India SEBI Recommends Regulators Oversee Crypto Trade Amid RBI’s Tightened Grip

Highlights

- SEBI recently recommended several regulators oversee crypto trade in India.

- The decision ignited a frenzy, contrasting the RBI's stance.

- A brief report on RBI's scrutiny of crypto.

In an unprecedented development within India’s crypto landscape, SEBI (Securities and Exchange Board of India), the nation’s market watchdog, has recommended several regulators oversee crypto trade nationwide. The decision, contrasting the RBI’s tightened grip on crypto, has promptly gained significant traction among Indian crypto market participants.

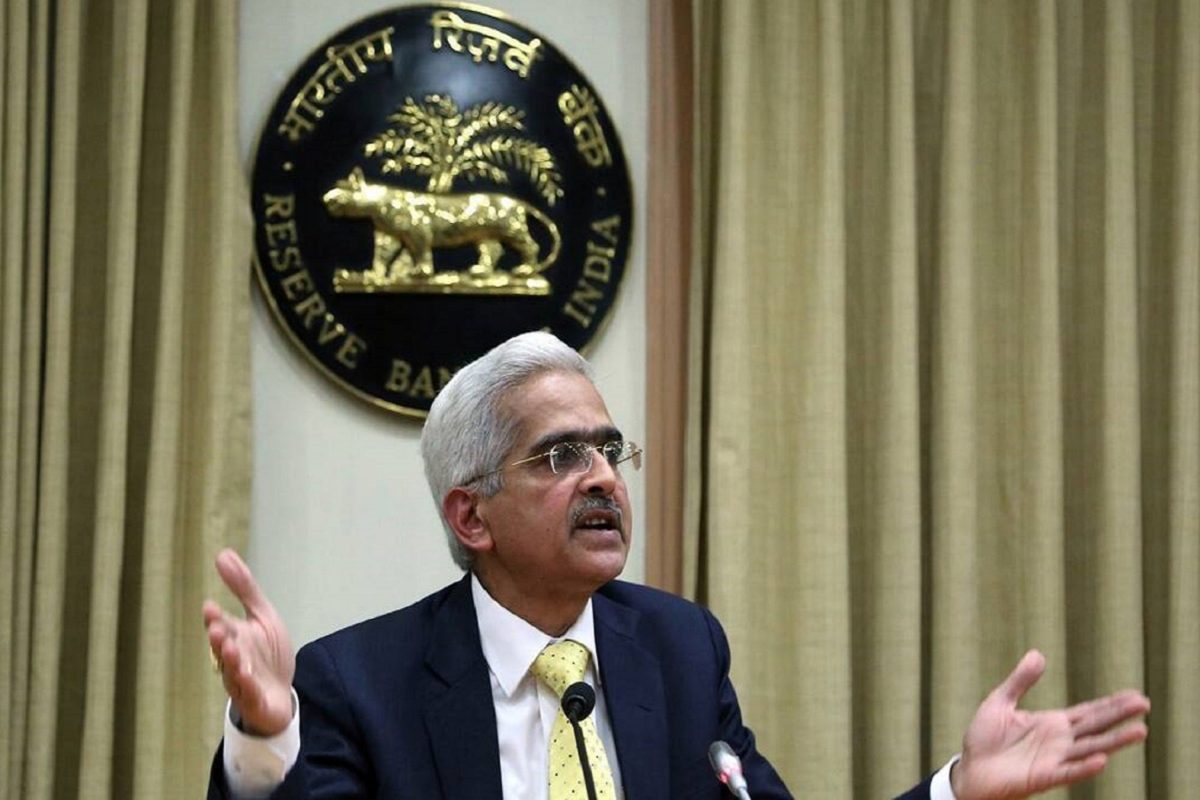

It’s worth noting that the RBI has had a firm grip on cryptocurrencies since 2017, prohibiting banks and other regulated institutions from facilitating the trade of crypto, which the Indian government recognizes as VDAs (Virtual Digital Assets). However, with the SEBI’s recommendation for multiple regulators to oversee crypto trade in India, the market is now in a state of frenzy.

A Closer Look Into The Report

India’s market watchdog’s recent stance on crypto indicates that some authorities in the country are open to the use of private virtual assets. However, the Indian crypto community is eagerly awaiting more comprehensive details on this matter.

Meanwhile, Ashish Singhal, Co-founder of CoinSwitch, shared optimistic views on the abovementioned development. He proclaimed, “Encouraging views on crypto from the Securities and Exchange Board of India (SEBI) which has overseen India’s thriving stock markets. An enabling regulatory environment has paved the way for greater consumer adoption in several other sectors in the past such as telecom, information technology, e-commerce, etc. This is a start, and many nuances will need to be discussed. Nevertheless, great news for crypto in India.”

Also Read: Elon Musk Lauds Grok AI Launch In Europe But There’s A Catch

RBI’s Scrutiny of Crypto In India: What’s The Scoop?

The chronicle of India’s tightened grip on crypto started as early as 2013, wherein the RBI issued a warning to entities dealing in crypto trade. Moving ahead, in 2017, crypto trading services were halted for banks and other regulated institutions, as mentioned above.

Nevertheless, during the recent G20 summit, India called for a global need to regulate these types of assets efficiently. Recent developments unfolded bringing a slight ray of hope for Indian crypto market participants.

Also Read: Render Price: Whales Bag $61M Profit As RNDR Price Rallies

Play 10,000+ Casino Games at BC Game with Ease

- Instant Deposits And Withdrawals

- Crypto Casino And Sports Betting

- Exclusive Bonuses And Rewards

- Senate Eyes CLARITY Act Markup This Month as Banks, Crypto Continue Stablecoin Yield Talks

- Why XRP Price Rising Today? (2 March)

- Breaking: Bitcoin Price Rises to $70k as Gold Crashes Amid U.S.-Iran Conflict

- Bitcoin News: Anthony Pompliano’s ProCap Buys 450 BTC, Gold Bug Peter Schiff Reacts

- Fed Rate Cuts More Likely If U.S.-Iran Conflict Extends, Arthur Hayes Predicts

- Top 5 Historical Reasons Dogecoin Price Is Not Rising

- Pi Coin Price Prediction for March 2026 Amid Network Upgrade, KYC Boost, Rewards Distribution

- Gold Price Nears ATH; Silver Eyes $100 Breakout on Us- Iran War

- Bitcoin And XRP Price As US Kills Iran Supreme Leader- Is A Crypto Crash Ahead?

- Gold Price Prediction 2026: Analysts Expect Gold to Reach $6,300 This Year

- Circle (CRCL) Stock Price Prediction as Today is the CLARITY Act Deadline

Buy $GGs

Buy $GGs