Is $100k BTC Price Back in Play? Bitcoin ETFs Record Largest Inflow Since October Crypto Crash

Highlights

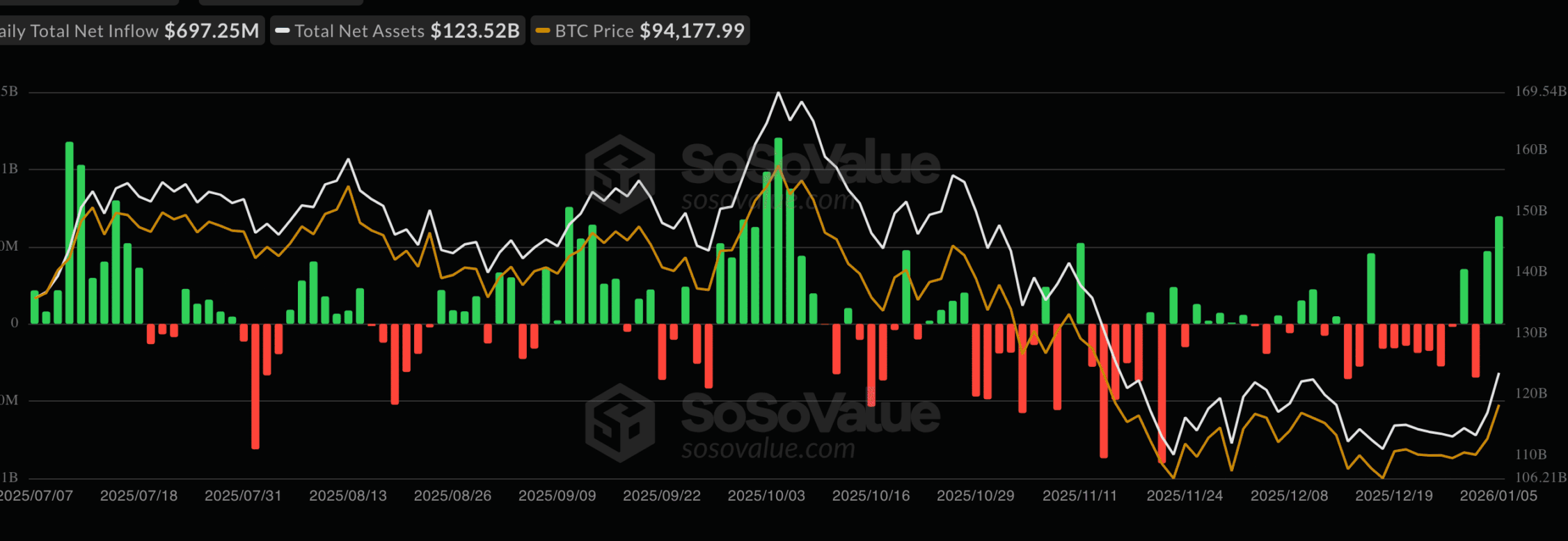

- Spot Bitcoin ETFs recorded $697 million in inflows, their largest single-day inflow since October

- Bitcoin price opens the year strong, climbing above $94,000.

- Total ETF inflows exceeded $1.16 billion in the first two trading days of the month.

