoin mission of Strategy despite strong market declines and drop in MSTR price.

- Decreasing price of MSTR fosters concern of valuation, but the large amount of Bitcoin held by Strategy is profitable.

- According to skeptics, Bitcoin will collapse faster during pressure triggers as Hartnett warns of Fed capitulation.

Bitcoin’s (BTC) sharp drop this week triggered renewed anxiety across the crypto market. However, Michael Saylor’s latest post indicates Strategy’s commitment to its massive BTC reserve remains firm.

Saylor Reaffirms Strategy’s BTC Commitment Amid Downturn

With BTC price down almost 9% in the last week, Saylor’s post saying, “I won’t back down” shows his company’s entire approach. His statement came as many wonder whether Strategy, the public company he chairs, could maintain its aggressive Bitcoin purchases.

This is because the crypto market is experiencing one of its harshest corrections in the current cycle. Also, Saylor did not directly address or give a hint that Strategy would make a BTC purchase tomorrow as he has previously done. However, Saylor reaffirmed the company’s Bitcoin conviction, suggesting commitment to continuous accumulation.

According to a ZeroHedge report, Bank of America’s chief investment strategist Michael Hartnett said the “Fed needs to cut.”

He added that Bitcoin will be first to be affected coming Fed capitulation. This further adds to the current macro pressure on BTC.

MSTR Drop Raises Fresh Questions About Strategy’s Stability

Strategy holds 649,870 Bitcoin at an average cost of $74,430, according to the company’s latest figures. Strategy’s Bitcoin portfolio is not in the red despite the recent market crash, showing a gain of roughly 16%.

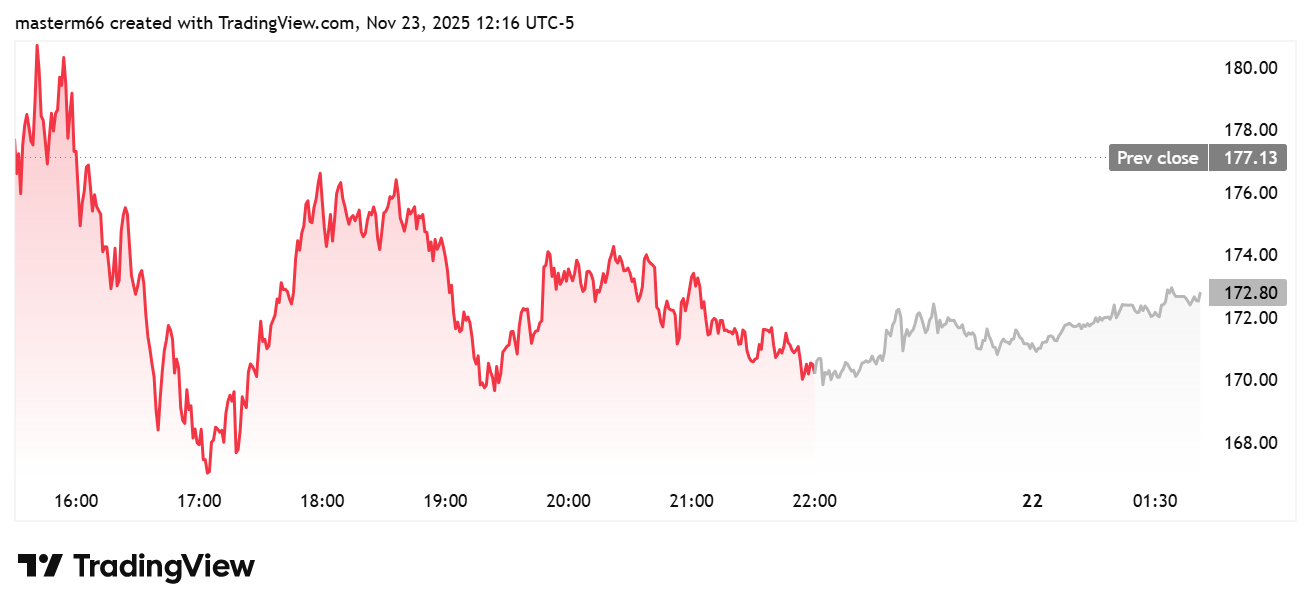

However, the company’s stock has not matched that resilience. Based on TradingView data, MSTR has slid toward the $170 level. It has nearly erased its extra value it has over the company’s underlying Bitcoin reserves.

The stock drop placed renewed attention on Strategy’s valuation. Also, it raised concerns about whether the company still has enough cushion to withstand deeper market stress.

Meanwhile, Michael Saylor’s post follows his community poll, which showed that 77.8% of participants held their Bitcoin throughout the week. This happened even as the BTC price dropped towards the $80,000 zone this past week.

The result reflected continued confidence among retail holders despite the speed of the decline. It also aligned with Saylor’s long-term position that volatility does not alter the company’s mission.

Skeptics See Bitcoin as the “Weakest Link.”

The market’s fall from above $120,000 reignited criticism from Bitcoin skeptics. These critics, including Peter Schiff, said the latest crash that shows Bitcoin moving from strong holders to weak holders will lead to even larger selloffs.

He further argued that Bitcoin is behaving like the weakest link in the risk-asset chain because it carries the most risk during market stress.

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Breaking: U.S. CFTC Moves To Defend Polymarket, Kalshi From Regulatory Crackdown By State Regulators

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k