Jane Street and Abu Dhabi Wealth Fund Mubadala Increase Holdings In BlackRock’s Bitcoin ETF

Highlights

- Jane Street purchases additional IBIT shares, indicating that there is more institutional demand for the Bitcoin ETF.

- The Mubadala fund associated with Abu Dhabi also increased its holding.

- Although some banks are selling their holdings, other banks and fund managers are increasing their investment.

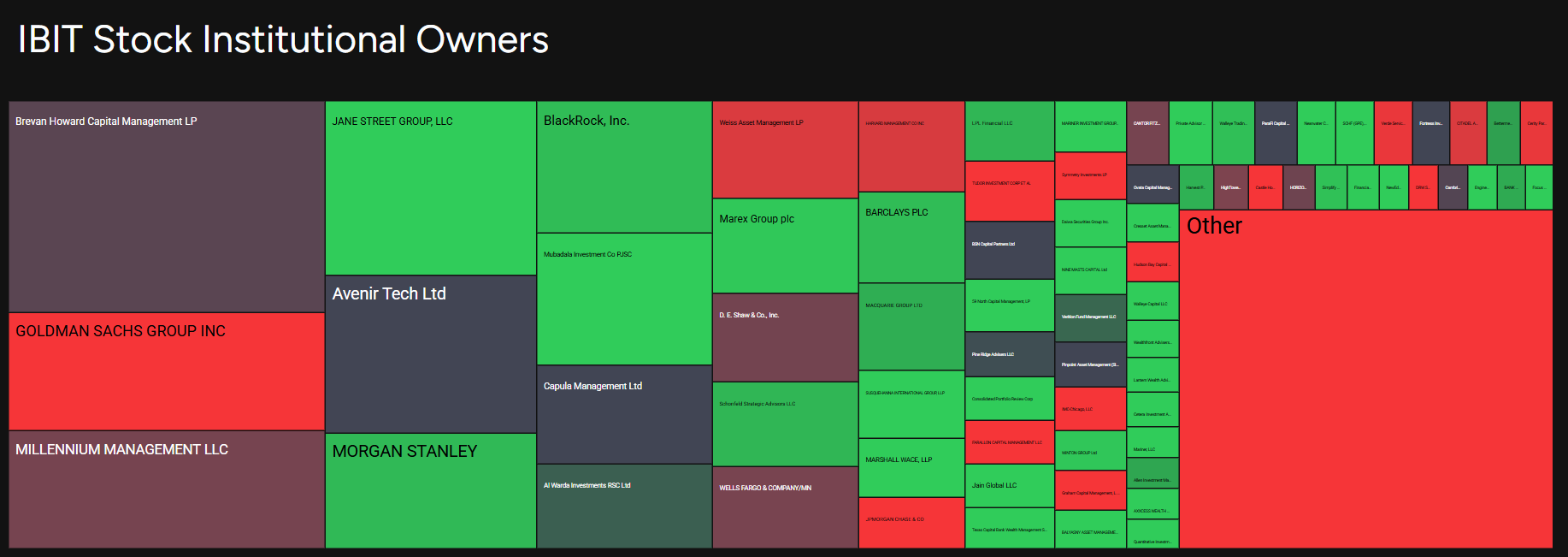

In the Q4 2025 disclosure, Jane Street and Mubadala Investment Company increased their holdings in the BlackRock iShares Bitcoin Trust (IBIT) ETF. The allocations show continued institutional involvement in Bitcoin products amidst the price fluctuations of the coin.

Jane Street Adds 7 Million BlackRock Bitcoin ETF Shares

According to the latest SEC filing by Jane Street, its IBIT holdings grew by approximately 54% this past quarter. This indicated that the company bought over seven million new shares in this period.

This made its total position 20.3 million shares valued at about $790 million as of December 31, 2025. Jane Street is ranked as the fourth-largest holder of the ETF, per Quiver Quant data. At the time of acquisition, the new shares were valued at some $276 million. Jane Street has increased its holdings from about 13.2 million IBIT shares, which it had in the previous quarter.

In addition, Jane Street has become a prominent institutional player for inflows into XRP ETFs. The company revealed shares in several XRP ETFs. It is a shareholder in the Bitwise XRP ETF, the REX-Osprey XRP ETF, and the Volatility Shares XRP ETF.

The trading giant also owns Volatility Shares 2X XRP ETF shares, as well as massive put and calls in Volatility Shares ETFs. The company joins financial giants such as Goldman Sachs and Susquehanna in accumulating XRP.

Mubadala Boosts IBIT Holdings

Abu Dhabi sovereign wealth fund, Mubadala, also increased its BlackRock Bitcoin ETF holdings by 46 percent, according to its SEC report for the fourth quarter of 2025.

The fund has 12.7 million shares of IBIT worth over $630 million as of December 31, 2025. This represents an increase of approximately 4 million shares from the 8.7 million it held in the previous quarter. This increased allocation by Mubadala contrasts with that of some other institutional investors that have made reductions in the same period.

These acquisitions strengthen IBIT’s asset under management as the biggest spot Bitcoin ETF. According to the latest AUM, the fund had approximately $52.4 billion, which confirms its leadership status in the U.S. Bitcoin ETF market.

Giant Institutions Modify BlackRock Bitcoin ETF Exposure

The figures by Quiver Quant showed that multiple global banks and hedge funds also actively accumulated IBIT shares last quarter. Morgan Stanley owned 13.44 million IBIT shares, as it expanded its holdings by about 22% as of December 31, 2025. BlackRock reported 12.77 million shares, after a 23% increase.

Barclays had 5.29 million shares, raising its holdings by 22.73%. Susquehanna International Group now owns 3.93 million shares after a nearly 71% increase in its IBIT holdings. However, Harvard Management Co (HMC) lowered its BlackRock Bitcoin ETF holdings by 21% and purchased more shares of the BlackRock Ethereum ETF (ETHA).

JPMorgan decreased its holdings by 42.7% and now holds 3.03 million IBIT shares. Goldman Sachs also reduced its exposure to hold 20.69 million shares, which represents a reduction of more than 39%.

- FOMC Minutes Drop Tomorrow: Will Crypto Market Rally or Face Fed Shock?

- BlackRock Amends Filing For Staked Ethereum ETF, Eyes 18% of Staking Rewards From ETH Fund

- Arizona Advances Bitcoin, XRP Reserve Bill Using Seized Crypto Assets

- Bitcoin ETF Update: BlackRock Signals BTC Sell-Off as Kevin O’Leary Warns of Decline In Institutional Demand

- Breaking: Tom Lee’s BitMine Buys 45,759 ETH as CryptoQuant Flags Potential Bottom For Ethereum

- Pi Network Price Beats Bitcoin, Ethereum, XRP as Upgrades and Potential CEX Listing Fuels Demand

- 5 Things Dogecoin Price Needs to Hit $0.20 in Feb 2026

- Bitcoin Price Prediction as Experts Warns of Quantum Risks

- Dogecoin, Shiba Inu, Pepe Coin Price Predictions As BTC Crashes Below $68k

- Ethereum Price Outlook as Harvard Shifts Focus from Bitcoin to ETH ETF

- HOOD and COIN Stock Price Forecast as Expert Predicts Bitcoin Price Crash to $10k