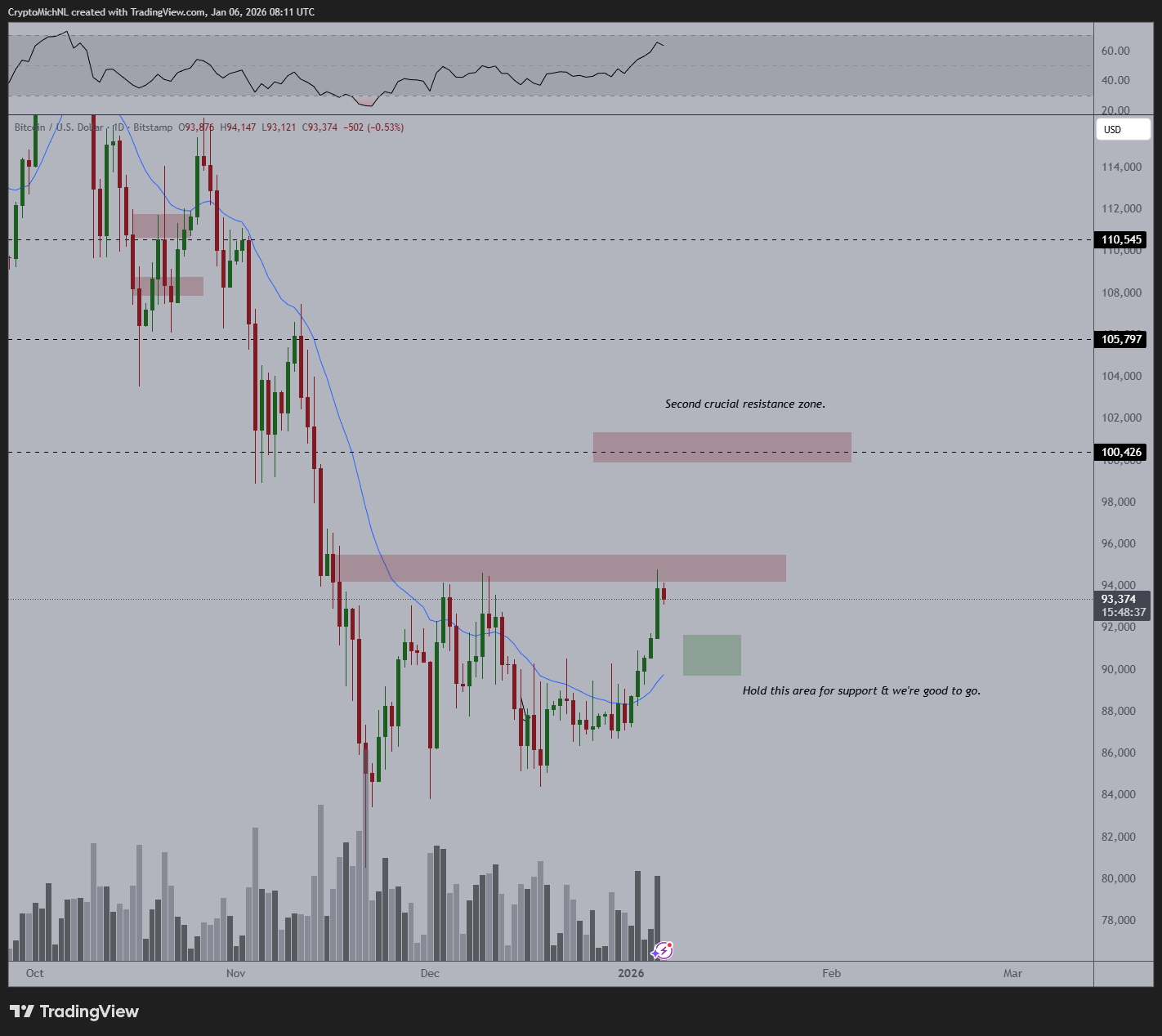

The BTC price has started this year in greater strength, and analysts have now started calling for a return to $100,000 per coin. This also comes when spot Bitcoin ETF products experienced their biggest inflows yet since the crypto crash in October.

Bitcoin ETF See Biggest Inflows in Months

The BTC price continued to strengthen its momentum, moving above the $94,000 mark with ease as the overall cryptocurrency market saw an improvement in momentum. Adding to the positive momentum, spot Bitcoin ETF products saw the largest single-day net inflow since October.

According to data from SoSoValue, the spot BTC ETF fund cumulatively saw $697.25 million worth of net inflows on Monday. Adding this to the $471.14 million that were added last Friday, total inflows for the first two trading days of the month have now exceeded $1.16 billion.

IBIT from BlackRock had the highest inflow in the list, grossing $372.47 million. This was followed by FBTC from Fidelity, which had $191.2 million. Bitwise’s fund, BITB, saw an inflow of $38.5 million, followed by ARKB from ARK Invest, which had an inflow of $36 million. There were also other funds that had net inflows.

It is pointed out that the synchronized buying trend is closer to portfolio rebalancing, particularly as the BTC price has maintained itself above the $90,000 mark during the trading day.

The fresh demand in the ETF market comes amidst recent on-chain activities performed by BlackRock that caused temporary market volatility. Just a week ago, the massive asset management company transferred 1,134 BTCs, valued at $101 million, to the Coinbase exchange.

Data from Arkham shows that the transfer was probably associated with ETF outflows seen on December 31. This transfer of funds came after the expiry of crypto options worth $2.2 billion.

Experts Go Bullish, Forecast BTC Price Return to $100,000

As the crypto prices turn bullish, some experts believe the run towards $100,000 may be in play once again. Crypto expert Michaël van de Poppe said the level of inflows into the Bitcoin ETF reduces the chance of any strong pullback.

The data from the options market also indicates an increase in the optimism of traders. The strike of $100,000 for the call option has started being preferred by the traders.

Bitcoin Option Buyers are Bullish on $100k!

The most popular option amoung buyers are Calls with $100k strike.

The option skew has also shifted bullish as Call prices rise relative to Puts.

Is $100k coming soon? pic.twitter.com/iqeNf0E4FW

— Nic (@nicrypto) January 6, 2026

In other markets, the Solana ETF products experienced net inflows of $16.8 million on Monday. Thus, the total inflows surpassed over $1.09 billion. In the Bitwise ETF product, the Bitwise Solana Staking ETF recorded $12.47 million.

- Breaking: U.S. CFTC Moves To Defend Polymarket, Kalshi From Regulatory Crackdown By State Regulators

- Breaking: Michael Saylor’s Strategy Adds 2,486 BTC Amid Institutional Concerns Over Quantum Threat To Bitcoin

- Ripple CEO Hints Crypto Bill Is Near Deal, Sets April as Approval Timeline

- Wall Street Giant Signals XRP Price ‘Long Winter’ After Cutting Target By 65%

- Shark Tank Kevin O’Leary Warns Bitcoin Crash as Quantum Computing Threats Turns Institutions Cautious

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k

- XRP Price Prediction Ahead of Supreme Court Trump Tariff Ruling