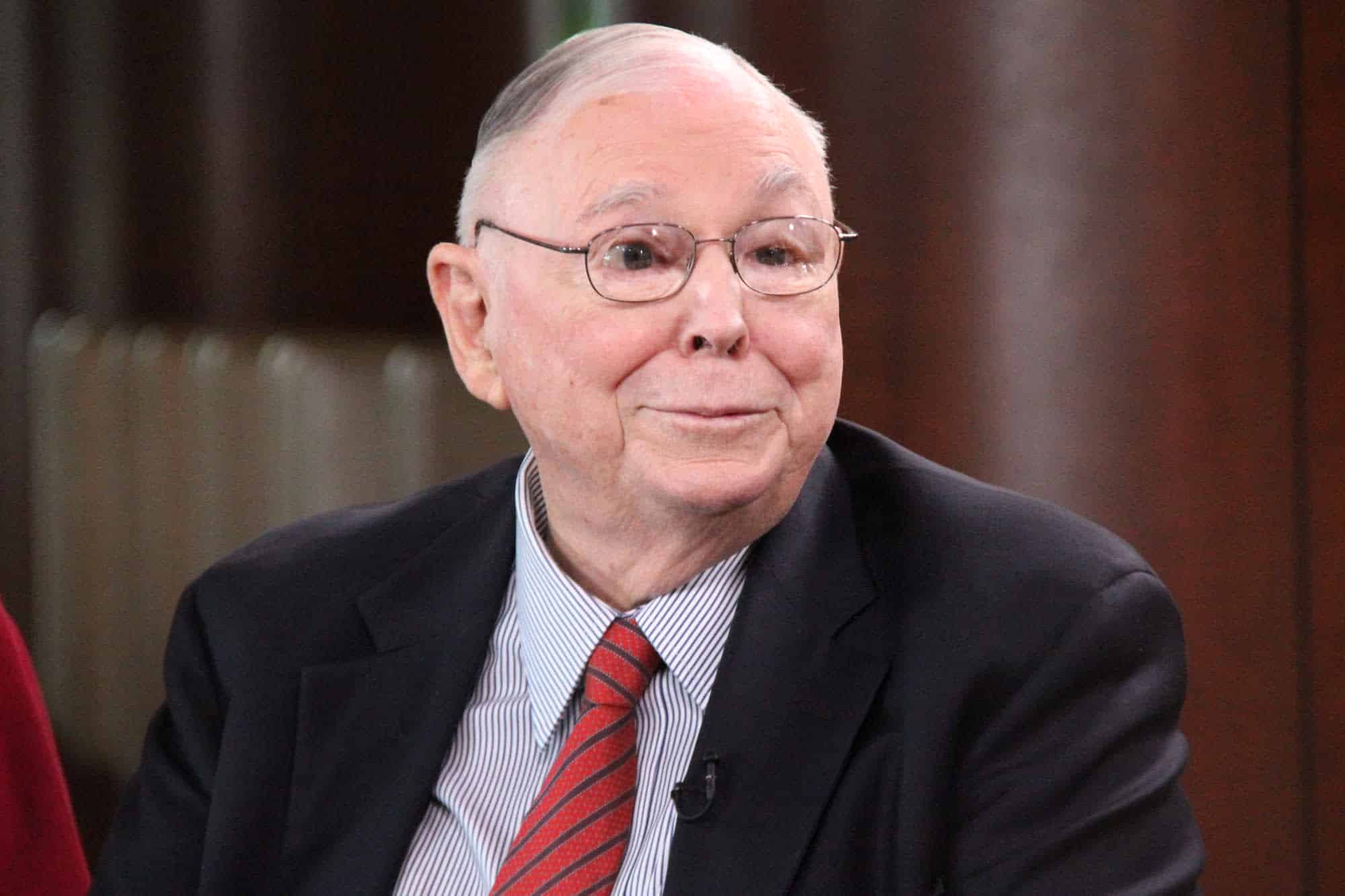

Investor Charlie Munger Calls Crypto ‘Crazier Than DotCom Era’, Backs China for Banning Them

The crypto market rally this year in 2021 has been indeed crazier with the broader growing market growing 3x by adding nearly $2 trillion to the overall market cap. However, traditional investors and big names like Charlie Munger are finding it too difficult to digest.

The investment legend calls this rally in the crypto market to be crazier than the dotcom era. Addressing Australian investors at the Sohn Hearts and Minds conference on Friday, December 3, Mr. Munger called this investment environment “a little more extreme”. He also backed China on clamping down on “some of the exuberances” of capitalism. Expressing his extreme criticism towards cryptocurrencies and Bitcoin, Mr. Munger said:

“I think the dot com boom was crazier in terms of valuations than even what we have now. But overall, I consider this era even crazier than the dot-com era. I just can’t stand participating in these insane booms, one way or the other. It seems to be working; everybody wants to pile in, and I have a different attitude. I want to make my money by selling people things that are good for them, not things that are bad for them.

Believe me, the people who are creating cryptocurrencies are not thinking about the customer, they are thinking about themselves,” he added.

Munger Backs China for Banning Digital Assets

The legendary investor further added that he would never participate in this “insane” crypto boom. More interestingly, Munger even backed China for banning cryptocurrencies entirely. He noted:

“I’m never going to buy a cryptocurrency. I wish they’d never been invented. I think the Chinese made the correct decision, which is to simply ban them. My country – English-speaking civilisation – has made the wrong decision”.

Legendary investor Warren Buffett and Munger’s partner at Berkshire Hathaway have also showered strong criticism on Bitcoin in the past calling it ‘rat poison squared’. After Buffet’s comments back in 2018, Bitcoin has just continued to grow higher.

Recent Posts

- Crypto News

XRP Holders Eye ‘Institutional Grade Yield’ as Ripple Engineer Details Upcoming XRPL Lending Protocol

Ripple engineer Edward Hennis has provided key details about the upcoming XRP Ledger (XRPL) lending…

- Crypto News

Michael Saylor Sparks Debate Over Bitcoin’s Quantum Risk as Bitcoiners Dismiss It as ‘FUD’

Strategy co-founder Michael Saylor earlier this week commented on the risk of quantum computing to…

- Crypto News

Ethereum Faces Selling Pressure as BitMEX Co-Founder Rotates $2M Into DeFi Tokens

Ethereum is under new sell pressure after a high-profile crypto trader sold his ETH assets…

- Gambling

Best Crypto Casinos in Germany 2025

If you’re a German gambler tired of strict limits and slow payouts at locally licensed…

- Crypto News

Tom Lee’s Fundstrat Warns Clients Bitcoin Could Fall to $60,000 Despite His ATH Public Forecast

Top asset manager Fundstrat has advised its private clients to expect a pullback in Bitcoin…

- Crypto News

125 Crypto Firms Mount Unified Defense as Banks Push to Block Stablecoin Rewards

Over 125 cryptocurrency companies have joined forces to defend stablecoin rewards programs against banking industry…